Comcast 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

51

Comcast 2009 Annual Report on Form 10-

K

2007

Houston Transaction

In July 2006, we initiated the dissolution of Texas and

Kansas City Cable Partners (the “Houston transaction”), our

50%-50% cable system partnership with Time Warner Cable

(“TWC”). On January 1, 2007, the distribution of assets by

Texas and Kansas City Cable Partners was completed and

we received the cable system serving Houston, Texas (the

“Houston asset pool”) and TWC received the cable systems

serving Kansas City, south and west Texas, and New Mexico

(the “Kansas City asset pool”). We accounted for the

distribution of assets by Texas and Kansas City Cable

Partners as a sale of our 50% interest in the Kansas City

asset pool in exchange for acquiring an additional 50%

interest in the Houston asset pool. This transaction resulted

in an increase of approximately 700,000 video customers.

The estimated fair value of the 50% interest of the Houston

asset pool we received was approximately $1.1 billion and

resulted in a pretax gain of approximately $500 million, which

is included in other income (expense). We recorded our 50%

interest in the Houston asset pool as a step acquisition,

which was in accordance with the applicable accounting

guidance at that time.

The results of operations for the cable systems acquired in

the Houston transaction have been reported in our Cable

segment since August 1, 2006 and in our consolidated

financial statements since January 1, 2007 (the date of the

distribution of assets). The weighted-average amortization

period of the franchise-related customer relationship

intangible assets acquired was 7 years. As a result of the

Houston transaction, we reversed deferred tax liabilities of

approximately $200 million, which were primarily related to

the excess of tax basis of the assets acquired over the tax

basis of the assets exchanged, and reduced the amount of

goodwill that would have otherwise been recorded in the

acquisition. Substantially all of the goodwill recorded is

expected to be amortizable for tax purposes.

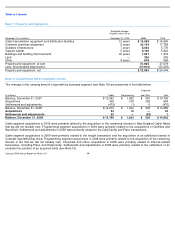

The table below presents the purchase price allocation to

assets acquired and liabilities assumed as a result of the

Houston transaction.

Other

In April 2007, we acquired Fandango, an online

entertainment site and movie-ticket service. The results of

operations of Fandango have been included in our

consolidated financial statements since

(in millions)

Property and equipment

$

870

Franchise

-

related customer relationships

266

Cable franchise rights

1,954

Goodwill

426

Other assets

267

Total liabilities

(73

)

Net assets acquired

$

3,710

the acquisition date and are reported in Corporate and Other.

In June 2007, we acquired Rainbow Media Holdings LLC’s

60% interest in Comcast SportsNet Bay Area (formerly

known as Bay Area SportsNet) and its 50% interest in

Comcast SportsNet New England (formerly known as Sports

Channel New England), expanding our regional sports

networks. The completion of this transaction resulted in our

100% ownership in Comcast SportsNet New England and

60% ownership in Comcast SportsNet Bay Area. In August

2007, we acquired the cable system of Patriot Media serving

approximately 81,000 video customers in central New Jersey.

The results of operations of Patriot Media, Comcast

SportsNet Bay Area and Comcast SportsNet New England

have been included in our consolidated financial statements

since their acquisition dates and are reported in our Cable

segment. The aggregate purchase price of these other 2007

acquisitions was approximately $1.288 billion. None of these

acquisitions were material to our consolidated financial

statements for the year ended December 31, 2007.

Note 6: Investments

Fair Value Method

As of December 31, 2009, we held $1.929 billion of fair value

method equity securities related to our obligations under

prepaid forward sale agreements as collateral. These

obligations are recorded to other noncurrent liabilities and

terminate between 2011 and 2015. At termination of these

prepaid forward sale agreements, the counterparties are

entitled to receive some or all of the equity securities, or an

equivalent amount of cash at our option, based on the market

value of the equity securities at that time.

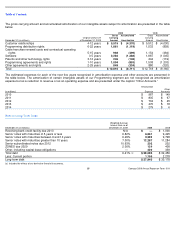

December 31 (in millions)

2009

2008

Fair Value Method

Equity securities

$

1,933

$

940

Debt securities

—

3

1,933

943

Equity Method

SpectrumCo, LLC

1,410

1,354

Clearwire LLC

530

421

Other

401

402

2,341

2,177

Cost Method

AirTouch

1,494

1,479

Other

229

243

1,723

1,722

Total investments

5,997

4,842

Less: Current investments

50

59

Noncurrent investments

$

5,947

$

4,783