Comcast 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Restricted Stock Plan

We maintain a restricted stock plan under which certain employ-

ees and directors (“participants”) may be granted RSU awards in

units of Class A or Class A Special common stock. Under the

restricted stock plan, a combined total of approximately 50 million

shares of our Class A and Class A Special common stock are

reserved for issuance, including those outstanding as of

December 31, 2008. RSUs, which are valued based on the closing

price on the date of grant and discounted for the lack of dividends,

if any, during the vesting period, entitle participants to receive, at

the time of vesting, one share of common stock for each RSU.

The awards vest annually, generally over a period not to exceed 5

years, and do not have voting or dividend rights.

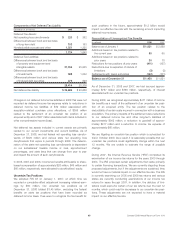

The table below summarizes the weighted-average fair value at the

date of grant of the RSUs.

2008 2007 2006

Weighted-average fair value $ 18.06 $ 25.65 $ 19.98

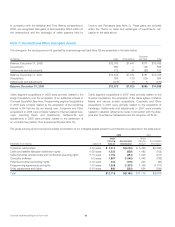

2008 Restricted Stock Plan Activity

Nonvested

Restricted

Share Unit

Awards

(in thousands)

Weighted-

Average Grant

Date Fair Value

Class A Common Stock

Nonvestedawardsasof

January 1, 2008 16,456 $ 21.97

Granted 8,652 $ 18.06

Vested (3,342) $ 21.64

Forfeited (1,430) $ 20.87

Nonvestedawardsasof

December 31, 2008 20,336 $ 19.64

The table below summarizes information on vested RSUs.

Year ended December 31 (in millions) 2008 2007 2006

Fair value of RSUs vested $65 $75 $32

Tax benefit of RSUs vested $23 $24 $ 9

The restricted stock plan also provides certain employees and

directors the opportunity to defer the receipt of shares of Class A

or Class A Special common stock that would otherwise be

deliverable when their RSUs vest. As of December 31, 2008,

approximately 941,000 and 89,000 shares of Class A common

stock and Class A Special common stock, respectively, were

issuable under vested RSU awards, the receipt of which was

irrevocably deferred by participants.

Employee Stock Purchase Plan

We maintain an employee stock purchase plan that offers employ-

ees the opportunity to purchase shares of Class A common stock

at a 15% discount. We recognize the fair value of the discount

associated with shares purchased under the plan as share-based

compensation expense in accordance with SFAS No. 123R. The

employee cost associated with participation in the plan was sat-

isfied with payroll withholdings of approximately $50 million, $48

million and $35 million in 2008, 2007 and 2006, respectively.

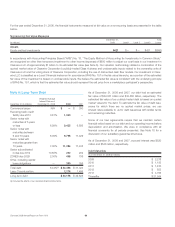

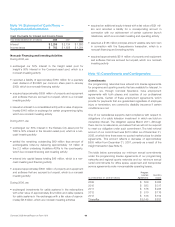

Note 13: Income Taxes

Components of Income Tax (Expense) Benefit

Year ended December 31 (in millions) 2008 2007 2006

Current (expense) benefit

Federal $ (751) $ (1,280) $ (887)

State (287) (273) (77)

(1,038) (1,553) (964)

Deferred (expense) benefit

Federal (547) (128) (301)

State 52 (119) (82)

(495) (247) (383)

Income tax (expense) benefit $ (1,533) $ (1,800) $ (1,347)

Our income tax expense differs from the federal statutory amount

because of the effect of the items detailed in the table below.

Year ended December 31 (in millions) 2008 2007 2006

Federal tax at statutory rate $ (1,420) $ (1,522) $ (1,258)

State income taxes, net of

federal benefit (45) (153) (132)

Nondeductible losses from

joint ventures and equity in

net (losses) income of

affiliates, net 1318

Adjustments to uncertain

and effectively settled tax

positions (34) (35) 93

Accrued interest on

uncertain and effectively

settled tax positions (65) (110) 64

Other 30 17 (132)

Income tax expense $ (1,533) $ (1,800) $ (1,347)

Comcast 2008 Annual Report on Form 10-K 64