Comcast 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

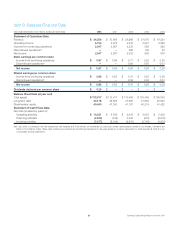

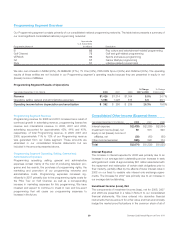

Cable Segment Operating Expenses

Year ended December 31 (in millions) 2008 2007 2006

% Change

2007 to 2008

% Change

2006 to 2007

Video programming $ 6,479 $ 5,813 $4,848 11.5% 19.9%

Technical labor costs 2,138 1,899 1,572 12.6 20.8

High-speed Internet 523 575 435 (9.0) 32.2

Phone 730 685 427 6.6 60.4

Other 2,794 2,437 2,040 14.6 19.5

Total $12,664 $11,409 $9,322 11.0% 22.4%

Video programming expenses, our largest operating expense, are

the fees we pay to programming networks to license the

programming we package, offer and distribute to our video cus-

tomers. These expenses are affected by changes in the fees

charged by programming networks, the number of our video cus-

tomers and the number of programming options we offer. Video

programming expenses increased in 2008 and 2007, primarily due

to rate increases, additional digital customers, an additional num-

ber of programming options and additional customers from our

newly acquired cable systems. We anticipate that our video pro-

gramming expenses will continue to increase in 2009 and in the

future as the fees charged by programming networks increase, as

new fees for retransmission of broadcast networks are incurred

and as we provide additional channels and video on demand pro-

gramming options to our customers.

Technical labor expenses include the internal and external labor to

complete service call and installation activities in the home, net-

work operations, fulfillment and provisioning costs. These

expenses increased in 2008 and 2007 primarily due to growth in

the number of customers, which required additional personnel to

handle service calls and provide in-house customer support and

the addition of our newly acquired cable systems.

High-speed Internet expenses and phone expenses include cer-

tain direct costs identified by us for providing these services. Other

related costs associated with providing these services are gen-

erally shared among all our cable services and are not allocated to

these captions. The decrease in high-speed Internet expenses in

2008 was primarily driven by lower support service costs that were

the result of our entering into new contracts with lower cost pro-

viders and renegotiating existing contracts. High-speed Internet

expenses increased in 2007 primarily due to growth in the number

of customers receiving these services and the addition of our

newly acquired cable systems. Phone expenses grew at a lower

rate in 2008 due to efficiencies associated with an increased

number of customers as well as the least-cost routing of call traffic

and lower support service costs that were the result of our enter-

ing into new contracts with lower cost providers and renegotiating

existing contracts. Phone expenses increased in 2007 primarily

due to growth in the number of customers receiving these services

and the addition of our newly acquired cable systems.

Other operating expenses include franchise fees, pole rentals,

plant maintenance and vehicle-related costs, including fuel, as well

as expenses related to our regional sports networks. These

expenses increased in 2008 and 2007 primarily due to the addition

of our newly acquired cable systems and the acquisitions in June

2007 of Comcast SportsNet Bay Area and Comcast SportsNet

New England.

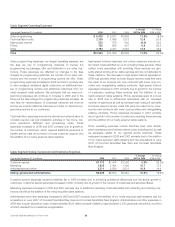

Cable Segment Selling, General and Administrative Expenses

Year ended December 31 (in millions) 2008 2007 2006

% Change

2007 to 2008

% Change

2006 to 2007

Customer service $1,773 $1,674 $1,326 5.9% 26.2%

Marketing 1,625 1,404 1,196 15.7 17.4

Administrative and other 3,211 2,896 2,531 10.9 14.4

Selling, general and administrative $6,609 $5,974 $5,053 10.6% 18.2%

Customer service expenses remained relatively flat in 2008 primarily due to achieving operational efficiencies and the slower growth in

customers. Customer service expenses increased in 2007 primarily due to growth in the number of customers and services offered.

Marketing expenses increased in 2008 and 2007 primarily due to additional marketing costs associated with attracting and retaining cus-

tomers, as well as the addition of the newly acquired cable systems.

Administrative and other expenses increased in 2008 and 2007 primarily due to the addition of our newly acquired cable systems and the

acquisitions in June 2007 of Comcast SportsNet Bay Area and Comcast SportsNet New England. Administrative and other expenses in

2008 also include severance costs of approximately $126 million primarily related to approximately 3,300 personnel reductions, a portion

of which resulted from a divisional reorganization.

Comcast 2008 Annual Report on Form 10-K 28