Comcast 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

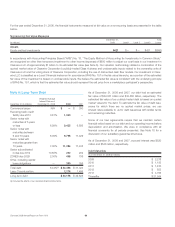

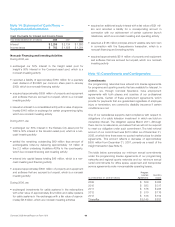

The following table summarizes our rental expense and program-

ming license expense charged to operations:

Year ended December 31 (in millions) 2008 2007 2006

Rental expense $ 436 $ 358 $ 273

Programming license expense $ 548 $ 484 $ 350

Contingencies

We and the minority owner group in Comcast Spectacor each

have the right to initiate an exit process under which the fair mar-

ket value of Comcast Spectacor would be determined by

appraisal. Following such determination, we would have the option

to acquire the 24.3% interest in Comcast Spectacor owned by the

minority owner group based on the appraised fair market value. In

the event we do not exercise this option, we and the minority

owner group would then be required to use our best efforts to sell

Comcast Spectacor. This exit process includes the minority owner

group’s interest in Comcast SportsNet (Philadelphia).

The minority owners in certain of our technology development

ventures also have rights to trigger an exit process after a certain

period of time based on the fair value of the entities at the time the

exit process is triggered.

Antitrust Cases

We are defendants in two purported class actions originally filed in

December 2003 in the United States District Courts for the District

of Massachusetts and the Eastern District of Pennsylvania. The

potential class in the Massachusetts case is our subscriber base in

the “Boston Cluster” area, and the potential class in the

Pennsylvania case is our subscriber base in the “Philadelphia and

Chicago Clusters,” as those terms are defined in the complaints. In

each case, the plaintiffs allege that certain subscriber exchange

transactions with other cable providers resulted in unlawful

horizontal market restraints in those areas and seek damages

under antitrust statutes, including treble damages.

Our motion to dismiss the Pennsylvania case on the pleadings was

denied in December 2006 and classes of Philadelphia Cluster and

Chicago Cluster subscribers were certified in May 2007 and

October 2007, respectively. Our motion to dismiss the Massachu-

setts case, which was transferred to the Eastern District of

Pennsylvania in December 2006, was denied in July 2007. We are

proceeding with discovery on plaintiffs’ claims concerning the

Philadelphia Cluster. Plaintiffs’ claims concerning the other two

clusters are stayed pending determination of the Philadelphia

Cluster claims.

In addition, we are among the defendants in a purported class

action filed in the United States District Court for the Central Dis-

trict of California (“Central District”) in September 2007. The

plaintiffs allege that the defendants who produce video program-

ming have entered into agreements with the defendants who

distribute video programming via cable and satellite (including us,

among others), which preclude the distributors from reselling

channels to subscribers on an “unbundled” basis in violation of

federal antitrust laws. The plaintiffs seek treble damages for the

loss of their ability to pick and choose the specific “bundled”

channels to which they wish to subscribe, and injunctive relief

requiring each distributor defendant to resell certain channels to its

subscribers on an “unbundled” basis. The potential class is com-

prised of all persons residing in the United States who have

subscribed to an expanded basic level of video service provided

by one of the distributor defendants. We and the other defendants

filed motions to dismiss an amended complaint in April 2008. In

June 2008, the Central District denied the motions to dismiss. In

July 2008, we and the other defendants filed motions to certify

certain issues decided in the Central District’s June 2008 order for

interlocutory appeal to the Ninth Circuit Court of Appeals. On

August 8, 2008, the Central District denied the certification

motions. In January 2009, the Central District approved a stip-

ulation between the parties dismissing the action as to one of the

two plaintiffs identified in the amended complaint as a Comcast

subscriber. Discovery relevant to plaintiffs’ anticipated motion for

class certification is currently proceeding, with plaintiffs scheduled

to file their class certification motion in April 2009.

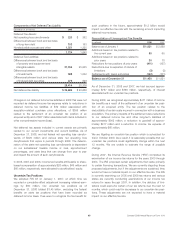

Securities and Related Litigation

We and several of our current and former officers were named as

defendants in a purported class action lawsuit filed in the United

States District Court for the Eastern District of Pennsylvania

(“Eastern District”) in January 2008. We filed a motion to dismiss

the case in February 2008. The plaintiff did not respond, but

instead sought leave to amend the complaint, which the court

granted. The plaintiff filed an amended complaint in May 2008

naming only us and two current officers as defendants. The

alleged class was comprised of purchasers of our publicly issued

securities between February 1, 2007 and December 4, 2007. The

plaintiff asserted that during the alleged class period, the defend-

ants violated federal securities laws through alleged material

misstatements and omissions relating to forecast results for 2007.

The plaintiff sought unspecified damages. In June 2008, we filed a

motion to dismiss the amended complaint. In an order dated

August 25, 2008, the Court granted our motion to dismiss and

denied the plaintiff permission to amend the complaint again. The

plaintiff has not timely appealed the Court’s decision, so the dis-

missal of this case is final.

We and several of our current officers have been named as defend-

ants in a separate purported class action lawsuit filed in the

Eastern District in February 2008. The alleged class comprises

participants in our retirement-investment (401(k)) plan that invested

in the plan’s company stock account. The plaintiff asserts that the

defendants breached their fiduciary duties in managing the plan.

The plaintiff seeks unspecified damages. The plaintiff filed an

amended complaint in June 2008, and in July 2008 we filed a

motion to dismiss the amended complaint. On October 29, 2008,

67 Comcast 2008 Annual Report on Form 10-K