Comcast 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

stock outstanding on the date of our 2002 acquisition of AT&T

Corp.’s cable business, subject to adjustment in specified sit-

uations. Stock dividends payable on the Class B common stock in

the form of Class B or Class A Special common stock do not

decrease the nondilutable voting power of the Class B common

stock. The Class B common stock also has separate approval

rights over several potentially material transactions, even if they are

approved by our Board of Directors or by our other stockholders

and even if they might be in the best interests of our other stock-

holders. These potentially material transactions include: mergers or

consolidations involving Comcast Corporation, transactions (such

as a sale of all or substantially all of our assets) or issuances of

securities that require shareholder approval, transactions

that result in any person or group owning shares representing

more than 10% of the combined voting power of the resulting or

surviving corporation, issuances of Class B common stock or

securities exercisable or convertible into Class B common stock,

and amendments to our articles of incorporation or by-laws that

would limit the rights of holders of our Class B common stock.

Brian L. Roberts beneficially owns all of the outstanding shares of

our Class B common stock and, accordingly, has considerable

influence over our operations and the ability (subject to certain

restrictions through November 17, 2012) to transfer poten-

tial effective control by selling the Class B common stock. In

addition, under our articles of incorporation, Mr. Roberts is entitled

to remain as our Chairman, Chief Executive Officer and President

until May 26, 2010, unless he is removed by the affirmative vote of

at least 75% of the entire Board of Directors or he is no longer will-

ingorabletoserve.

Item 1B: Unresolved Staff Comments

None.

Item 2: Properties

We believe that substantially all of our physical assets are in good

operating condition.

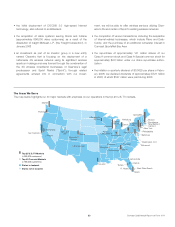

Cable

Our principal physical assets consist of operating plant and equip-

ment, including signal receiving, encoding and decoding devices;

headends and distribution systems; and equipment at or near our

customers’ homes. The signal receiving apparatus typically

includes a tower, antenna, ancillary electronic equipment and earth

stations for reception of satellite signals. Headends consist of elec-

tronic equipment necessary for the reception, amplification and

modulation of signals and are located near the receiving devices.

Our distribution system consists primarily of coaxial and fiber-optic

cables, lasers, routers, switches and related electronic equipment.

Our cable plants and related equipment generally are connected to

utility poles under pole rental agreements with local public utilities,

although in some areas the distribution cable is buried in under-

ground ducts or trenches. Customer premises equipment (“CPE”)

consists primarily of set-top boxes and cable modems. The phys-

ical components of cable systems require periodic maintenance

and replacement.

Our signal reception sites, primarily antenna towers and headends,

and microwave facilities, are located on owned and leased parcels

of land, and we own or lease space on the towers on which cer-

tain of our equipment is located. We own most of our service

vehicles.

Our high-speed Internet network consists of fiber-optic cables

owned by us and related equipment. We also operate regional

data centers with equipment that is used to provide services (such

as e-mail, news and web services) to our high-speed Internet

customers and digital phone service customers. In addition, we

maintain a network operations center with equipment necessary to

monitor and manage the status of our high-speed Internet net-

work.

Throughout the country we own buildings that contain call centers,

service centers, warehouses and administrative space. We also

own a building that houses our media center. The media center

contains equipment that we own or lease, including equipment

related to network origination, global transmission via satellite and

terrestrial fiber-optics, a broadcast studio, mobile and post-

production services, interactive television services and streaming

distribution services.

Programming

Television studios and business offices are the principal physical

assets of our Programming operations. We own or lease the tele-

vision studios and business offices of our Programming

operations.

Other

Two large, multipurpose arenas that we own are the principal

physical assets of our other operations.

As of December 31, 2008, we leased locations for our corporate

offices in Philadelphia, Pennsylvania as well as numerous business

offices, warehouses and properties housing divisional information

technology operations throughout the country.

Comcast 2008 Annual Report on Form 10-K 16