Comcast 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

21

Comcast 2009 Annual Report on Form 10-

K

Item 7: Management’s Discussion and

Analysis of Financial Condition and Results

of Operations

Introduction and Overview

We are a leading provider of video, high-speed Internet and

phone services (“cable services”), offering a variety of

entertainment, information and communications services to

residential and commercial customers. As of December 31,

2009, our cable systems served approximately 23.6 million

video customers, 15.9 million high-speed Internet customers

and 7.6 million phone customers and passed over

51.2 million homes and businesses in 39 states and the

District of Columbia. We report the results of these

operations as our Cable segment, which generates

approximately 95% of our consolidated revenue. Our Cable

segment also includes the operations of our regional sports

networks. Our Programming segment consists primarily of

our consolidated national programming networks. During

2009, our operations generated consolidated revenue of

approximately $ 35.8 billion.

Our Cable segment generates revenue primarily from

subscriptions to our cable services. In addition to cable

services, other Cable segment revenue sources include the

sale of advertising and the operation of our regional sports

networks. We market our cable services individually and in

packages. Our video services range from a limited analog

service to a full digital service with access to hundreds of

channels, including premium and pay-per-view channels On

Demand, music channels, and an interactive, on-screen

program guide. Digital video customers may also subscribe

to our advanced services, which consist of high-definition

television (“HDTV”) and/or digital video recorders (“DVR”).

Our high-speed Internet services provide Internet access at

downstream speeds of up to 50 Mbps, depending on the

service selected and subject to geographic market

availability. Our phone services provide local and long-

distance calling and other features. We also offer our cable

services to small and medium-sized businesses (“commercial

services”).

Our Programming segment consists primarily of our

consolidated national programming networks, E!, Golf

Channel, VERSUS, G4 and Style. Revenue from our

Programming segment is generated primarily from monthly

per subscriber license fees paid by multichannel video

providers, the sale of advertising and the licensing of our

programming internationally.

Our other business interests include Comcast Interactive

Media and Comcast Spectacor. Comcast Interactive Media

develops and operates our Internet businesses, including

Comcast.net, Fancast, thePlatform, Fandango, Plaxo and

DailyCandy. Revenue from Comcast Interactive Media is

generated primarily from the sale of advertising. Comcast

Spectacor owns two professional sports teams, the

Philadelphia 76ers and the Philadelphia Flyers, and a

large, multipurpose arena in Philadelphia, the Wachovia

Center, and provides facilities management services,

including food services, for sporting events, concerts and

other events. Comcast Interactive Media, Comcast Spectacor

and all other consolidated businesses not included in our

Cable or Programming segments are included in “Corporate

and Other” activities.

We operate our businesses in an intensely competitive

environment. Competition for the cable services we offer

consists primarily of direct broadcast satellite (“DBS”)

operators and phone companies. In 2009, our competitors

continued to add features and adopt aggressive pricing and

packaging for services that are comparable to the services

we offer. In addition, a substantial portion of our revenue

comes from residential customers whose spending patterns

may be affected by prevailing economic conditions.

Intensifying competition and the weak economy negatively

affected our results of operations in 2009 and may continue

to impact our results of operations in the future.

2009 Developments

The following are the more significant developments in our

businesses during 2009:

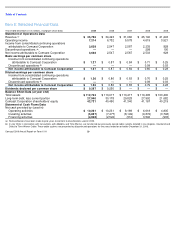

•

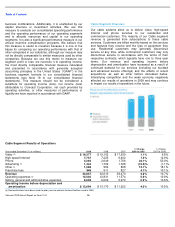

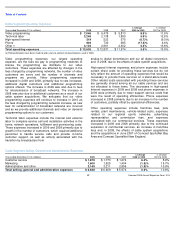

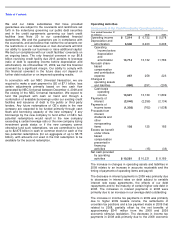

an increase in consolidated revenue of 3.9% to

approximately $35.8 billion and an increase in consolidated

operating income of 7.2% to approximately $7.2 billion

•

an increase in Cable segment revenue of 3.8% to

approximately $33.9 billion and an increase in operating

income before depreciation and amortization of 4.0% to

approximately $13.7 billion

•

an increase in Programming segment revenue of 4.9% to

approximately $1.5 billion and an increase in operating

income before depreciation and amortization of 7.5% to

approximately $389 million

•

the addition of approximately 1.0 million high-

speed

Internet customers and approximately 1.1 million phone

customers; a decrease of approximately 623,000 video

customers

•

a reduction in Cable segment capital expenditures of 9.2%

to approximately $5.0 billion

•

the continued investment in service enhancements,

including the transition from analog to digital transmission

of approximately 40 to 50 of the channels we distribute

(“our all digital conversion”),

which allows us to recapture

bandwidth and expand our video service offerings; the

continued deployment of DOCSIS 3.0 wideband

technology, which allows us to offer faster high-

speed

Internet service; the offering of certain cable network

programming to our customers online through Fancast

XFINITY TV; and the initial deployment of 4G wireless

high-speed Internet service in certain markets