Comcast 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Comcast 2009 Annual Report on Form 10-K

56

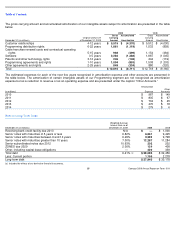

As of December 31, 2009 and 2008, our debt had an

estimated fair value of $31.247 billion and $32.001 billion,

respectively. The estimated fair value of our publicly traded

debt is based on quoted market values on an active market

for the debt. To estimate the fair value of debt issuances for

which there are no quoted market prices, we use interest

rates available to us for debt issuances with similar terms and

remaining maturities.

Some of our loan agreements require that we maintain

certain financial ratios based on our debt and our operating

income before depreciation and amortization. We were in

compliance with all financial covenants for all periods

presented. See Note 20 for a discussion of our subsidiary

guarantee structures.

As of December 31, 2009 and 2008, accrued interest was

$497 million and $520 million, respectively.

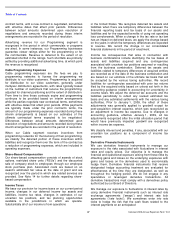

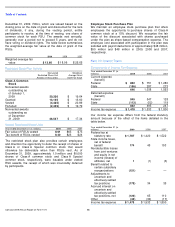

Debt Maturities

Debt Borrowings

We used the net proceeds of these borrowings, together with

cash on hand, for the repurchase of debt securities prior to

their scheduled maturities, the repayment of outstanding

borrowings under our revolving credit facility, the repayment

of debt at its maturity, as well as for working capital and

general corporate purposes.

As of December 31, 2009 (in millions)

2010

$

1,156

2011

$

1,809

2012

$

832

2013

$

2,450

2014

$

1,091

Thereafter

$

21,758

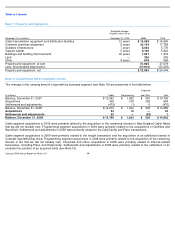

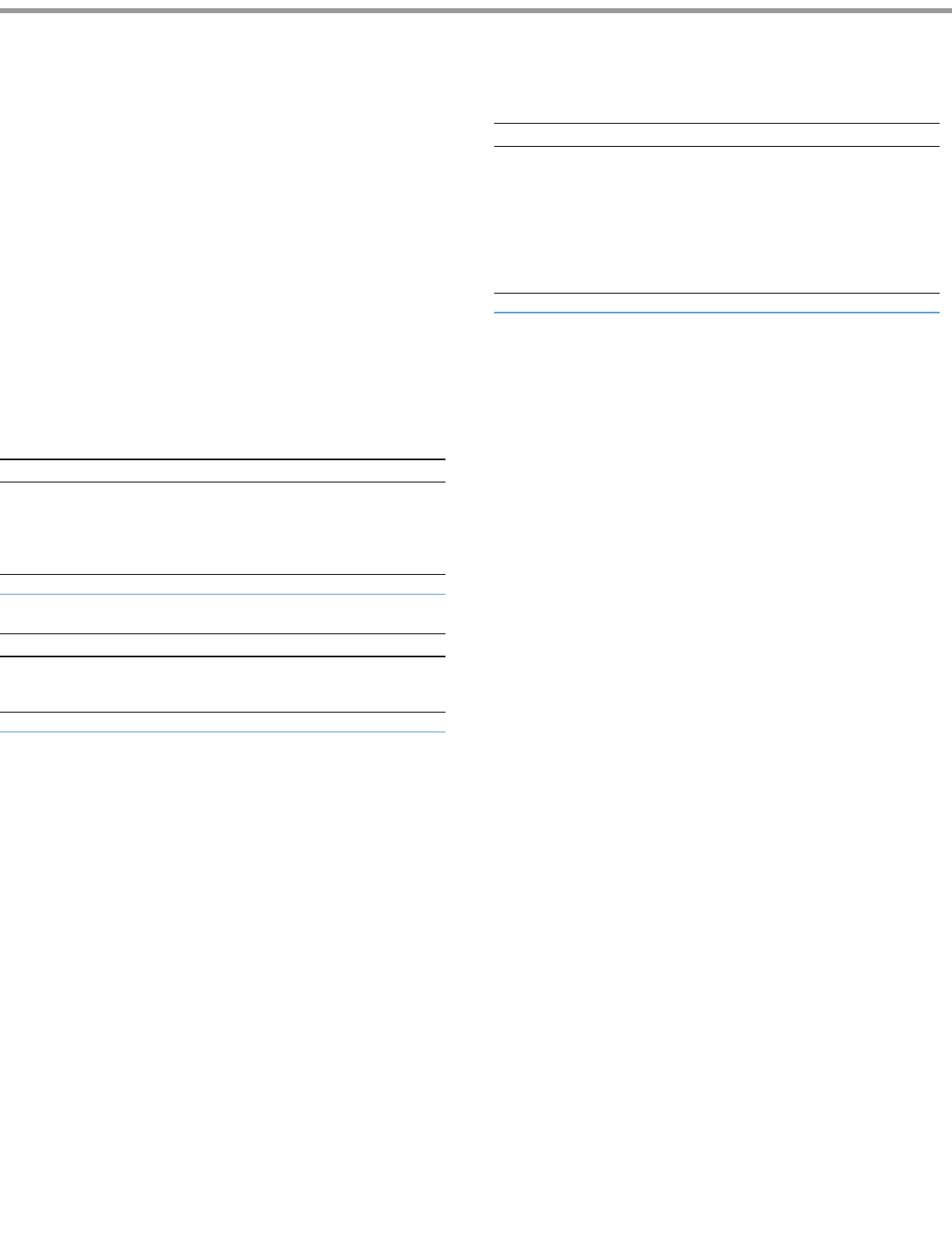

Year ended December 31, 2009 (in millions)

5.70% notes due 2019

$

700

6.55% notes due 2039

800

Other

64

Total

$

1,564

Debt Repayments

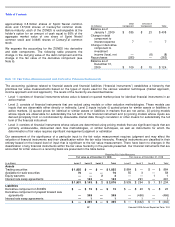

In July 2009, we completed a cash tender to purchase $1.3

billion aggregate principal amount of certain of our

outstanding notes for approximately $1.5 billion. These notes

consisted of approximately $621 million principal amount of

our 8.375% notes due 2013, $367 million principal amount of

our 7.125% notes due 2013 and $312 million principal

amount of our 7.875% senior debentures due 2013. In 2009,

we recognized approximately $180 million of interest

expense primarily associated with the premiums incurred in

this cash tender.

Debt Instruments

Commercial Paper Program

Our commercial paper program provides a lower cost

borrowing source of liquidity to fund our short-term working

capital requirements. The program allows for a maximum of

$2.25 billion of commercial paper to be issued at any one

time. Our revolving bank credit facility supports this program.

Revolving Bank Credit Facility

As of December 31, 2009, we had a $6.8 billion revolving

credit facility due January 2013 (the “credit facility”) with a

syndicate of banks. The base rate, chosen at our option, is

either the London Interbank Offered Rate (“LIBOR”) or the

greater of the prime rate or the Federal Funds rate plus 0.5%.

The borrowing margin is based on our senior unsecured debt

ratings. As of December 31, 2009, the interest rate for

borrowings under the credit facility was LIBOR plus 0.35%.

Lines and Letters of Credit

As of December 31, 2009, we and certain of our subsidiaries

had unused lines of credit totaling $6.411 billion under

various credit facilities and unused irrevocable standby letters

of credit totaling $416 million to cover potential fundings

under various agreements.

ZONES

At maturity, holders of our 2.0% Exchangeable Subordinated

Debentures due 2029 (“ZONES”) are entitled to receive in

cash an amount equal to the higher of the principal amount of

the outstanding ZONES of $282 million or the market value of

Year ended December 31, 2009 (in millions)

Revolving bank credit facility due 2013

$

1,000

Floating rate notes due 2009

1,241

6.875% notes due 2009

750

8.375% notes due 2013

676

7.125% notes due 2013

367

7.875% senior debentures due 2013

312

ZONES due 2029

262

Other

130

Total

$

4,738