Comcast 2008 Annual Report Download - page 49

Download and view the complete annual report

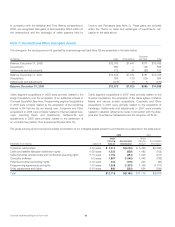

Please find page 49 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We assess the recoverability of our goodwill annually, or more

frequently whenever events or changes in circumstances indicate

that the asset might be impaired. We generally perform the

assessment of our goodwill one level below the operating segment

level. In our Cable business, since components one level below the

segment level (Cable divisions) are not separate reporting units and

have similar economic characteristics, we aggregate the compo-

nents into one reporting unit at the Cable segment level.

***

Since the adoption of SFAS No. 142, we have performed annual

impairment testing of our indefinite-lived intangibles, including

cable franchise rights, sports franchise rights and goodwill, using

April 1 as the measurement date. In 2008, we changed the timing

of our financial and strategic planning process, including the

preparation of long-term projections, from completion in the early

part of each calendar year to a midyear completion. These long-

term financial projections are used as the basis for performing our

annual impairment testing. As a result, we have changed our

measurement date from April 1 to July 1. We tested our indefinite-

lived intangibles for impairment as of April 1, 2008 and July 1,

2008, and no impairments were indicated as of either date. Since

the adoption of SFAS No. 142 in 2002, we have not recorded any

significant impairments as a result of our impairment testing. We

believe changing the measurement date to coincide with the

completion of our long-term financial projections is preferable and

does not result in the delay, acceleration or avoidance of an

impairment.

Other Intangibles

Other intangible assets consist primarily of franchise-related cus-

tomer relationships acquired in business combinations,

programming distribution rights, software, cable franchise renewal

costs, and programming agreements and rights. We record these

costs as assets and amortize them on a straight-line basis over the

term of the related agreements or estimated useful life. See Note 7

for the ranges of useful lives of our intangible assets.

Programming Distribution Rights

Our Programming subsidiaries enter into multiyear license agree-

ments with various multichannel video providers for distribution of

their programming (“distribution rights”). We capitalize amounts

paid to secure or extend these distribution rights and include them

within other intangible assets. We amortize these distribution rights

on a straight-line basis over the term of the related license agree-

ments. We classify the amortization of these distribution rights as a

reduction of revenue unless the Programming subsidiary receives,

or will receive, an identifiable benefit from the distributor separate

from the fee paid for the distribution right, in which case we

recognize the fair value of the identified benefit as an operating

expense in the period in which it was received.

Software

We capitalize direct development costs associated with

internal-use software, including external direct costs of material

and services and payroll costs for employees devoting time to

these software projects. We also capitalize costs associated with

the purchase of software licenses. We include these costs within

other intangible assets and amortize them on a straight-line basis

over a period not to exceed 5 years, beginning when the asset is

substantially ready for use. We expense maintenance and training

costs, as well as costs incurred during the preliminary stage of a

project, as they are incurred. We capitalize initial operating system

software costs and amortize them over the life of the associated

hardware.

***

We periodically evaluate the recoverability and estimated lives of

our intangible assets subject to amortization whenever events or

changes in circumstances indicate that the carrying amount may

not be recoverable or the useful life has changed. The evaluation is

based on the cash flows generated by the underlying assets and

profitability information, including estimated future operating

results, trends or other determinants of fair value. If the total of the

expected future undiscounted cash flows is less than the carrying

amount of the asset, we would recognize a loss for the difference

between the estimated fair value and the carrying value of the

asset. Unless presented separately, the loss would be included as

a component of amortization expense.

Asset Retirement Obligations

SFAS No. 143, “Accounting for Asset Retirement Obligations,” as

interpreted by Financial Accounting Standards Board (“FASB”)

Interpretation (“FIN”) No. 47, “Accounting for Conditional Asset

Retirement Obligations — an Interpretation of FASB Statement

No. 143,” requires that a liability be recognized for an asset retire-

ment obligation in the period in which it is incurred if a reasonable

estimate of fair value can be made.

Certain of our franchise and lease agreements contain provisions

requiring us to restore facilities or remove property in the event that

the franchise or lease agreement is not renewed. We expect to

continually renew our franchise agreements and therefore cannot

estimate any liabilities associated with such agreements. A remote

possibility exists that franchise agreements could terminate

unexpectedly, which could result in us incurring significant

expense in complying with restoration or removal provisions. The

disposal obligations related to our properties are not material to

our consolidated financial statements. No such liabilities have been

recorded in our consolidated financial statements.

47 Comcast 2008 Annual Report on Form 10-K