Comcast 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Part II

Item 5: Market for the Registrant’s

Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity

Securities

Our Class A common stock is listed on the Nasdaq Global Select

Market under the symbol CMCSA and our Class A Special com-

mon stock is listed on the Nasdaq Global Select Market under the

symbol CMCSK. There is no established public trading market for

our Class B common stock. Our Class B common stock can be

converted, on a share for share basis, into Class A or Class A

Special common stock.

In February, May, August and December 2008, our Board of Direc-

tors approved quarterly dividends of $0.0625 per share.

Holders of our Class A common stock in the aggregate hold

66

2

⁄

3

% of the voting power of our capital stock. The number of

votes that each share of our Class A common stock has at any

given time depends on the number of shares of Class A common

stock and Class B common stock then outstanding. Holders of

shares of our Class A Special common stock cannot vote in the

election of directors or otherwise, except where class voting is

required by law. In that case, shares of our Class A Special

common stock have the same number of votes per share as

shares of Class A common stock. Our Class B common stock has

a33

1

⁄

3

% nondilutable voting interest, and each share of Class B

common stock has 15 votes per share. Mr. Brian L. Roberts bene-

ficially owns all outstanding shares of our Class B common stock.

Generally, including as to the election of directors, holders of

Class A common stock and Class B common stock vote as one

class except where class voting is required by law.

As of December 31, 2008, there were 798,947 record holders of

our Class A common stock, 2,127 record holders of our Class A

Special common stock and three record holders of our Class B

Common Stock.

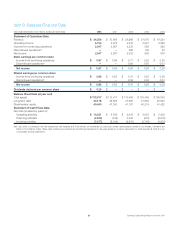

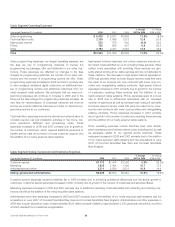

The table below summarizes our repurchases under our Board-authorized share repurchase program during 2008.

Period

Total Number

of Shares

Purchased

Average Price

per Share

Total Number

of Shares

Purchased as

Part of Publicly

Announced

Program

Total Dollars

Purchased Under

the Program

Maximum Dollar

Value of Shares that

May Yet Be

Purchased Under

the Program(a)

First Quarter 2008 53,240,452 $ 18.83 53,108,431 $ 1,000,000,000 $ 5,906,133,015

Second Quarter 2008 48,719,970 $ 20.79 48,123,097 $ 1,000,086,833 $ 4,906,046,182

Third Quarter 2008 39,678,437 $ 20.16 39,678,437 $ 800,001,409 $ 4,106,044,773

Fourth Quarter 2008 — $ — — $ — $ 4,106,044,773

Total 2008 141,638,859 $ 19.87 140,909,965 $ 2,800,088,242 $ 4,106,044,773

(a) In 2007, the Board of Directors authorized a $7 billion addition to the existing share repurchase program. Under the authorization, we may repurchase shares in the open

market or in private transactions subject to market conditions. As of December 31, 2008, we had approximately $4.1 billion of availability remaining under our share repurchase

authorization. We have previously indicated our plan to fully use our remaining share repurchase authorization by the end of 2009, subject to market conditions. However, it is

unlikely that we will complete our share repurchase authorization by the end of 2009 as previously planned.

The total number of shares purchased during 2008 includes 728,894 shares received in the administration of employee share-based

compensation plans.

19 Comcast 2008 Annual Report on Form 10-K