Comcast 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Comcast 2009 Annual Report on Form 10-K

46

Software

We capitalize direct development costs associated with

internal-use software, including external direct costs of

material and services and payroll costs for employees

devoting time to these software projects. We also capitalize

costs associated with the purchase of software licenses. We

include these costs within other intangible assets and

amortize them on a straight-line basis over a period not to

exceed 5 years, beginning when the asset is substantially

ready for use. We expense maintenance and training costs,

as well as costs incurred during the preliminary stage of a

project, as they are incurred. We capitalize initial operating

system software costs and amortize them over the life of the

associated hardware.

* * *

We periodically evaluate the recoverability and estimated

lives of our intangible assets subject to amortization

whenever events or substantive changes in circumstances

indicate that the carrying amount may not be recoverable or

the useful life has changed. The evaluation is based on the

cash flows generated by the underlying assets and

profitability information, including estimated future operating

results, trends or other determinants of fair value. If the total

of the expected future undiscounted cash flows is less than

the carrying amount of the asset, we would recognize a loss

for the difference between the estimated fair value and the

carrying value of the asset. Unless presented separately, the

loss is included as a component of amortization expense.

Asset Retirement Obligations

We recognize a liability for asset retirement obligations in the

period in which it is incurred if a reasonable estimate of fair

value can be made.

Certain of our cable franchise agreements and lease

agreements contain provisions requiring us to restore

facilities or remove property in the event that the franchise or

lease agreement is not renewed. We expect to continually

renew our cable franchise agreements and therefore cannot

estimate any liabilities associated with such agreements. A

remote possibility exists that franchise agreements could be

terminated unexpectedly, which could result in us incurring

significant expense in complying with restoration or removal

provisions. The disposal obligations related to our properties

are not material to our consolidated financial statements. We

do not have any significant asset retirement-related liabilities

recorded in our consolidated financial statements.

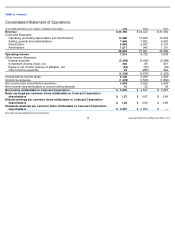

Revenue Recognition

Cable Segment

Our Cable segment generates revenue primarily from

subscriptions to our video, high-speed Internet and phone

services (“cable services”) and from the sale of advertising.

We recognize revenue from cable services as each service is

provided. We manage credit risk by screening applicants

through the use of credit bureau data.

If a customer’s account is delinquent, various measures are

used to collect outstanding amounts, including termination of

the customer’s cable service. Since installation revenue

obtained from the connection of customers to our cable

systems is less than related direct selling costs, we recognize

revenue as connections are completed.

As part of our programming license agreements with

programming networks, we receive an allocation of

scheduled advertising time that we may sell to local, regional

and national advertisers. We recognize advertising revenue

when the advertising is aired and based on the broadcast

calendar. In most cases, the available advertising time is sold

by our sales force. In some cases, we work with

representation firms as an extension of our sales force to sell

a portion of the advertising time. We also coordinate the

advertising sales efforts of other cable operators in some

markets, and in some markets we operate advertising

interconnects. These interconnects establish a physical,

direct link between multiple providers for the sale of regional

and national advertising across larger geographic areas than

could be provided by a single cable operator. Our prior

practice had been to record the fees we pay to representation

firms and other multichannel video providers as a revenue

offset. However, since we are acting as the principal in these

arrangements and as these coordination and interconnect

activities are expected to grow in significance, we have

concluded that we should report the fees paid to

representation firms and multichannel video providers as an

operating expense rather than as a revenue offset.

Accordingly, we changed the presentation for these items for

2008 and 2007, and classified approximately $167 million

and $165 million, respectively, of the fees paid as operating

expenses.

Revenue earned from other sources is recognized when

services are provided or events occur. Under the terms of our

cable franchise agreements, we are generally required to pay

to the local franchising authority an amount based on our

gross video revenue. We normally pass these fees through to

our cable customers and classify the fees as a component of

revenue with the corresponding costs included in operating

expenses. We present other taxes imposed on a revenue-

producing transaction as revenue if we are acting as a

principal or as a reduction to operating expenses if we are

acting as an agent.

Programming Segment

Our Programming segment generates revenue primarily from

monthly per subscriber license fees paid by multichannel

video providers for the distribution of our networks’

programming, the sale of advertising and the licensing of our

networks programming internationally. We recognize revenue

from distributors as programming is provided, generally under

multiyear distribution agreements. From time to time these

agreements expire while programming continues to be

provided to the distributor based on interim arrangements

while the parties negotiate new contract terms. Revenue

recognition is generally limited to current payments being

made by the distributor, typically under the prior