Comcast 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Comcast 2009 Annual Report on Form 10-K

50

Note 5: Acquisitions and Other Significant Events

2009

NBC Universal Transaction

We entered into agreements with General Electric Company

(“GE”) in December 2009 to form a new company of which

we will own 51% and control, with the remaining 49% to be

owned by GE. Under the terms of the transaction, GE will

contribute NBC Universal’s businesses, including its cable

and broadcast networks, filmed entertainment, televised

entertainment, theme parks and unconsolidated investments,

as well as other GE assets used primarily in NBC Universal’s

business. NBC Universal will borrow $9.1 billion from third

party lenders and distribute the proceeds to GE. We will

contribute our national programming networks, our regional

sports networks and certain of our Internet businesses, as

well as other assets used primarily in those businesses,

collectively valued at approximately $7.25 billion, and make a

cash payment to GE of $7.1 billion less certain adjustments

primarily based on the free cash flow generated by NBC

Universal between December 4, 2009 and the closing. GE

will be entitled to cause the new company to redeem half of

GE’s interest three and a half years after the closing and its

remaining interest seven years after the closing. If GE

exercises its first redemption right, we have the right to

purchase the remainder of GE’s interest. If GE does not

exercise its first redemption right, we have the right to

purchase half of GE’s interest five years after the closing. We

also will have the right to purchase GE’s remaining interest, if

any, eight years after the closing. The redemption and

purchase price will equal the ownership percentage being

acquired multiplied by 120% of the fully distributed public

market trading value of the new company, less half of the

excess of 120% of that value over $28.15 billion. Subject to

various limitations, we are committed to fund up to $2.875

billion in cash or common stock for each of the two

redemptions (for an aggregate of up to $5.75 billion), with

amounts not used in the first redemption to be available for

the second redemption. The transaction is subject to various

regulatory approvals and is expected to close by the end of

2010.

The results of operations for the new company will be

consolidated with our results of operations, as we will control

the new company. When the transaction is completed, the

NBC Universal businesses will be recorded at their fair value

and the businesses we contribute will be recorded at their

historical or carry-over basis. GE’s interest will be recorded

as a redeemable noncontrolling interest in our consolidated

financial statements.

2008

Insight Transaction

In April 2007, we and Insight Communications (“Insight”)

agreed to divide the assets and liabilities of Insight Midwest,

a 50%-50% cable system partnership with Insight (the

“Insight transaction”). On December 31, 2007, we contributed

approximately $1.3 billion to Insight Midwest for our share of

the partnership’s debt. On January 1,

2008, the distribution of the assets of Insight Midwest was

completed without assumption of any of Insight’s debt by us

and we received cable systems serving approximately

696,000 video customers in Illinois and Indiana (the

“Comcast asset pool”). Insight received cable systems

serving approximately 652,000 video customers, together

with approximately $1.24 billion of debt allocated to those

cable systems (the “Insight asset pool”). We accounted for

our interest in Insight Midwest as an equity method

investment until the Comcast asset pool was distributed to us

on January 1, 2008. We accounted for the distribution of

assets by Insight Midwest as a sale of our 50% interest in the

Insight asset pool in exchange for acquiring an additional

50% interest in the Comcast asset pool. The estimated fair

value of the 50% interest of the Comcast asset pool we

received was approximately $1.2 billion and resulted in a

pretax gain of approximately $235 million, which is included

in other income (expense). We recorded our 50% interest in

the Comcast asset pool as a step acquisition, which was in

accordance with the applicable accounting guidance at that

time.

The results of operations for the cable systems acquired in

the Insight transaction have been reported in our

consolidated financial statements since January 1, 2008 and

are reported in our Cable segment. The weighted-average

amortization period of the franchise-related customer

relationship intangible assets acquired was 4.5 years.

Substantially all of the goodwill recorded is expected to be

amortizable for tax purposes.

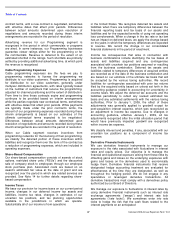

The table below presents the purchase price allocation to

assets acquired and liabilities assumed as a result of the

Insight transaction.

Other

In April 2008, we acquired an additional interest in Comcast

SportsNet Bay Area. In July 2008, we acquired Plaxo, an

address book management and social networking website

service. In August 2008, we acquired the remaining interest

in G4 that we did not already own. In September 2008, we

acquired DailyCandy, an e-mail newsletter and website. The

results of operations for these acquisitions have been

included in our consolidated results of operations since their

respective acquisition dates. The results of operations for

Plaxo and DailyCandy are reported in Corporate and Other.

The aggregate purchase price of these other 2008

acquisitions was approximately $610 million. None of these

acquisitions were material to our consolidated financial

statements for the year ended December 31, 2008.

(in millions)

Property and equipment

$

587

Franchise-related customer relationships

64

Cable franchise rights

1,374

Goodwill

105

Other assets

27

Total liabilities

(31

)

Net assets acquired

$

2,126