Comcast 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

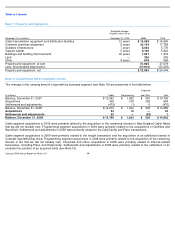

Our financial instruments measured at fair value on a nonrecurring basis are presented in the table below.

Nonrecurring Fair Value Measures

Fair value as of December 31, 2008

(in millions)

December 31, 2008

Level 1

Level 2

Level 3

Total Losses

Equity method investments

$

421

$

—

$

—

$

421

$

(600

)

Comcast 2009 Annual Report on Form 10-K

58

We recognized an other-than-temporary impairment for the

year ended December 31, 2008 to other income (expense) of

$600 million to adjust the cost basis of our approximately $1

billion investment in Clearwire LLC to its estimated fair value

(see Note 6). Our valuation methodology used a combination

of the quoted market value of Clearwire Corporation’s

publicly traded Class A shares and unobservable inputs

related to the ownership units of Clearwire LLC and the

voting stock of Clearwire Corporation, including the use of

discounted cash flow models. Our investment in Clearwire

LLC is classified as a Level 3 financial instrument in the fair

value hierarchy because a portion of the estimated fair value

of the investment is based on unobservable inputs. As of

December 31, 2009, the fair value of our investment

exceeded our cost basis.

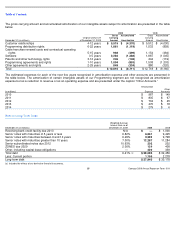

Amount of Gain (Loss) Recognized in Income on Derivative

Financial Instruments

Year ended December 31, 2009 (in millions)

Designated Fair Value Hedging

Relationships

Interest Income (Expense):

Interest rate swap agreements (fixed to

variable)

$

(148

)

Long-term debt — interest rate swap

agreements (fixed to variable)

148

Investment Income (Expense):

Unrealized gains (losses) on securities

underlying prepaid forward sale

agreement

46

Mark to market adjustments on derivative

component of prepaid forward sale

agreement

(37

)

Gain (loss) on fair value hedging relationships

9

Nondesignated

Investment Income (Expense):

Unrealized gains (losses) on securities

underlying prepaid forward sale

agreements

951

Mark to market adjustments on derivative

component of prepaid forward sale

agreements

(778

)

Mark to market adjustments on derivative

component of ZONES

8

Total gain (loss)

$

190

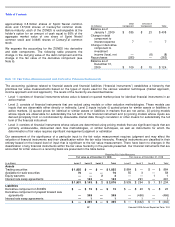

Interest Rate Risk Management

We are exposed to the market risk of adverse changes in

interest rates. To manage the volatility relating to these

exposures, our policy is to maintain a mix of fixed-rate and

variable-rate debt and to use interest rate derivative

transactions.

Using swaps, we agree to exchange, at specified dates, the

difference between fixed and variable interest amounts

calculated by reference to an agreed-upon notional principal

amount. In the ordinary course of business, some of our

swaps could be subject to termination provisions if we do not

maintain investment grade credit ratings. The amount to be

paid or received upon termination, if any, would be based on

the fair value of the outstanding contracts at that time. None

of our current derivative contracts require us to post

collateral. As of December 31, 2009 and 2008, the estimated

fair value of those swaps was an asset of $26 million and an

asset of $44 million, respectively. The table below

summarizes the terms of our existing swaps.

Fixed to Variable Swaps

The notional amounts presented in the table above are used

to measure interest to be paid or received and do not

represent the amount of exposure to credit loss. The

estimated fair value represents the approximate amount of

proceeds or payments required to settle the contracts,

including accrued interest of $40 million and $18 million as of

December 31, 2009 and 2008, respectively.

In 2009 and 2008, the effect of our interest rate derivative

financial instruments was a decrease to our interest expense

of approximately $104 million and $34 million, respectively. In

2007, the effect was an increase to our interest expense of

approximately $43 million.

See Note 2 for further discussion on our accounting policies

for derivative financial instruments.

December 31 (in

millions)

2009

2008

Maturities

2010

-

2018

2009

-

2018

Notional amount

$

3,750

$

3,500

Average pay rate

2.9

%

3.9

%

Average receive

rate

6.3

%

5.8

%

Estimated fair

value

$

183

$

309