Comcast 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

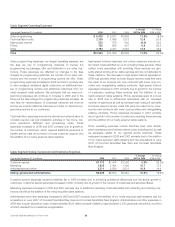

customer for our digital phone service has declined, to approx-

imately $39 in 2008 from approximately $42 in 2007 and

approximately $45 in 2006, due to customers receiving service as

part of a promotional offer or in a bundled service offering. We

expect the rates of customer and revenue growth to slow in 2009,

because we do not expect to launch any significant new service

areas in 2009 and due to weak economic conditions continuing.

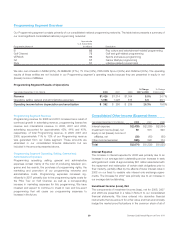

Comcast Digital Voice Customers

(in millions)

2008

2007

2006

1.9

4.4

6.5

Advertising

As part of our programming license agreements with programming

networks, we receive an allocation of scheduled advertising time

that we may sell to local, regional and national advertisers. We also

coordinate the advertising sales efforts of other cable operators in

some markets, and in some markets we operate advertising inter-

connects. These interconnects establish a physical, direct link

between multiple cable systems and provide for the sale of

regional and national advertising across larger geographic areas

than could be provided by a single cable operator.

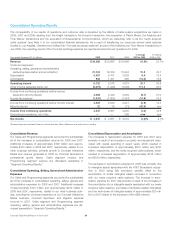

Advertising revenue decreased in 2008 primarily due to a decline in

the television advertising market, including the automotive and

housing sectors, offset by an increase in political advertising and

the addition of the newly acquired cable systems. Advertising

revenue increased in 2007 as a result of our newly acquired cable

systems. Absent the growth from the newly acquired cable sys-

tems, advertising revenue decreased slightly in 2007, reflecting

weakness across the television advertising market, a lower level of

political advertising and one less week in the broadcast calendar

during 2007 compared to 2006. We expect our advertising rev-

enue to decline in 2009 due to a deteriorating advertising market,

less political advertising and weak economic conditions continuing.

Other

We also generate revenue from our regional sports networks, our

digital media center, on-screen guide advertising, commissions

from electronic retailing networks and fees for other services.

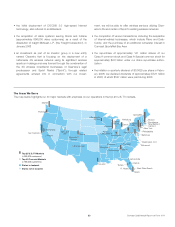

Our regional sports networks include Comcast SportsNet

(Philadelphia), Comcast SportsNet Mid-Atlantic (Baltimore/

Washington), Cable Sports Southeast, Comcast SportsNet

Chicago, Comcast SportsNet California (Sacramento), Comcast

SportsNet Northwest (Portland), Comcast SportsNet New England

(Boston), Comcast SportsNet Bay Area (San Francisco) and

MountainWest Sports Network. These networks generate revenue

through programming license agreements with multichannel video

providers and the sale of advertising time.

Other revenue increased in 2008 and 2007 as a result of our

acquisitions in June 2007 of Comcast SportsNet Bay Area and

Comcast SportsNet New England and our acquisitions of the

newly acquired cable systems.

Franchise Fees

Our franchise fee revenue represents the pass-through to our cus-

tomers of the fees required to be paid to state and local franchising

authorities. Under the terms of our franchise agreements, we are

generally required to pay to the franchising authority an amount

based on our gross video revenue. The increases in franchise fees

collected from our cable customers in 2008 and 2007 were primarily

due to increases in the revenue on which the fees apply.

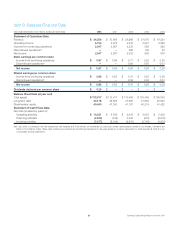

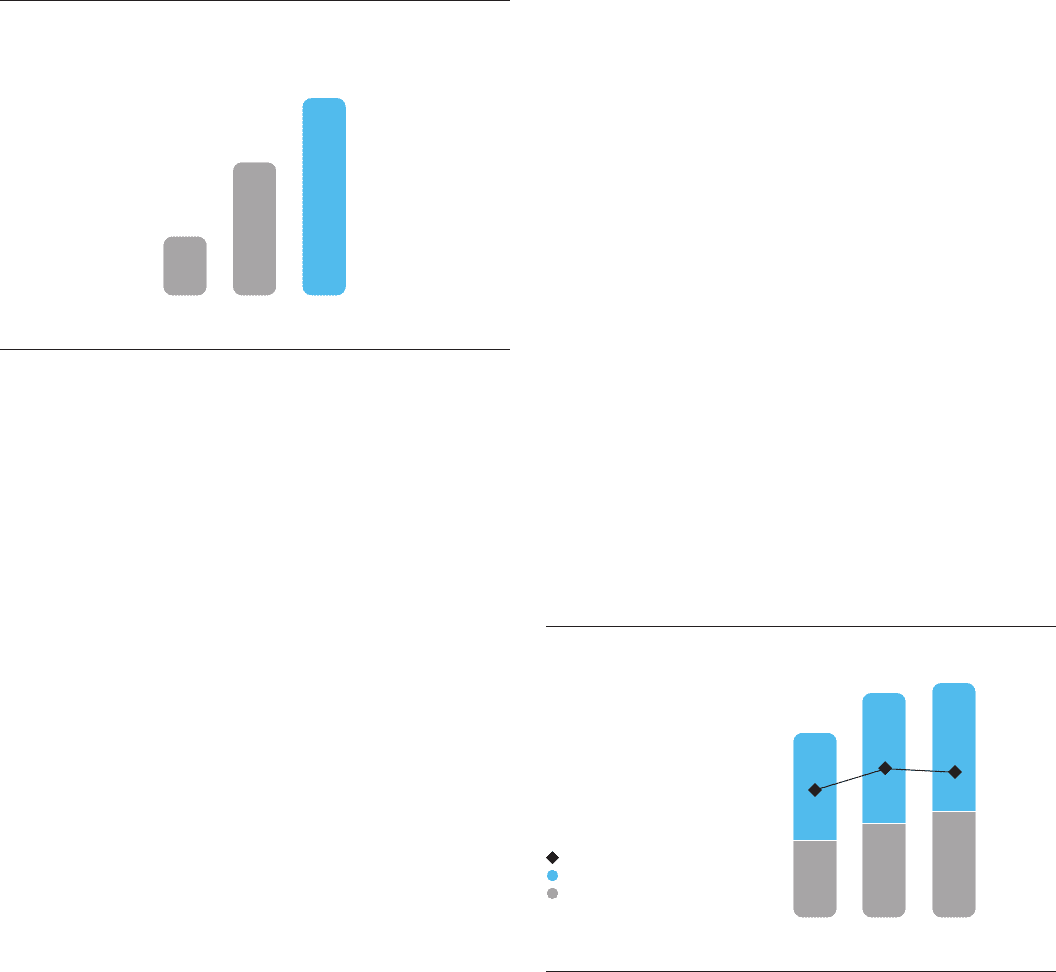

Cable Segment Expenses

We continue to focus on controlling the growth of expenses. Our

operating margins (operating income before depreciation and

amortization as a percentage of revenue) for 2008, 2007 and 2006

were 40.6 %, 40.7% and 40.2%, respectively.

Operating Margins

(in billions)

20072006

$9.7

$11.9

$24.0

$29.3

40.2%

40.7%

Operating Margins

Revenue

Operating Income Before

Depreciation and Amortization

2008

$13.2

$32.4

40.6%

27 Comcast 2008 Annual Report on Form 10-K