Comcast 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Comcast 2009 Annual Report on Form 10-K

52

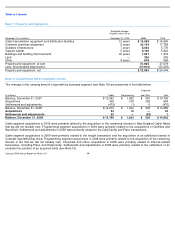

The net unrealized gains on investments accounted for as

AFS securities as of December 31, 2009 and 2008 were $

34 million and $ 29 million, respectively. The amounts were

reported as a component of accumulated other

comprehensive income (loss), net of related deferred income

taxes of $12 million and $10 million as of December 31, 2009

and 2008, respectively.

Available

-For-Sale Securities

Proceeds from the sale of AFS securities in 2009, 2008 and

2007 were $90 million, $638 million and $1.033 billion,

respectively. Gross realized gains on these sales in 2009,

2008 and 2007 were $13 million, $1 million and $145 million,

respectively. Sales of AFS securities in 2008 and 2007

consisted primarily of the sale of debt securities and sales of

Time Warner Inc. common stock, respectively.

Equity Method

SpectrumCo, LLC

SpectrumCo, LLC (“SpectrumCo”) is a joint venture in which

we, along with TWC and Bright House Networks, are

partners. SpectrumCo was the successful bidder for 137

wireless spectrum licenses for approximately $2.4 billion in

the Federal Communications Commission’s advanced

wireless spectrum auction that concluded in September

2006. Our portion of the total cost to purchase the licenses

was approximately $1.3 billion. Based on SpectrumCo

’s

currently planned activities, we have determined that it is not

a VIE. We have and continue to account for this joint venture

as an equity method investment based on its governance

structure, notwithstanding our majority interest.

Clearwire

In November 2008, Sprint Nextel and the legal predecessor

of Clearwire Corporation (“old Clearwire”) closed on a series

of transactions (collectively, the “Clearwire transaction”) with

an investor group made up of us, Intel, Google, TWC and

Bright House Networks. As a result of the Clearwire

transaction, Sprint Nextel and old Clearwire combined their

next-generation wireless broadband businesses and formed

a new independent holding company, Clearwire Corporation,

and its operating subsidiary, Clearwire Communications LLC

(“Clearwire LLC”), that will focus on the deployment of a

nationwide 4G wireless network. We, together

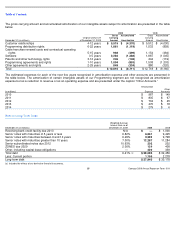

Year ended December 31 (in millions)

2009

2008

Cost

$

46

$

60

Unrealized gains

34

34

Unrealized losses

—

(

5

)

Fair value

$

80

$

89

with the other members of the investor group, initially

invested $3.2 billion in Clearwire LLC. Our portion of the

initial investment was $1.05 billion. As a result of our initial

investment, we received 61.8 million ownership units

(“ownership units”) of Clearwire LLC and 61.8 million shares

of Class B stock (“voting stock”) of Clearwire Corporation, the

publicly traded holding company that controls Clearwire LLC.

The voting stock has voting rights equal to those of the

publicly traded Class A stock of Clearwire Corporation, but

has only minimal economic rights. We hold our economic

rights through the ownership units, which have limited voting

rights. One ownership unit combined with one share of voting

stock are exchangeable into one share of Clearwire

Corporation’s publicly traded Class A stock. Also in

connection with the Clearwire transaction, we entered into an

agreement with Sprint Nextel that allows us to offer wireless

services using certain of Sprint Nextel’s existing wireless

networks and an agreement with Clearwire LLC that allows

us to offer wireless services using Clearwire LLC’s next

generation wireless broadband network. We allocated a

portion of our $1.05 billion investment to the related

agreements.

In 2009, we purchased an aggregate of approximately

25.6 million ownership units and approximately 25.6 million

voting units of Clearwire LLC for approximately $185 million

in connection with Clearwire Corporation’s $1.564 billion

rights offering. Immediately following the rights offering, we

transferred the 25.6 million voting units received to Clearwire

Corporation and received 25.6 million shares of Clearwire

Corporation voting stock. As of December 31, 2009, we held

approximately 9.4% of the ownership interests in Clearwire

Corporation on a fully diluted basis.

In 2008, as a result of the significant decline in the quoted

market value of Clearwire Corporation’s publicly traded

Class A shares from the date of our initial agreement in May

2008 to the quoted market value as of December 31, 2008,

we evaluated our investment to determine if an other

-than-

temporary decline in fair value below our cost basis had

occurred. As a result of the severe decline in the quoted

market value, we recognized an impairment in other income

(expense) of $600 million to adjust our cost basis in our

investment to its estimated fair value as of December 31,

2008. If, in the future, we are required to evaluate our

investment to determine if an other-than-temporary decline in

fair value below our cost basis has occurred, we anticipate

that our evaluation would consider (i) a comparison of actual

operating results and updated forecasts to the projected

discounted cash flows that were used in making our initial

investment decision, (ii) other impairment indicators, such as

changes in competition or technology, and (iii) a comparison

to the value that would be obtained by exchanging our

investment into Clearwire Corporation’s publicly traded

Class A shares. As of December 31, 2009, the fair value of

our investment exceeded our cost basis.