Comcast 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Comcast 2009 Annual Report on Form 10-K

48

issuance or assumption of fixed-rate debt may be adversely

affected by interest-rate fluctuations.

We manage our exposure to and benefits from price

fluctuations in the common stock of some of our investments

by using equity derivative financial instruments embedded in

other contracts, such as prepaid forward sale agreements,

whose values, in part, are derived from the market value of

certain publicly traded common stock.

We periodically examine the instruments we use to hedge

exposure to interest rate and equity price risks to ensure that

the instruments are matched with underlying assets or

liabilities, to reduce our risks relating to changes in interest

rates or equity prices and, through market value and

sensitivity analysis, to maintain a high correlation to the risk

inherent in the hedged item. For those instruments that do

not meet the above conditions, and for those derivative

financial instruments that are not designated as a hedge,

changes in fair value are recognized on a current basis in

earnings.

We manage the credit risks associated with our derivative

financial instruments through the evaluation and monitoring

of the creditworthiness of the counterparties. Although we

may be exposed to losses in the event of nonperformance by

the counterparties, we do not expect such losses, if any, to

be significant. The valuation adjustments we recorded

against the derivative financial instruments to reflect our

credit risk and counterparty credit risk are not significant.

For derivative financial instruments used to hedge exposure

to interest rate risk that are designated and effective as fair

value hedges, such as fixed to variable swaps, changes in

the fair value of the derivative financial instrument

substantially offset changes in the fair value of the hedged

item, each of which is recorded to interest expense. For

derivative financial instruments used to hedge exposure to

equity price risk that are designated and effective as fair

value hedges, such as the derivative component of a prepaid

forward sale agreement, changes in the fair value of the

derivative financial instrument substantially offset changes in

the fair value of the hedged item, each of which is recorded

to investment income (loss), net. When fair value hedges are

terminated, sold, exercised or have expired, any gain or loss

resulting from changes in the fair value of the hedged item is

deferred and recognized in earnings over the remaining life of

the hedged item. When the hedged item is settled or sold, the

unamortized adjustment in the carrying amount of the hedged

item is recognized in earnings.

For derivative financial instruments designated as cash flow

hedges, such as variable to fixed swaps and rate locks, the

effective portion of the hedge is reported in other

comprehensive income (loss) and recognized as an

adjustment to interest expense over the same period in which

the related interest costs are recognized in earnings. When

hedged variable-rate debt is settled, the

previously deferred effective portion of the hedge is written

off to interest expense in a manner similar to debt

extinguishment costs.

Equity derivative financial instruments embedded in other

contracts are separated from their host contract. The

derivative component is recorded at its estimated fair value in

our consolidated balance sheet and changes in its value are

recorded each period to investment income (loss), net.

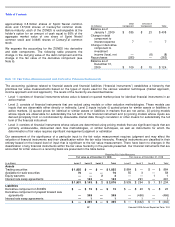

As of December 31, 2009, our derivative financial

instruments designated as hedges included (i) the derivative

component of one of our prepaid forward sale agreements,

which is recorded to other noncurrent liabilities, and (ii) our

interest rate swap agreements, which are recorded to other

current or noncurrent assets or liabilities. As of December 31,

2009, our derivative financial instruments not designated as

hedges were (i) the derivative component of our indexed debt

instruments (our ZONES debt), which is recorded to long-

term debt, and (ii) the derivative component of certain of our

prepaid forward sale agreements, which are recorded to

other noncurrent liabilities.

The gain or loss recognized on our interest rate swap

agreements due to changes in interest rates is recorded to

interest expense and is fully offset by changes in the value of

our debt. The gain or loss recognized on the derivative

component of our prepaid forward sale agreements is

recorded to investment income (loss), net and is substantially

offset by changes in the value of the underlying investments.

The gain or loss recognized on the derivative component of

our ZONES debt is recorded to investment income (loss),

net.

See Note 10 for further discussion on our derivative financial

instruments and fair value measurements.

Subsequent Events

We have evaluated events and transactions that occurred

after the balance sheet date through the issuance date of

these financial statements to determine if financial statement

recognition or additional disclosure is required.

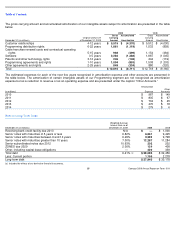

Note 3: Recent Accounting Pronouncements

Business Combinations

In November 2007, the Financial Accounting Standards

Board (“FASB”) made changes to the accounting guidance

related to business combinations. The updated guidance

(i) continues to require that all business combinations be

accounted for by applying the acquisition method, (ii) requires

all transaction costs be expensed as incurred and

(iii) rescinded the accounting guidance for uncertainties

related to income taxes in a business combination. We have

applied the updated guidance since January 1, 2009,

although none of our acquisitions in 2009 had a material

impact on our consolidated financial statements.