Comcast 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Programming Segment Overview

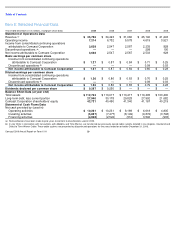

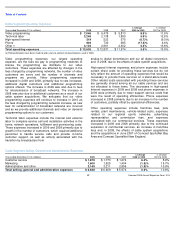

Our Programming segment consists primarily of our consolidated national programming networks. The table below presents a

summary of our consolidated national programming networks.

We also own noncontrolling interests in certain networks and content providers, including FEARnet (33%), iN DEMAND (54%),

MGM (20%), PBS KIDS Sprout (40%) and TV One (34%). The operating results of these entities are not included in our

Programming segment’s operating results because they are presented in equity in net income (losses) of affiliates.

Programming Segment Results of Operations

Programming Network

Approximate

U.S. Subscribers at

December 31, 2009

(in millions)

Description of Programming

E!

86

Entertainment

Golf Channel

74

Golf and golf

-

related

VERSUS

54

Sports and leisure

G4

59

Gamer lifestyle

Style

57

Lifestyle

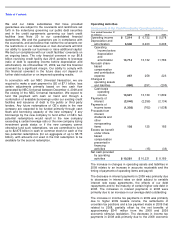

Year ended December 31 (in millions)

2009

2008

2007

% Change

2008 to 2009

% Change

2007 to 2008

Revenue

$

1,496

$

1,426

$

1,314

4.9

%

8.5

%

Operating, selling, general and administrative

1,107

1,064

1,028

4.0

%

3.6

%

Operating income before depreciation and amortization

$

389

$

362

$

286

7.5

%

26.3

%

Comcast 2009 Annual Report on Form 10-K

28

Customer service expenses increased in 2009 primarily due

to activity associated with the transition by broadcasters from

analog to digital transmission during the first half of the year

and our all digital conversion. Customer service expenses

increased in 2008 primarily due to growth in the number of

customers.

Marketing expenses decreased in 2009 primarily due to lower

costs and volume for media advertising, partially offset by an

increase in direct sales efforts. Marketing expenses

increased in 2008 primarily due to additional marketing costs

associated with attracting and retaining customers, as well as

the effects of cable system acquisitions.

During 2009 and 2008, we implemented personnel and cost

reduction programs that were focused on streamlining our

Cable operations. In connection with these initiatives, we

recorded $81 million and $126 million of severance costs

during 2009 and 2008, respectively. Administrative and other

expenses decreased in 2009 primarily due to the impact of

the programs initiated in 2008. Administrative and other

expenses increased in 2008 primarily due to the effects of

cable system acquisitions.

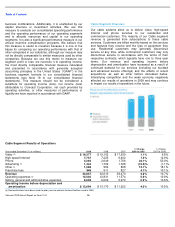

Programming Segment Revenue

Programming revenue increased in 2009 primarily due to

growth in programming license fee revenue and a favorable

adjustment to advertising revenue as a result of reduced

reserves for ratings commitments. Programming revenue

increased in 2008 primarily due to growth in advertising

revenue, programming license fee revenue and international

revenue. In 2009, 2008 and 2007, advertising accounted for

approximately 41%, 43% and 44%, respectively, of total

Programming revenue. In 2009, 2008 and 2007,

approximately 12% to 13% of our Programming revenue was

generated from our Cable segment. These amounts are

eliminated in our consolidated financial statements but are

included in the amounts presented above.

Programming Segment Operating, Selling, General and

Administrative Expenses

Programming operating, selling, general and administrative

expenses consist mainly of the cost of producing television

programs and live events, the purchase of programming

rights, the marketing and promotion of our programming

networks and administrative costs. We have invested and

expect to continue to invest in new and live-event

programming that will cause our programming expenses to

increase in the future.