Comcast 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Phone Services

Our digital phone service competes against local phone compa-

nies, wireless phone service providers, competitive local exchange

carriers (“CLECs”) and other VoIP service providers. The local

phone companies have substantial capital and other resources,

longstanding customer relationships, and extensive existing facili-

ties and network rights-of-way. A few CLECs also have existing

local networks and significant financial resources.

Advertising

We compete for the sale of advertising against a wide variety of

media, including local broadcast stations, national broadcast

networks, national and regional programming networks, local radio

broadcast stations, local and regional newspapers, magazines and

Internet sites.

Programming Segment

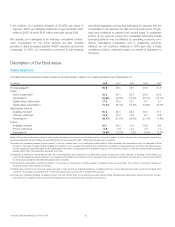

The table below presents a summary of our most significant consolidated national programming networks as of December 31, 2008.

Programming Network

Approximate

U.S. Subscribers

(in millions) Description

E! 85 Pop culture and entertainment-related programming

Golf Channel 73 Golf and golf-related programming

VERSUS 66 Sports and leisure programming

G4 57 Gamer lifestyle programming

Style 51 Lifestyle-related programming

Revenue for our programming networks is primarily generated

from the sale of advertising and from monthly per subscriber

license fees paid by multichannel video providers that have typi-

cally entered into multiyear contracts to distribute our

programming networks. To obtain long-term contracts with

distributors, we may make cash payments, provide an initial period

in which license fee payments are waived or do both. Our

programming networks assist distributors with ongoing marketing

and promotional activities to retain existing customers and acquire

new customers. Although we believe prospects of continued car-

riage and marketing of our programming networks by larger

distributors are generally good, the loss of one or more of such

distributors could have a material adverse effect on our program-

ming networks.

Sources of Supply

Our programming networks often produce their own television

programs and broadcasts of live events. This often requires us to

acquire the rights to the content that is used in such productions

(such as rights to screenplays or sporting events). In other cases,

our programming networks license the cable telecast rights to

television programs produced by third parties.

Competition

Our programming networks compete with other television

programming services for distribution and programming. In addi-

tion, our programming networks compete for audience share with

all other forms of programming provided to viewers, including

broadcast networks; local broadcast stations; pay and other cable

networks; home video, pay-per-view and video on demand serv-

ices; and Internet sites. Finally, our programming networks

compete for advertising revenue with other national and local

media, including other television networks, television stations, radio

stations, newspapers, Internet sites and direct mail.

Other Businesses

Our other business interests include Comcast Interactive Media

and Comcast Spectacor. Comcast Interactive Media develops and

operates Comcast’s Internet businesses focused on entertain-

ment, information and communication, including Comcast.net,

Fancast, thePlatform, Fandango, Plaxo and DailyCandy. Comcast

Spectacor owns two professional sports teams and two large,

multipurpose arenas, and manages other facilities for sporting

events, concerts and other events.

We also own noncontrolling interests in certain networks and

content providers, including MGM, iN DEMAND, TV One, PBS

KIDS Sprout, FEARnet, New England Cable News, Pittsburgh

Cable News Channel, Music Choice and SportsNet New York. In

addition, we have noncontrolling interests in wireless-related

companies, including Clearwire and SpectrumCo, LLC.

7Comcast 2008 Annual Report on Form 10-K