Comcast 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

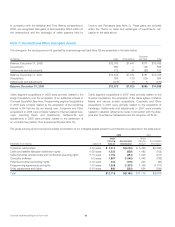

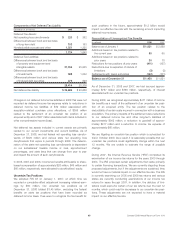

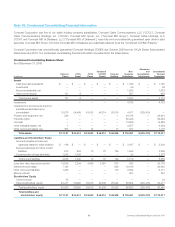

Deferred Compensation Plans

Year ended December 31 (in millions) 2008 2007 2006

Benefit obligation $797 $672 $554

Interest expense $76 $65 $50

Split Dollar Life Insurance

We also have collateral assignment split-dollar life insurance agree-

ments with select key employees that require us to bear certain

insurance-related costs. Under some of these agreements, our

obligation to provide benefits to the employees extends beyond

retirement.

On January 1, 2008, in connection with the adoption of EITF

06-10, we adjusted beginning retained earnings and recorded a

liability of $132 million for the present value of the postretirement

benefit obligation related to our split-dollar life insurance agree-

ments (see Note 3). As of December 31, 2008, this benefit

obligation was $145 million. The related expenses were $24 million

for the year ended December 31, 2008.

Retirement Investment Plans

We sponsor several 401(k) retirement plans that allow eligible

employees to contribute a portion of their compensation through

payroll deductions in accordance with specified guidelines. We

match a percentage of the employees’ contributions up to certain

limits. For the years ended December 31, 2008, 2007 and 2006,

expenses related to these plans amounted to $178 million, $150

million and $125 million, respectively.

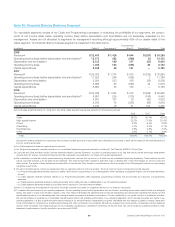

Note 11: Stockholders’ Equity

Common Stock

In the aggregate, holders of our Class A common stock have

66

2

⁄

3

% of the voting power of our common stock and holders of

our Class B common stock have 331/3% of the voting power of

our common stock. Our Class A Special common stock is gen-

erally nonvoting. Each share of our Class B common stock is

entitled to 15 votes. The number of votes held by each share of

our Class A common stock depends on the number of shares of

Class A and Class B common stock outstanding at any given time.

The 331/3% aggregate voting power of our Class B common stock

cannot be diluted by additional issuances of any other class of

common stock. Our Class B common stock is convertible, share

for share, into Class A or Class A Special common stock, subject

to certain restrictions.

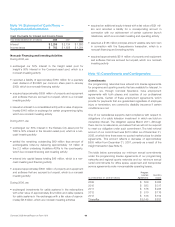

Share Repurchase and Dividends

In 2007, our Board of Directors authorized a $7 billion addition to

our existing share repurchase authorization. Under this author-

ization, we may repurchase shares in the open market or in private

transactions, subject to market conditions. As of December 31,

2008, we had approximately $4.1 billion of availability remaining

under our share repurchase authorization. We have previously

indicated our plan to fully use our remaining share repurchase

authorization by the end of 2009, subject to market conditions.

However, due to difficult economic conditions and instability in the

capital markets, it is unlikely we will complete our share repurchase

authorization by the end of 2009 as previously planned. The table

below shows our aggregate repurchases during 2008, 2007 and

2006.

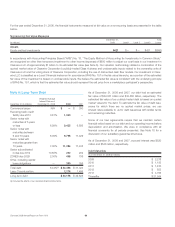

Share Repurchases

(in millions) 2008 2007 2006

Aggregate consideration $2,800 $3,102 $2,347

Shares repurchased 141 133 113

Our Board of Directors declared a dividend of $0.0625 per share

for each quarter in 2008, totaling approximately $727 million, of

which approximately $547 million was paid in 2008. We expect to

continue to pay quarterly dividends, though each subsequent divi-

dend is subject to approval by our Board of Directors. We did not

declare or pay any cash dividends in 2007 or 2006.

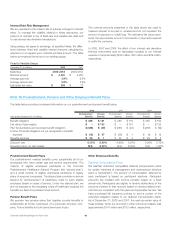

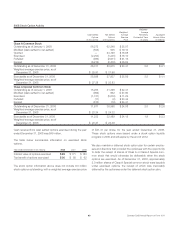

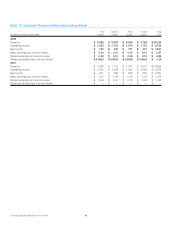

Accumulated Other Comprehensive Income (Loss)

The table below presents our accumulated other comprehensive

income (loss), net of taxes.

Year ended December 31 (in millions) 2008 2007

Unrealized gains (losses) on marketable

securities $19 $27

Unrealized gains (losses) on cash flow hedges (97) (110)

Unrealized gains (losses) on employee benefit

obligations (31) 24

Cumulative translation adjustments (4) 3

Accumulated other comprehensive income

(loss) $ (113) $ (56)

Unrealized losses on cash flow hedges in the table above relate to

our interest rate lock agreements entered into to fix the interest

rates of certain of our debt obligations in advance of their issu-

ance. Unless we retire this debt early, these unrealized losses as of

December 31, 2008 will be reclassified as an adjustment to inter-

est expense over 9 years, the same period over which the related

interest costs are recognized in earnings.

61 Comcast 2008 Annual Report on Form 10-K