Comcast 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

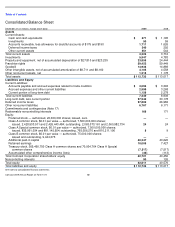

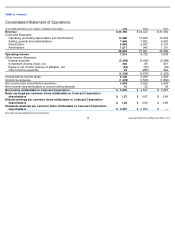

Table of Contents

Comcast 2009 Annual Report on Form 10-K

36

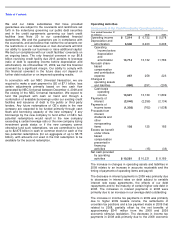

We use the notional amounts on the instruments to calculate

the interest to be paid or received. The notional amounts do

not represent the amount of our exposure to credit loss. The

estimated fair value approximates the payments necessary or

proceeds to be received to settle the outstanding contracts.

We estimate interest rates on variable debt and swaps using

the average implied forward London Interbank Offered Rate

(“LIBOR”) for the year of maturity based on the yield curve in

effect on December 31, 2009, plus the applicable margin in

effect on December 31, 2009.

As a matter of practice, we typically do not structure our

financial contracts to include credit-ratings-based triggers that

could affect our liquidity. In the ordinary course of business,

some of our swaps could be subject to termination provisions

if we do not maintain investment grade credit ratings. As of

December 31, 2009 and 2008, the estimated fair value of

those swaps was an asset of $26 million and an asset of $44

million, respectively. The amount to be paid or received upon

termination, if any, would be based on the fair value of the

outstanding contracts at that time.

Equity Price Risk Management

We are exposed to the market risk of changes in the equity

prices of our investments in marketable securities. We enter

into various derivative transactions in accordance with our

policies to manage the volatility relating to these

exposures. Through market value and sensitivity analyses,

we monitor our equity price risk exposures to ensure that the

instruments are matched with the underlying assets or

liabilities, reduce our risks relating to equity prices and

maintain a high correlation to the risk inherent in the hedged

item.

To limit our exposure to and benefits from price fluctuations

in the common stock of some of our investments, we use

equity derivative financial instruments. These derivative

financial instruments, which are accounted for at fair value,

include equity collar agreements, prepaid forward sale

agreements and indexed debt instruments.

Except as described above in “Investment Income (Loss),

Net,” the changes in the fair value of the investments that we

accounted for as trading or available for sale securities were

substantially offset by the changes in the fair values of the

equity derivative financial instruments.

Refer to Note 2 to our consolidated financial statements for a

discussion of our accounting policies for derivative financial

instruments and to Note 6 and Note 10 to our consolidated

financial statements for a discussion of our derivative

financial instruments.