Comcast 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cable capital expenditures decreased 7.5% in 2008 primarily due

to lower spending in residential cable services. Line extensions

decreased in 2008 compared to 2007 primarily due to the slow-

down in the housing market. Cable capital expenditures increased

41.2% in 2007 primarily as a result of the continued rollout of our

digital phone service and an increase in demand for advanced

set-top boxes (including DVR and HDTV) and high-speed Internet

modems. These increases were accelerated by the success of our

triple play bundle and as a result of regulatory changes in 2007.

We also incurred additional capital expenditures in our newly

acquired cable systems and continued to improve the capacity

and reliability of our network in 2007 in order to handle the addi-

tional volume and advanced services.

Capital expenditures in our Programming segment were not sig-

nificant in 2008, 2007 and 2006. In 2008 and 2007, our other

business activities included approximately $137 million and $110

million, respectively, of capital expenditures related to the con-

solidation of offices in Pennsylvania and the relocation of our

corporate headquarters. Capital expenditures for 2009 and for

subsequent years will depend on numerous factors, including

acquisitions, competition, changes in technology, regulatory

changes and the timing and rate of deployment of new services.

Our 2009 capital expenditures will include the purchase of set-top

boxes associated with our migration to all digital transmission for

certain analog channels.

Acquisitions

In 2008, acquisitions were primarily related to our acquisition of an

additional interest in Comcast SportsNet Bay Area; our acquisition

of the remaining interest in G4 that we did not already own; and

our acquisitions of Plaxo and DailyCandy. In 2007, acquisitions

were primarily related to our acquisitions of Patriot Media, Fandan-

go, Comcast SportsNet New England, and an interest in Comcast

SportsNet Bay Area. In 2006, acquisitions were primarily related to

the Adelphia and Time Warner transactions, the acquisition of the

cable systems of Susquehanna Communications and the acquis-

ition of our additional interest in E! Entertainment Television.

Proceeds from Sales of Investments

In 2008, proceeds from the sales of investments were primarily

related to the disposition of available-for-sale debt securities. In

2007 and 2006, proceeds from the sales of investments were

primarily related to the disposition of our ownership interests in

Time Warner Inc.

Purchases of Investments

In 2008, purchases of investments consisted primarily of the fund-

ing of our investment in Clearwire. In 2007, purchases of

investments consisted primarily of an additional investment in

Insight Midwest, L.P. and the purchase of available-for-sale debt

securities. In 2006, purchases of investments consisted primarily

of the purchase of our interest in SpectrumCo LLC and our addi-

tional investment in Texas and Kansas City Cable Partners.

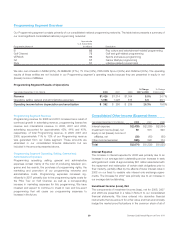

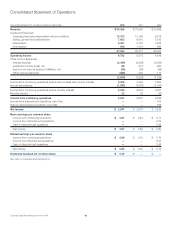

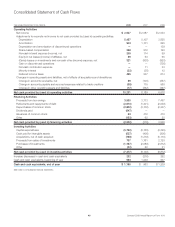

Contractual Obligations

Our unconditional contractual obligations as of December 31, 2008, which consist primarily of our debt obligations and the associated

payments due in future periods, are presented in the table below.

Payments Due by Period

(in millions) Total Year 1

Years

2–3

Years

4–5

More

than 5

Debt obligations(a) $ 32,394 $ 2,269 $ 2,957 $ 5,613 $ 21,555

Capital lease obligations 62 9 36 8 9

Operating lease obligations 2,088 385 542 328 833

Purchase obligations(b) 16,069 3,666 3,915 2,462 6,026

Other long-term liabilities reflected on the balance sheet:

Acquisition-related obligations(c) 153 118 32 3 —

Other long-term obligations(d) 3,795 232 511 383 2,669

Total $ 54,561 $ 6,679 $ 7,993 $ 8,797 $ 31,092

Refer to Note 9 (long-term debt) and Note 15 (commitments) to our consolidated financial statements.

(a) Excludes interest payments.

(b) Purchase obligations consist of agreements to purchase goods and services that are legally binding on us and specify all significant terms, including fixed or minimum quanti-

ties to be purchased and price provisions. Our purchase obligations are primarily related to our Cable segment, including contracts with programmingnetworks,CPE

manufacturers, communication vendors, other cable operators for which we provide advertising sales representation and other contracts entered into in the normal course of

business. We also have purchase obligations through Comcast Spectacor for the players and coaches of our professional sports teams. We did not include contracts with

immaterial future commitments.

(c) Acquisition-related obligations consist primarily of costs related to exiting contractual obligations and other assumed contractual obligations of the acquired entity.

(d) Other long-term obligations consist primarily of prepaid forward sale agreement transactions of equity securities we hold; subsidiary preferred shares; effectively settled tax

positions and related interest, net of deferred tax benefit; deferred compensation obligations; pension, post-retirement and post-employment benefit obligations; and

programming rights payable under license agreements. Reserves for uncertain tax positions of approximately $1.4 billion are not included in the table above. The liability for

unrecognized tax benefits has been excluded because we cannot make a reliable estimate of the period in which the unrecognized tax benefits will be realized.

33 Comcast 2008 Annual Report on Form 10-K