Comcast 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

61

Comcast 2009 Annual Report on Form 10-

K

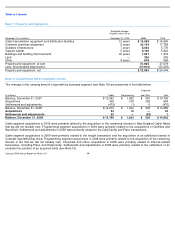

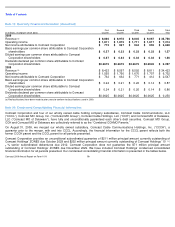

Changes in Common Stock

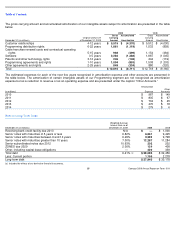

Dividends

In December 2009, our Board of Directors increased the

quarterly dividend paid in January 2010 from $0.0675 per

share to $0.0945 per share. We expect to continue to pay

quarterly dividends, though each dividend is subject to

approval by our Board of Directors.

Accumulated Other Comprehensive Income (Loss)

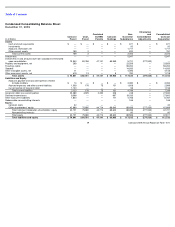

Common Stock Share Class

(shares, in millions)

A

A Special

B

Balance, January 1, 2007

2,060

1,050

9

Stock compensation plans

17

6

—

Repurchase and retirement of

common stock

(25

)

(108

)

—

Employee stock purchase plan

2

—

—

Balance, December 31, 2007

2,054

948

9

Stock compensation plans

4

3

—

Repurchase and retirement of

common stock

(20

)

(121

)

—

Employee stock purchase plan

3

—

—

Share exchange

20

(20

)

—

Balance, December 31, 2008

2,061

810

9

Stock compensation plans

3

—

—

Repurchase and retirement of

common stock

(5

)

(45

)

—

Employee stock purchase plan

4

—

—

Balance, December 31, 2009

2,063

765

9

Period Declared

Per Share

Amount

February

$

0.0675

$

195

May

0.0675

194

August

0.0675

193

December (paid in January 2010)

0.0945

268

Total

$

0.2970

$

850

December 31 (in millions)

2009

2008

Unrealized gains (losses) on

marketable securities

$

22

$

19

Deferred gains (losses) on cash flow

hedges

(62

)

(97

)

Unrealized gains (losses) on

employee benefit obligations

(6

)

(31

)

Cumulative translation adjustments

—

(

4

)

Accumulated other comprehensive

income (loss), net of deferred

taxes

$

(46

)

$

(113

)

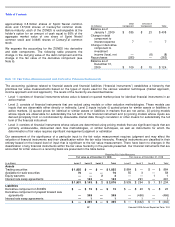

Deferred losses on cash flow hedges in the table above

relate primarily to previous interest rate lock agreements

entered into to fix the interest rates of certain of our debt

obligations in advance of their issuance. Unless we retire this

debt early, these unrealized losses will be reclassified as an

adjustment to interest expense, primarily through 2022, the

same period in which the related interest expense is

recognized in earnings. As of December 31, 2009, we expect

$16 million of unrealized losses, $10 million net of deferred

taxes, to be reclassified as an adjustment to interest expense

over the next 12 months.

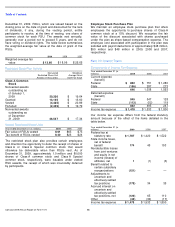

Note 14: Share-Based Compensation

Our approach to long-term incentive compensation includes

the awarding of stock options and RSUs to certain

employees and directors. We grant these awards under

various plans. Additionally, through our employee stock

purchase plan, employees are able to purchase shares of

Comcast Class A common stock at a discount through payroll

deductions.

Recognized Share-Based Compensation Expense

As of December 31, 2009, we had unrecognized pretax

compensation expense of $320 million related to nonvested

stock options and unrecognized pretax compensation

expense of $307 million related to nonvested RSUs that will

be recognized over a weighted average period of

approximately 2.0 years and 1.7 years, respectively. The

amount of share-based compensation capitalized was not

material to our consolidated financial statements for the

periods presented.

When stock options are exercised or RSU awards are settled

through the issuance of shares, any income tax benefit

realized in excess of the amount associated with

compensation expense that was previously recognized for

financial reporting purposes is presented as a financing

activity rather than as an operating activity in our

consolidated statement of cash flows. There was no excess

cash income tax benefit classified as a financing cash inflow

in 2009. In 2008 and 2007, there was approximately $15

million and $33 million, respectively, of excess cash income

tax benefit classified as a financing cash inflow.

Year ended December 31 (in millions)

2009

2008

2007

Stock options

$

103

$

99

$

74

Restricted share units

93

96

79

Employee stock purchase

plan

13

13

11

Total

$

209

$

208

$

164

Tax benefit

$

73

$

71

$

56