Comcast 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LLC”), that will focus on the deployment of a nationwide 4G wire-

less network. We, together with the other members of the investor

group, have invested $3.2 billion in Clearwire LLC. Our portion of

the investment was $1.05 billion. As a result of our investment, we

received ownership units (“ownership units”) of Clearwire LLC and

Class B stock (“voting stock”) of Clearwire Corporation, the pub-

licly traded holding company that controls Clearwire LLC. The

voting stock has voting rights equal to those of the publicly traded

Class A stock of Clearwire Corporation, but has only minimal

economic rights. We hold our economic rights through the owner-

ship units, which have limited voting rights. One ownership unit

combined with one share of voting stock are exchangeable into

one share of Clearwire Corporation’s publicly traded Class A

stock. At closing, we received 52.5 million ownership units and

52.5 million shares of voting stock, which represents an approx-

imate 7% ownership interest on a fully diluted basis. During the

first quarter of 2009, the purchase price per share is expected to

be adjusted based on the trading prices of Clearwire Corporation’s

publicly traded Class A stock. After the post-closing adjustment,

we anticipate that we will have an approximate 8% ownership

interest on a fully diluted basis.

In connection with the Clearwire transaction, we entered into an

agreement with Sprint that allows us to offer wireless services

utilizing certain of Sprint’s existing wireless networks and an

agreement with Clearwire LLC that allows us to offer wireless serv-

ices utilizing Clearwire’s next generation wireless broadband

network. We allocated a portion of our $1.05 billion investment to

the related agreements.

We will account for our investment under the equity method and

record our share of net income or loss one quarter in arrears.

Clearwire LLC is expected to incur losses in the early years of

operation, which under the equity method of accounting, will be

reflected in our future operating results and reduce the cost basis

of our investment. We evaluated our investment at December 31,

2008 to determine if an other than temporary decline in fair value

below our cost basis had occurred. The primary input in estimating

the fair value of our investment was the quoted market value of

Clearwire publicly traded Class A shares at December 31, 2008,

which declined significantly from the date of our initial agreement in

May 2008. As a result of the severe decline in the quoted market

value, we recognized an impairment in other income (expense) of

$600 million to adjust our cost basis in our investment to its esti-

mated fair value. In the future, our evaluation of other than

temporary declines in fair value of our investment will include a

comparison of actual operating results and updated forecasts to

the projected discounted cash flows that were used in making our

initial investment decision, other impairment indicators, such as

changes in competition or technology, as well as a comparison to

the value that would be obtained by exchanging our investment

into Clearwire Corporation’s publicly traded Class A shares.

Cost Method

AirTouch Communications, Inc.

We hold two series of preferred stock of AirTouch Communica-

tions, Inc. (“AirTouch”), a subsidiary of Vodafone, which are

redeemable in April 2020. As of December 31, 2008 and 2007,

the AirTouch preferred stock was recorded at $1.479 billion and

$1.465 billion, respectively.

As of December 31, 2008, the estimated fair value of the AirTouch

preferred stock was $1.357 billion, which is below our carrying

amount. The recent decline in fair value is attributable to changes

in interest rates. We have determined this decline to be temporary.

The factors considered were the length of time and the extent to

which the market value has been less than cost, the credit rating

of AirTouch, and our intent and ability to retain the investment for a

period of time sufficient to allow for recovery. Specifically, we

expect to hold the two series of AirTouch preferred stock until their

redemption in 2020.

The dividend and redemption activity of the AirTouch preferred

stock determines the dividend and redemption payments asso-

ciated with substantially all of the preferred shares issued by one of

our consolidated subsidiaries, which is a VIE. The subsidiary has

three series of preferred stock outstanding with an aggregate

redemption value of $1.750 billion. Substantially all of the preferred

shares are redeemable in April 2020 at a redemption value of

$1.650 billion. As of December 31, 2008 and 2007, the two

redeemable series of subsidiary preferred shares were recorded at

$1.468 billion and $1.465 billion, respectively, and those amounts

are included in other noncurrent liabilities. The one nonredeemable

series of subsidiary preferred shares was recorded at $100 million

as of both December 31, 2008 and 2007 and those amounts are

included in minority interest on our consolidated balance sheet.

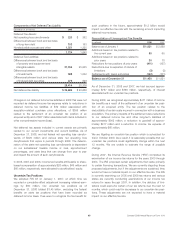

Investment Income (Loss), Net

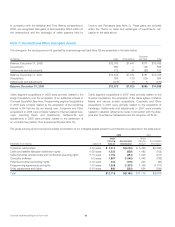

Year ended December 31 (in millions) 2008 2007 2006

Gains on sales and exchanges of

investments, net $8$ 151 $ 733

Investment impairment losses (28) (4) (4)

Unrealized gains (losses) on

trading securities and hedged

items (1,117) 315 339

Mark to market adjustments on

derivatives related to trading

securities and hedged items 1,120 (188) (238)

Mark to market adjustments on

derivatives 57 160 (18)

Interest and dividend income 149 199 212

Other (100) (32) (34)

Investment income (loss), net $89 $ 601 $ 990

55 Comcast 2008 Annual Report on Form 10-K