Comcast 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

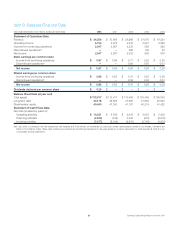

Cable Segment Revenue

Our average monthly total revenue per video customer increased

to approximately $110 in 2008 from approximately $102 in 2007

and approximately $95 in 2006. The increases in average monthly

total revenue per video customer are primarily due to an increased

number of customers receiving multiple services.

A

verage Monthly Total Revenue

per Video Customers

$95

$102

2007

$110

2008

2006

Video

We offer video services ranging from a limited analog service to a

full digital service with access to hundreds of channels, including

premium and pay-per-view channels. Digital video customers may

also subscribe to advanced digital video services, including DVR

and HDTV. As of December 31, 2008, 70% of our video custom-

ers subscribed to at least one of our digital video services,

compared to 63% and 52% as of December 31, 2007 and 2006,

respectively.

Our video revenue continued to grow in 2008 and 2007 due to

customer growth in our digital video services, including the

demand for digital features such as On Demand, DVR and HDTV;

rate adjustments; and the addition of our newly acquired cable

systems. During 2008 and 2007, we added approximately

1.5 million and 2.5 million digital video customers, respectively.

During 2008 and 2007, the number of video customers decreased

by approximately 575,000 and 180,000, respectively, excluding

the impact of the newly acquired cable systems, primarily due to

increased competition in our service areas, as well as weakness in

the overall economy. Continued competition and weak economic

conditions are expected to result in further declines in the number

of video customers during 2009. In 2008, approximately $455 mil-

lion of the increase in our video revenue was attributable to our

newly acquired cable systems. In 2007, the amount was approx-

imately $1.6 billion. Our average monthly video revenue per video

customer increased to approximately $64 in 2008 from approx-

imately $61 in 2007 and approximately $57 in 2006.

High-Speed Internet

We offer high-speed Internet services with Internet access at

downstream speeds of up to 24 Mbps, depending on the service

selected, and up to 50 Mbps with the introduction of DOCSIS 3.0

technology, also referred to as Wideband, based on geographic

market availability. These services also include our Internet portal,

Comcast.net, which provides multiple e-mail addresses and online

storage, as well as a variety of proprietary content and value-

added features and enhancements that are designed to take

advantage of the speed our services provide.

Revenue increased in 2008 and 2007 primarily due to an increase

in the number of customers and the addition of our newly acquired

cable systems. As of December 31, 2008, 30% of the homes in

the areas we serve subscribed to our high-speed Internet service,

compared to 28% and 25% as of December 31, 2007 and 2006,

respectively. In 2008, approximately $157 million of the increase in

revenue was attributable to our newly acquired cable systems. In

2007, the amount was approximately $640 million. Average

monthly revenue per high-speed Internet customer has remained

relatively stable, between $42 and $43 from 2006 to 2008. We

expect the rates of customer and revenue growth to slow in 2009

due to the market maturing, increased competition and weak

economic conditions continuing.

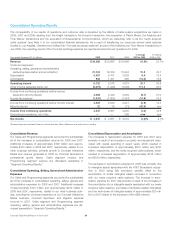

High-Speed Internet Customers

(in millions)

11.5

13.2

2007

14.9

2008

2006

Phone

We offer digital phone services that provide local and long-

distance calling and include features such as voice mail, caller ID

and call waiting. As of December 31, 2008, our digital phone serv-

ices were available to approximately 47 million or 92% of the

homes in the areas we serve.

Revenue increased significantly in 2008 and 2007 as a result of

increases in the number of digital phone customers. These

increases were partially offset by the loss of approximately

170,000 and 470,000 circuit-switched phone customers in 2008

and 2007, respectively. We phased out substantially all of our

circuit-switched phone service in 2008. In 2008, approximately

$43 million of the increase in our phone revenue was attributable

to our newly acquired cable systems. In 2007, the amount was

approximately $100 million. Average monthly revenue per

Comcast 2008 Annual Report on Form 10-K 26