Comcast 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Diluted EPS for 2008, 2007 and 2006 excludes approximately 159 million, 61 million and 116 million, respectively, of potential common

shares related to our share-based compensation plans, because the inclusion of the potential common shares would have an antidilutive

effect.

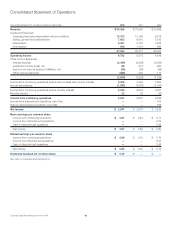

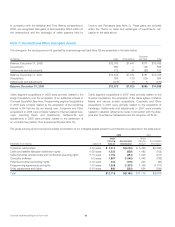

Computation of Diluted EPS

2008 2007 2006

Year ended December 31 (in millions,

except per share data) Income Shares

Per

Share

Amount Income Shares

Per

Share

Amount Income Shares

Per

Share

Amount

Basic EPS $2,547 2,939 $0.87 $2,587 3,098 $0.84 $2,235 3,160 $0.71

Effect of dilutive securities:

Assumed exercise or issuance of

shares relating to stock plans 13 31 20

Diluted EPS $2,547 2,952 $0.86 $2,587 3,129 $0.83 $2,235 3,180 $0.70

Note 5: Acquisitions and Other Significant Events

2008 Acquisitions

Insight Transaction

In April 2007, we and Insight Communications (“Insight”) agreed to

divide the assets and liabilities of Insight Midwest, a 50%-50%

cable system partnership with Insight (the “Insight transaction”).

On December 31, 2007, we contributed approximately $1.3 billion

to Insight Midwest for our share of the partnership’s debt. On

January 1, 2008, the distribution of the assets of Insight Midwest

was completed without assumption of any of Insight’s debt by us

and we received cable systems serving approximately 696,000

video customers in Illinois and Indiana (the “Comcast asset pool”).

Insight received cable systems serving approximately 652,000

video customers, together with approximately $1.24 billion of debt

allocated to those cable systems (the “Insight asset pool”). We

accounted for our interest in Insight Midwest as an equity method

investment until the Comcast asset pool was distributed to us on

January 1, 2008. We accounted for the distribution of assets by

Insight Midwest as a sale of our 50% interest in the Insight asset

pool in exchange for acquiring an additional 50% interest in the

Comcast asset pool. The estimated fair value of the 50% interest

of the Comcast asset pool we received was approximately $1.2

billion and resulted in a pretax gain of approximately $235 million,

which is included in other income (expense). We recorded our

50% interest in the Comcast asset pool as a step acquisition in

accordance with SFAS No. 141, “Business Combinations,” (“SFAS

No. 141”).

The results of operations for the cable systems acquired in the

Insight transaction have been reported in our consolidated financial

statements since January 1, 2008 and are reported in our Cable

segment. The weighted-average amortization period of the

franchise-related customer relationship intangible assets acquired

was 4.5 years. Substantially all of the goodwill recorded is

expected to be amortizable for tax purposes.

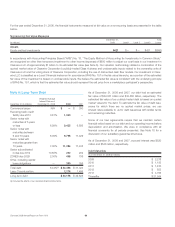

The table below presents the purchase price allocation to assets

acquired and liabilities assumed as a result of the Insight trans-

action.

(in millions)

Property and equipment $ 587

Franchise-related customer relationships 64

Cable franchise rights 1,374

Goodwill 105

Other assets 27

Total liabilities (31)

Net assets acquired $2,126

The following unaudited pro forma information has been presented

as if the Insight transaction had occurred on January 1, 2007. This

information is based on historical results of operations, adjusted

for purchase price allocations, and is not necessarily indicative of

what the results would have been had we operated the cable

systems since January 1, 2007.

Year ended December 31, 2007 (in millions, except per share data)

Revenue $31,582

Net income $ 2,627

Basic EPS $ 0.85

Diluted EPS $ 0.84

Other 2008 Acquisitions

In April 2008, we acquired an additional interest in Comcast

SportsNet Bay Area. In July 2008, we acquired Plaxo, an address

book management and social networking Web site service. In

August 2008, we acquired the remaining interest in G4 that we did

not already own. In September 2008, we acquired DailyCandy, an

e-mail newsletter and Web site. The results of operations for these

acquisitions have been included in our consolidated results of

operations since their respective acquisition dates. The results of

operations for Plaxo and DailyCandy are reported in Corporate and

51 Comcast 2008 Annual Report on Form 10-K