Comcast 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

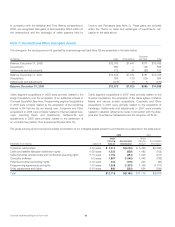

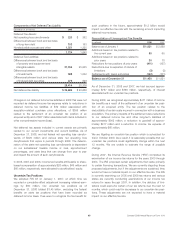

For the year ended December 31, 2008, the financial instruments measured at fair value on a nonrecurring basis are presented in the table

below.

Nonrecurring Fair Value Measures

(in millions)

December 31,

2008 Level 1 Level 2 Level 3

Total

Losses

Assets

Equity method investments $421 $— $— $421 $(600)

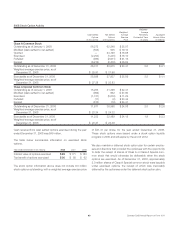

In accordance with Accounting Principles Board (“APB”) No. 18, “The Equity Method of Accounting for Investments in Common Stock,”

we recognized an other than temporary impairment to other income (expense) of $600 million to adjust our cost basis in our investment in

Clearwire LLC of approximately $1 billion to its estimated fair value (see Note 6). Our valuation methodology utilized a combination of the

quoted market value of Clearwire Corporation’s publicly traded Class A shares and unobservable inputs related to the ownership units of

Clearwire LLC and the voting stock of Clearwire Corporation, including the use of discounted cash flow models. Our investment in Clear-

wire LLC is classified as a Level 3 financial instrument in accordance SFAS No. 157 in the fair value hierarchy, as a portion of the estimated

fair value of the investment is based on unobservable inputs. We believe the estimated fair value is consistent with the underlying principle

of SFAS No. 157, which is that the estimated fair value should represent the exit price from a marketplace participant’s perspective.

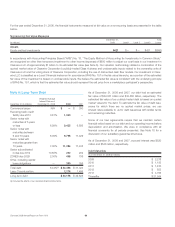

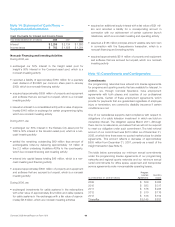

Note 9: Long-Term Debt

December 31 (in millions)

Weighted Average

Interest Rate as of

December 31, 2008 2008 2007

Commercial paper N/A $—$ 300

Revolving bank credit

facility due 2013 0.81% 1,000 —

Senior notes with

maturities of 5 years

or less 6.99% 9,425 6,895

Senior notes with

maturities between

6 and 10 years 6.09% 9,798 11,429

Senior notes with

maturities greater than

10 years 7.00% 11,284 11,435

Senior subordinated

notes due 2012 10.63% 202 202

ZONES due 2029 2.00% 408 706

Other, including capital

lease obligations — 339 356

Total debt 6.44%(a) $ 32,456 $ 31,323

Less: Current portion 2,278 1,495

Long-term debt $ 30,178 $ 29,828

(a) Includes the effects of our derivative financial instruments.

As of December 31, 2008 and 2007, our debt had an estimated

fair value of $32.001 billion and $32.565 billion, respectively. The

estimated fair value of our publicly traded debt is based on quoted

market values for the debt. To estimate the fair value of debt issu-

ances for which there are no quoted market prices, we use

interest rates available to us for debt issuances with similar terms

and remaining maturities.

Some of our loan agreements require that we maintain certain

financial ratios based on our debt and our operating income before

depreciation and amortization. We were in compliance with all

financial covenants for all periods presented. See Note 18 for a

discussion of our subsidiary guarantee structures.

As of December 31, 2008 and 2007, accrued interest was $520

million and $546 million, respectively.

Debt Maturities

As of December 31, 2008 (in millions)

2009 $ 2,278

2010 $ 1,183

2011 $ 1,810

2012 $ 853

2013 $ 4,768

Thereafter $ 21,564

Comcast 2008 Annual Report on Form 10-K 58