Comcast 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 12: Share-Based Compensation

Our Board of Directors may grant share-based awards, in the form

of stock options and RSUs, to certain employees and directors.

Additionally, through our employee stock purchase plan, employ-

ees are able to purchase shares of Comcast Class A stock at a

discount through payroll deductions.

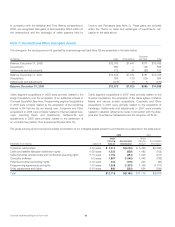

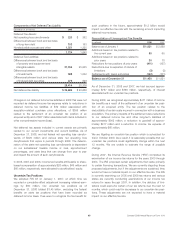

Recognized Share-Based Compensation Expense

Under SFAS 123R

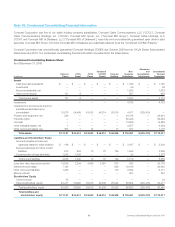

Year ended December 31 (in millions) 2008 2007 2006

Stock options $99 $ 74 $120

Restricted share units 96 79 62

Employee stock purchase plan 13 11 8

Total $208 $164 $190

Tax benefit $71 $56 $66

As of December 31, 2008, we had unrecognized pretax compen-

sation expense of $292 million and $279 million related to

nonvested stock options and nonvested RSUs, respectively, that

will be recognized over a weighted average period of approx-

imately 2.0 years. The amount of share-based compensation

capitalized was not material to our consolidated financial state-

ments for the periods presented.

When stock options are exercised or RSU awards are settled

through the issuance of shares, any income tax benefit realized in

excess of the amount associated with compensation expense that

was previously recognized for financial reporting purposes is pre-

sented as a financing activity rather than as an operating activity in

our consolidated statement of cash flows. The excess cash

income tax benefit classified as a financing cash inflow in 2008,

2007 and 2006 was approximately $15 million, $33 million and

$33 million, respectively.

Option Plans

We maintain stock option plans for certain employees under

which fixed-price stock options may be granted and the option

price is generally not less than the fair value of a share of the

underlying stock at the date of grant. Under our stock option

plans, a combined total of approximately 226 million shares of our

Class A and Class A Special common stock are reserved for the

exercise of stock options, including those outstanding as of

December 31, 2008. Option terms are generally 10 years, with

options generally becoming exercisable between 2 and 9.5 years

from the date of grant.

We use the Black-Scholes option pricing model to estimate the fair

value of each stock option on the date of grant. The Black-Scholes

option pricing model uses the assumptions summarized in the

table below. Dividend yield is based on the yield at the date of

grant. Expected volatility is based on a blend of implied and histor-

ical volatility of our Class A common stock. The risk-free rate is

based on the U.S. Treasury yield curve in effect at the date of

grant. We use historical data on the exercise of stock options and

other factors expected to impact holders’ behavior to estimate the

expected term of the options granted. The table below summa-

rizes the weighted-average fair values at the date of grant of a

Class A common stock option granted under our stock option

plans and the related weighted-average valuation assumptions.

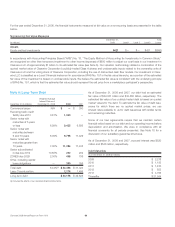

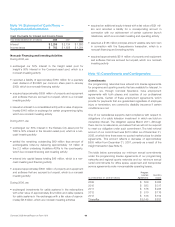

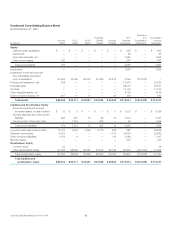

Stock Option Fair Value and Significant Assumptions

2008 2007 2006

Fair value $6.47 $ 9.61 $ 7.30

Dividend yield 1.3% 0% 0%

Expected volatility 32.8% 24.3% 26.9%

Risk-free interest rate 3.0% 4.5% 4.8%

Expected option life (in years) 7.0 7.0 7.0

In 2007, we began granting net settled stock options instead of

stock options exercised with a cash payment (“cash settled stock

options”). In net settled stock options, an employee receives the

number of shares equal to the number of options being exercised

less the number of shares necessary to satisfy the cost to exercise

the options and, if applicable, taxes due on exercise based on the

fair value of the shares at the exercise date. The change to net

settled stock options will result in fewer shares being issued and

no cash proceeds being received by us when a net settled option

is exercised. Following the change, we offered employees the

opportunity to modify their outstanding stock options from cash

settled to net settled. The modifications that were made did not

result in any additional compensation expense.

Comcast 2008 Annual Report on Form 10-K 62