Comcast 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Comcast 2009 Annual Report on Form 10-K

26

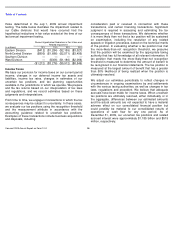

compared to 14% and 11% as of December 31, 2008 and

2007, respectively.

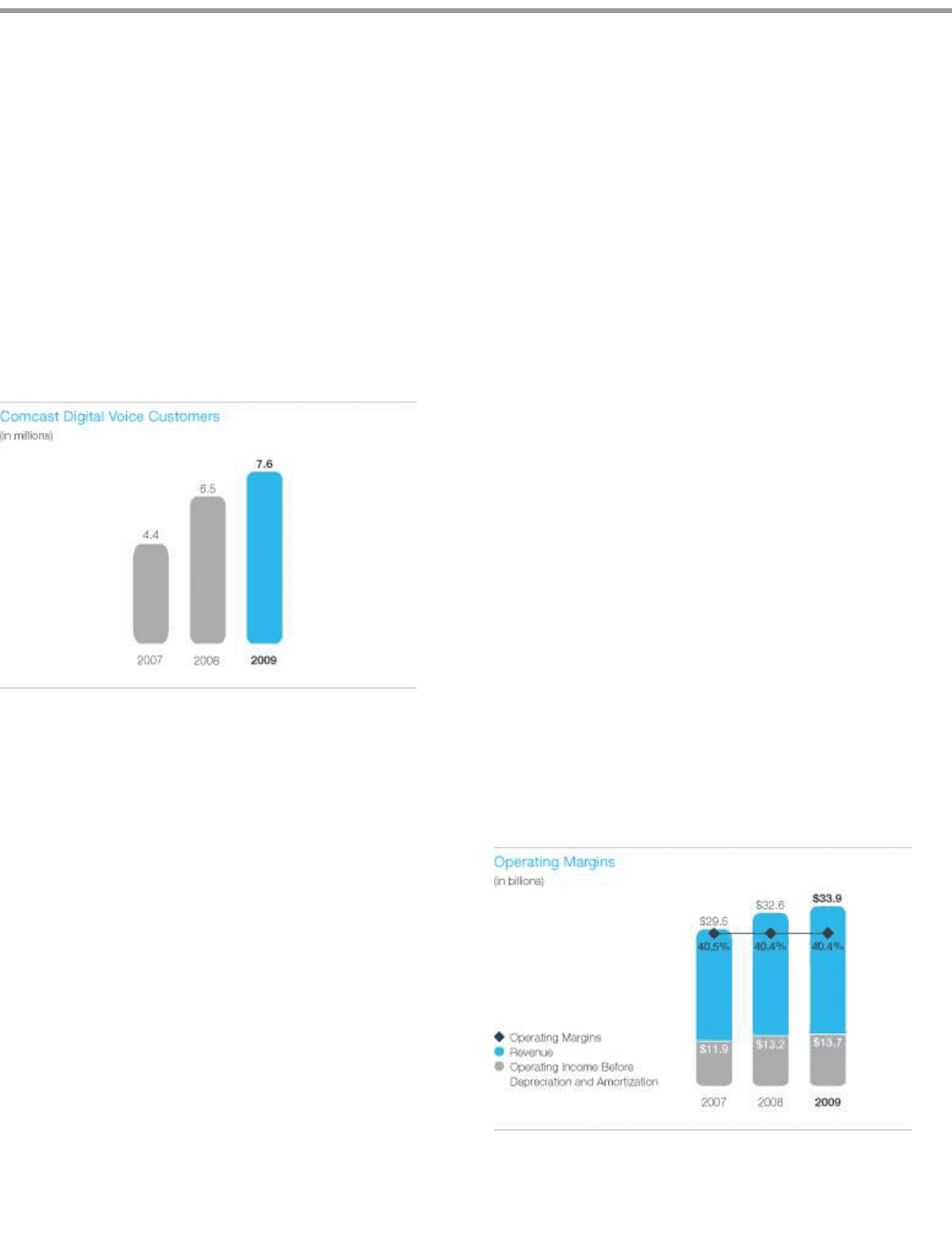

Our phone revenue increased in 2009 and 2008 as a result of

increases in the number of residential and commercial phone

customers. In 2008, these increases were partially offset by

the loss of approximately 170,000 circuit-switched phone

customers. We phased out substantially all of our circuit-

switched phone service in 2008. In 2008, approximately $43

million of the increase in our phone revenue was attributable

to the effects of cable system acquisitions. Average monthly

revenue per phone customer declined to approximately $39

in 2009 from approximately $40 in 2008 and approximately

$42 in 2007, due to customers receiving service as part of a

promotional offer or in a bundled service offering. We expect

the rates of customer and revenue growth to decline in 2010.

Advertising

As part of our programming license agreements with

programming networks, we receive an allocation of

scheduled advertising time that we may sell to local, regional

and national advertisers. In most cases, the available

advertising time is sold by our sales force. In some cases, we

work with representation firms as an extension of our sales

force to sell a portion of the advertising time allocated to us.

We also coordinate the advertising sales efforts of other

cable operators in some markets, and in some markets we

operate advertising interconnects. These interconnects

establish a physical, direct link between multiple providers for

the sale of regional and national advertising across larger

geographic areas than could be provided by a single cable

operator. Our prior practice had been to record the fees we

pay to representation firms and other multichannel video

providers as a revenue offset. However, since we are acting

as the principal in these arrangements and as these

coordination and interconnect activities are expected to grow

in significance, we have concluded that we should report the

fees paid to representation firms and multichannel video

providers as an operating expense rather than as a revenue

offset. Accordingly, we changed the presentation for these

items for 2008 and 2007,

and classified approximately $167 million and $165 million,

respectively, of the fees paid as operating expenses.

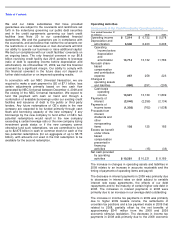

Advertising revenue decreased in 2009 and 2008 primarily

due to a decline in the overall television advertising market as

a result of weak economic conditions. In 2009, the decrease

also resulted from a decline in political advertising, while the

decrease in 2008 was partially offset by an increase in

political advertising and the impact of cable system

acquisitions.

Other

We also generate revenue from our regional sports networks,

our digital media center, commissions from electronic

retailing networks and fees for other services. Our regional

sports networks include Comcast SportsNet (Philadelphia),

Comcast SportsNet Mid-Atlantic (Baltimore/Washington),

Cable Sports Southeast, Comcast SportsNet Chicago,

MountainWest Sports Network, Comcast SportsNet California

(Sacramento), Comcast SportsNet New England (Boston),

Comcast SportsNet Northwest (Portland), Comcast Sports

Southwest (Houston), and Comcast SportsNet Bay Area

(San Francisco). These networks generate revenue from

programming license agreements with multichannel video

providers and through the sale of advertising.

Franchise Fees

Our franchise fee revenue represents the pass-through to our

customers of the fees required to be paid to state and local

franchising authorities. Under the terms of our franchise

agreements, we are generally required to pay to the

franchising authority an amount based on our gross video

revenue. The increases in franchise fees collected from our

cable customers in 2009 and 2008 were primarily due to

increases in the revenue on which the fees apply.

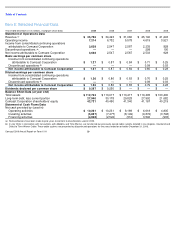

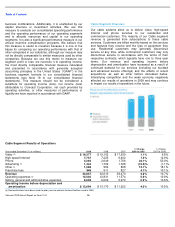

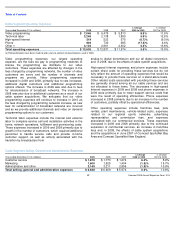

Cable Segment Expenses

We continue to focus on controlling the growth of expenses.

Our operating margins (operating income before depreciation

and amortization as a percentage of revenue) for 2009, 2008

and 2007 were 40.4%, 40.4% and 40.5%, respectively.