Comcast 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

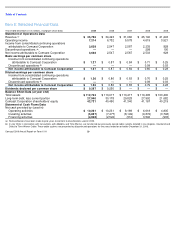

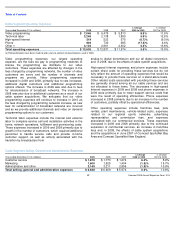

Consolidated Other Income (Expense) Items

Interest Expense

During 2009, 2008 and 2007, interest expense included $175

million, $64 million and $2 million, respectively, of early

extinguishment losses, net of early extinguishment gains,

associated with the repayment of debt obligations prior to

their scheduled maturity. The decrease in interest expense

for 2009 was primarily due to the decrease in our average

debt outstanding and decreases in interest rates on our

variable rate debt and on debt subject to variable interest rate

swap agreements, partially offset by an increase in early

extinguishment costs in 2009. The increase in interest

expense for 2008 was primarily due to an increase in our

average debt outstanding and an increase in early

extinguishment costs in 2008, partially offset by the effects of

lower interest rates on our fixed to variable rate interest rate

exchange agreements.

Investment Income (Loss), Net

The components of investment income (loss), net for 2009,

2008 and 2007 are presented in a table in Note 6 to our

consolidated financial statements. We have entered into

derivative financial instruments that we account for at fair

value and that economically hedge the market price

fluctuations in the common stock of all of our investments

accounted for as trading securities and substantially all of our

investments accounted for as available for sale securities.

The differences between the unrealized gains or losses on

securities underlying prepaid forward sale agreements and

the mark to market adjustments on the derivative component

of prepaid forward sale agreements, as presented in the table

in Note 6 to our consolidated financial statements, result from

one or more of the following:

Year ended December 31

(in millions)

2009

2008

2007

Interest expense

$

(2,348

)

$

(2,439

)

$

(2,289

)

Investment income

(loss), net

282

89

601

Equity in net

(losses) income

of affiliates, net

(64

)

(39

)

(63

)

Other income

(expense)

22

(285

)

522

Total

$

(2,108

)

$

(2,674

)

$

(1,229

)

•

there were unusual changes in the derivative valuation

assumptions such as interest rates, volatility and dividend

policy

•

the magnitude of the difference between the market price

of the underlying security to which the derivative relates

and the strike price of the derivative

•

the change in the time value component of the derivative

value during the period

•

the security to which the derivative relates changed due to

a corporate reorganization of the issuing company to a

security with a different volatility rate

Other Income (Expense)

Other expense for 2008 includes an impairment of

approximately $600 million related to our investment in

Clearwire LLC (see Note 6 to our consolidated financial

statements), partially offset by a gain of approximately $235

million on the sale of our 50% interest in the Insight asset

pool in connection with the Insight transaction. Other income

for 2007 consists primarily of a gain of approximately $500

million on the sale of our 50% interest in the Kansas City

asset pool in connection with the Houston transaction.

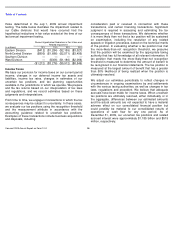

Income Tax Expense

Our effective income tax rate for 2009, 2008 and 2007 was

28.9%, 37.8% and 41.4%, respectively. Income tax expense

reflects an effective income tax rate that differs from the

federal statutory rate primarily due to state income taxes and

interest on uncertain tax positions. Our 2009 income tax

expense was reduced by approximately $566 million primarily

due to the recognition of tax benefits associated with

settlements and adjustments of uncertain tax positions and

related interest and certain subsidiary reorganizations

impacting deferred state income taxes (see Note 15 to our

consolidated financial statements). Our 2008 income tax

expense was reduced by approximately $154 million,

primarily due to the settlement of an uncertain tax position

and the net impact of certain state tax law changes, which

primarily affected our deferred income tax liabilities and other

noncurrent liabilities, and the future deductibility of certain

deferred compensation arrangements. Our income tax

expense may in the future continue to be impacted by

adjustments to uncertain tax positions and related interest

and changes in state tax laws. We expect our 2010 annual

effective tax rate to be approximately 40%.

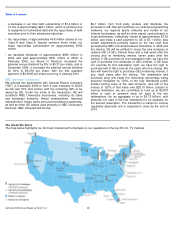

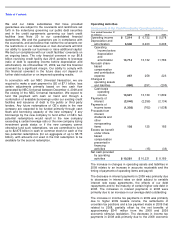

Liquidity and Capital Resources

Our businesses generate significant cash flows from

operating activities. We believe that we will be able to meet

our current and long-term liquidity and capital requirements,

including fixed charges, through our cash flows from

operating activities, existing cash, cash equivalents and

investments, available borrowings under our existing credit

facilities, and our ability to obtain future external financing.

We anticipate that we will continue to use a substantial

portion of our cash flows to fund our capital expenditures, to

invest in business opportunities, to meet our debt repayment

obligations and to return capital to investors.

We traditionally maintain significant availability under our

lines of credit and our commercial paper program to meet our

short-term liquidity requirements. As of December 31, 2009,

amounts available under all of our credit facilities totaled

approximately $6.4 billion.