Comcast 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

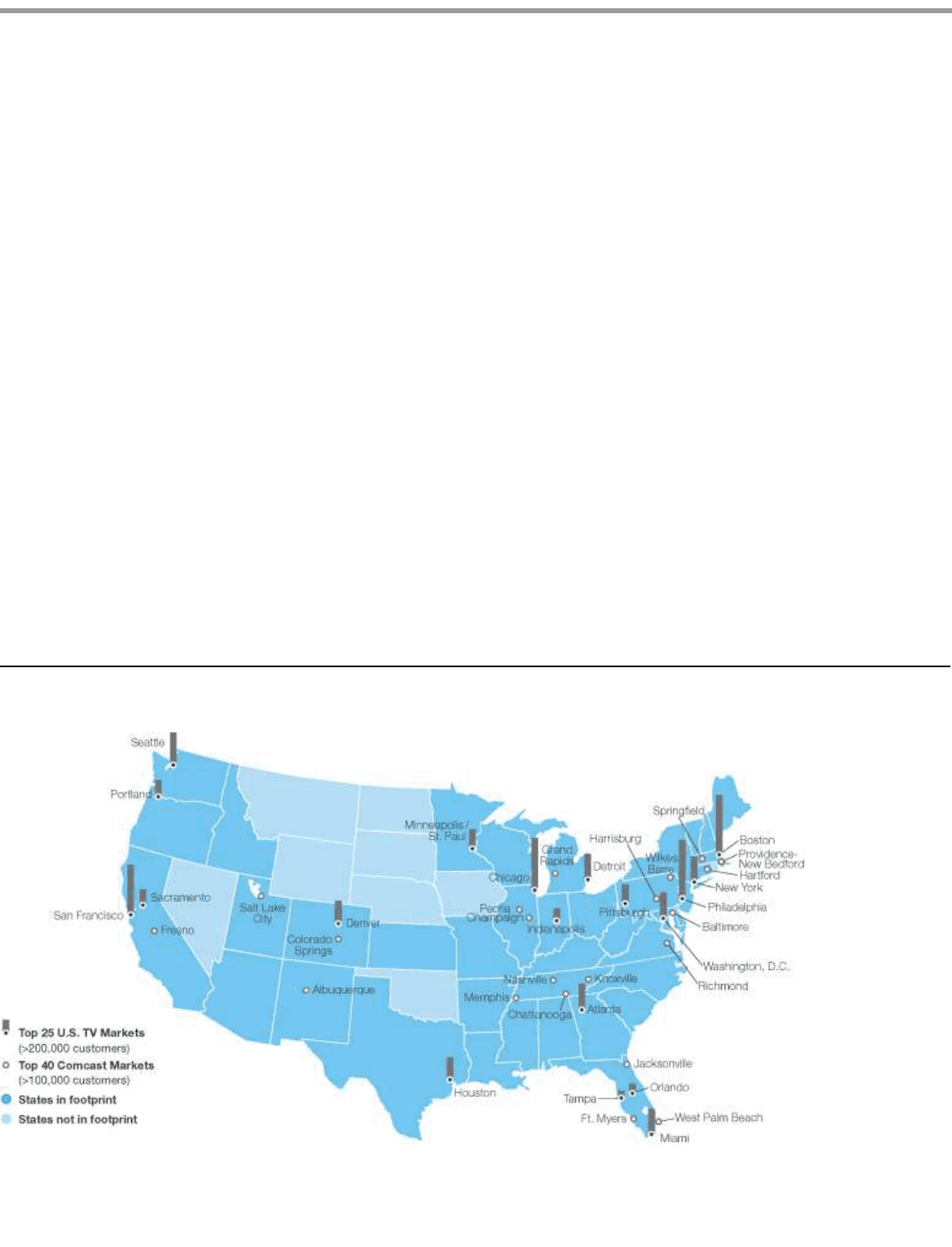

The Areas We Serve

The map below highlights our 40 major markets with emphasis on our operations in the top 25 U.S. TV markets.

Comcast 2009 Annual Report on Form 10-K

22

NBC Universal Transaction

We entered into agreements with General Electric Company

(“GE”) in December 2009 to form a new company of which

we will own 51% and control, with the remaining 49% to be

owned by GE. Under the terms of the transaction, GE will

contribute NBC Universal’s businesses, including its cable

and broadcast networks, filmed entertainment, televised

entertainment, theme parks and unconsolidated investments,

as well as other GE assets used primarily in NBC Universal’s

business. NBC Universal will borrow

•

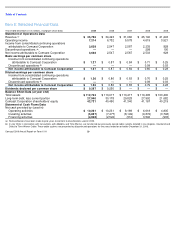

a decrease in our total debt outstanding of $3.4 billion or

10.4% to approximately $29.1 billion, which is primarily due

to repayment of scheduled debt and the repurchase of debt

securities prior to their scheduled maturities

•

the repurchase of approximately 49.8 million shares of our

Class A and Class A Special common stock under our

share repurchase authorization for approximately $765

million

•

we declared dividends of approximately $850 million in

2009 and paid approximately $761 million in 2009; in

February 2009, our Board of Directors increased the

planned annual dividend by 8% to $0.27 per share; and in

December 2009, it increased the planned annual dividend

by 40% to $0.378 per share, with the first quarterly

payment of $0.0945 per share occurring in January 2010

$9.1 billion from third party lenders and distribute the

proceeds to GE. We will contribute our national programming

networks, our regional sports networks and certain of our

Internet businesses, as well as other assets used primarily in

those businesses, collectively valued at approximately $7.25

billion, and make a cash payment to GE of $7.1 billion, less

certain adjustments primarily based on the free cash flow

generated by NBC Universal between December 4, 2009 and

the closing. GE will be entitled to cause the new company to

redeem half of GE’s interest three and a half years after the

closing and its remaining interest seven years after the

closing. If GE exercises its first redemption right, we have the

right to purchase the remainder of GE’s interest. If GE does

not exercise its first redemption right, we have the right to

purchase half of GE’s interest five years after the closing. We

also will have the right to purchase GE’s remaining interest, if

any, eight years after the closing. The redemption and

purchase price will equal the ownership percentage being

acquired multiplied by 120% of the fully distributed public

market trading value of the new company, less half of the

excess of 120% of that value over $28.15 billion. Subject to

various limitations, we are committed to fund up to $2.875

billion in cash or common stock for each of the two

redemptions (for an aggregate of up to $5.75 billion), with

amounts not used in the first redemption to be available for

the second redemption. The transaction is subject to various

regulatory approvals and is expected to close by the end of

2010.