Comcast 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

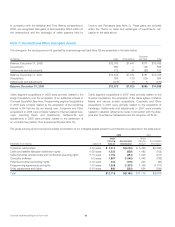

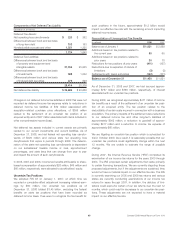

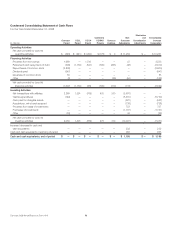

Note 14: Statement of Cash Flows —

Supplemental Information

Cash Payments for Interest and Income Taxes

Year ended December 31 (in millions) 2008 2007 2006

Interest $ 2,256 $ 2,134 $ 1,880

Income taxes $ 762 $ 1,638 $ 1,284

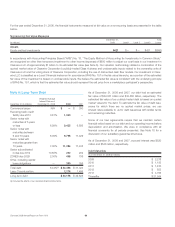

Noncash Financing and Investing Activities

During 2008, we:

• exchanged our 50% interest in the Insight asset pool for

Insight’s 50% interest in the Comcast asset pool, which is a

noncash investing activity

• recorded a liability of approximately $180 million for a quarterly

cash dividend of $0.0625 per common share paid in January

2009, which is a noncash financing activity

• acquired approximately $559 million of property and equipment

and software that are accrued but unpaid, which is a noncash

investing activity

• issued an interest in a consolidated entity with a value of approx-

imately $145 million in exchange for certain programming rights,

which is a noncash investing activity

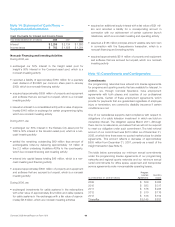

During 2007, we:

• exchanged our 50% interest in the Kansas City asset pool for

TWC’s 50% interest in the Houston asset pool, which is a non-

cash investing activity

• settled the remaining outstanding $49 million face amount of

exchangeable notes by delivering approximately 1.8 million of

the 2.2 million underlying Vodafone ADRs to the counterparty,

which is a noncash financing and investing activity

• entered into capital leases totaling $46 million, which is a non-

cash investing and financing activity

• acquired approximately $593 million of property and equipment

and software that are accrued but unpaid, which is a noncash

investing activity

During 2006, we:

• exchanged investments for cable systems in the redemptions

with a fair value of approximately $3.2 billion and cable systems

for cable systems in the exchanges with a fair value of approx-

imately $8.5 billion, which are noncash investing activities

• acquired an additional equity interest with a fair value of $21 mil-

lion and recorded a liability for a corresponding amount in

connection with our achievement of certain customer launch

milestones, which is a noncash investing and operating activity

• assumed a $185 million principal amount variable-rate term loan

in connection with the Susquehanna transaction, which is a

noncash financing and investing activity

• acquired approximately $314 million of property and equipment

and software that are accrued but unpaid, which is a noncash

investing activity

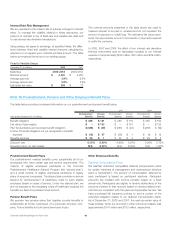

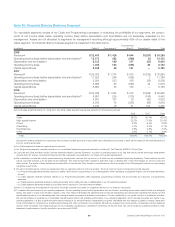

Note 15: Commitments and Contingencies

Commitments

Our programming networks have entered into license agreements

for programs and sporting events that are available for telecast. In

addition, we, through Comcast Spectacor, have employment

agreements with both players and coaches of our professional

sports teams. Certain of these employment agreements, which

provide for payments that are guaranteed regardless of employee

injury or termination, are covered by disability insurance if certain

conditions are met.

One of our subsidiaries supports debt compliance with respect to

obligations of a cable television investment in which we hold an

ownership interest. The obligation expires March 2011. Although

there can be no assurance, we believe that we will not be required

to meet our obligation under such commitment. The total notional

amount of our commitment was $410 million as of December 31,

2008, at which time there were no quoted market prices for similar

agreements. This amount reflects a decrease of approximately

$555 million from December 31, 2007, primarily as a result of the

Insight transaction (see Note 5).

The table below summarizes our minimum annual commitments

under the programming license agreements of our programming

networks and regional sports networks and our minimum annual

rental commitments for office space, equipment and transponder

service agreements under noncancelable operating leases.

As of December 31, 2008 (in millions)

Program

License

Agreements

Operating

Leases

2009 $ 559 $ 385

2010 $ 593 $ 317

2011 $ 578 $ 225

2012 $ 510 $ 176

2013 $ 516 $ 152

Thereafter $ 5,145 $ 833

Comcast 2008 Annual Report on Form 10-K 66