Comcast 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

facility due 2013 relates to leverage (ratio of debt to operating

income before depreciation and amortization). As of December 31,

2008, we met this financial covenant by a significant margin. Our

ability to comply with this financial covenant in the future does not

depend on further debt reduction or on improved operating

results.

Share Repurchase and Dividends

As of December 31, 2008, we had approximately $4.1 billion of

availability remaining under our share repurchase authorization. We

have previously indicated our plan to fully use our remaining share

repurchase authorization by the end of 2009, subject to market

conditions. However, as previously disclosed, due to difficult

economic conditions and instability in the capital markets, it is

unlikely that we will complete our share repurchase authorization

by the end of 2009 as previously planned.

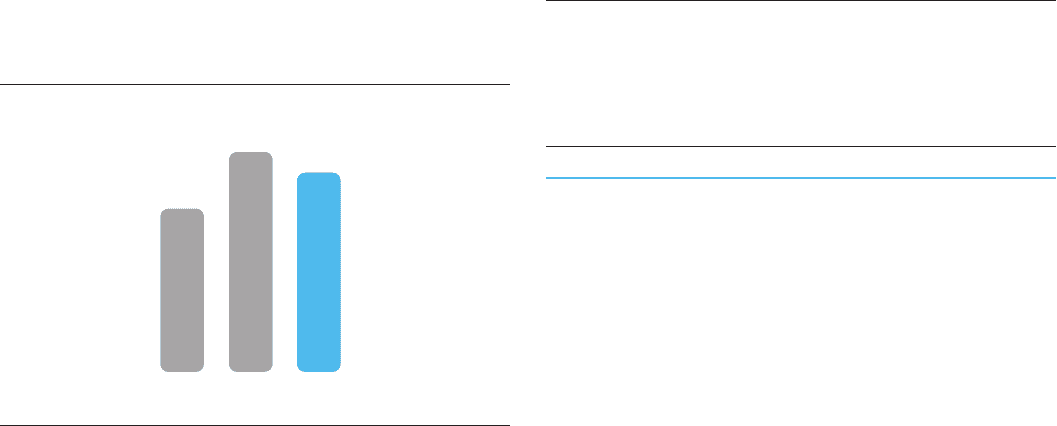

Share Repurchases

(in billions)

$2.3

$3.1

2007

2006

$2.8

2008

Our Board of Directors declared a dividend of $0.0625 per share

for each quarter in 2008 totaling approximately $727 million. We

paid approximately $547 million of dividends in 2008. We expect

to continue to pay quarterly dividends, though each subsequent

dividend is subject to approval by our Board of Directors. We did

not declare or pay any cash dividends in 2007 or 2006.

Investing Activities

Net cash used in investing activities consists primarily of cash paid

for capital expenditures, acquisitions and investments, partially

offset by proceeds from sales of investments.

Capital Expenditures

Our most significant recurring investing activity has been capital

expenditures in our Cable segment and we expect that this will con-

tinue in the future. A significant portion of our capital expenditures is

based on the level of customer growth and the technology being

deployed. The table below summarizes the capital expenditures we

incurred in our Cable segment from 2006 through 2008.

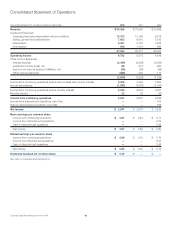

Year ended December 31 (in millions) 2008 2007 2006

Customer premises equipment(a) $3,147 $3,164 $2,321

Scalable infrastructure(b) 1,024 1,014 906

Line extensions(c) 212 352 275

Support capital(d) 522 792 435

Upgrades (capacity expansion)(e) 407 520 307

Business services(f) 233 151 —

Total $5,545 $5,993 $4,244

(a) Customer premises equipment (“CPE”) includes costs incurred to connect our

services at the customer’s home. The equipment deployed typically includes stan-

dard digital set-top boxes, HD set-top boxes, digital video recorders, remote

controls and modems. CPE also includes the cost of installing this equipment for

new customers as well as the material and labor cost incurred to install the cable

that connects a customer’s dwelling to the network.

(b) Scalable infrastructure includes costs incurred to secure growth in customers or

revenue units or to provide service enhancements, other than those related to

CPE. Scalable infrastructure includes equipment that controls signal reception,

processing and transmission throughout our distribution network, as well as

equipment that controls and communicates with the CPE residing within a

customer’s home. Also included in scalable infrastructure is certain equipment

necessary for content aggregation and distribution (video on demand equipment)

and equipment necessary to provide certain video, high-speed Internet and digital

phone service features (e.g., voice mail and e-mail).

(c) Line extensions include the costs of extending our distribution network into new

service areas. These costs typically include network design, the purchase and

installation of fiber-optic and coaxial cable, and certain electronic equipment.

(d) Support capital includes costs associated with the replacement or enhancement of

non-network assets due to technical or physical obsolescence and wear-out.

These costs typically include vehicles, computer and office equipment, furniture

and fixtures, tools, and test equipment.

(e) Upgrades include costs to enhance or replace existing portions of our cable net-

work, including recurring betterments.

(f) Business services include the costs incurred related to the rollout of our services to

small and medium-sized businesses. The equipment typically includes high-speed

Internet modems and phone modems and the cost of installing this equipment for

new customers as well as materials and labor incurred to install the cable that

connects a customer’s business to the closest point of the main distribution net-

work.

Comcast 2008 Annual Report on Form 10-K 32