Comcast 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

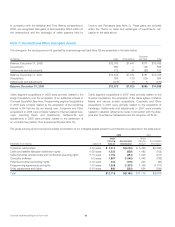

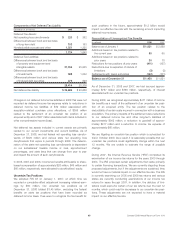

The estimated expense for each of the next five years recognized

in amortization expense and other accounts are presented in the

table below. The amortization of certain intangible assets of our

Programming segment are not recognized as amortization

expense but as a reduction to revenue or as an operating expense

and are presented under the caption “Other Accounts.”

(in millions)

Amortization

Expense

Other

Accounts

2009 $987 $154

2010 $882 $ 94

2011 $748 $ 39

2012 $623 $ 23

2013 $389 $ 6

Note 8: Fair Value of Financial Assets and

Financial Liabilities

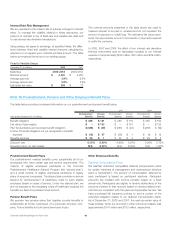

Effective January 1, 2008, we adopted the provisions of SFAS

No. 157 that relate to our financial assets and financial liabilities

(“financial instruments”) as discussed in Note 3. SFAS No. 157

establishes a hierarchy that prioritizes fair value measurements

based on the types of inputs used for the various valuation tech-

niques (market approach, income approach and cost approach).

The levels of the hierarchy are described below:

• Level 1: consists of financial instruments whose value is based

on quoted market prices for identical financial instruments in an

active market

• Level 2: consists of financial instruments that are valued using

models or other valuation methodologies. These models use

inputs that are observable either directly or indirectly; Level 2

inputs include (i) quoted prices for similar assets or liabilities in

active markets, (ii) quoted prices for identical or similar assets or

liabilities in markets that are not active, (iii) pricing models whose

inputs are observable for substantially the full term of the finan-

cial instrument and (iv) pricing models whose inputs are derived

principally from or corroborated by observable market data

through correlation or other means for substantially the full term

of the financial instrument

• Level 3: consists of financial instruments whose values are

determined using pricing models that utilize significant inputs

that are primarily unobservable, discounted cash flow

methodologies, or similar techniques, as well as instruments for

which the determination of fair value requires significant

management judgment or estimation

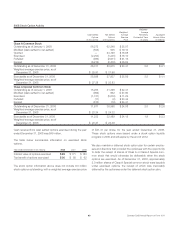

Our assessment of the significance of a particular input to the fair

value measurement requires judgment and may affect the valu-

ation of financial instruments and their classification within the fair

value hierarchy. As required by SFAS No. 157, financial instru-

ments are classified in their entirety based on the lowest level of

inputthatissignificanttothefair value measurement. There have

been no changes in the classification of any financial instruments

within the fair value hierarchy since our adoption of SFAS No. 157.

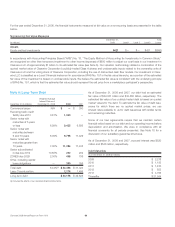

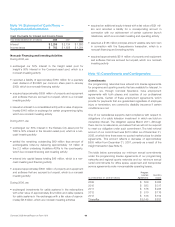

Our financial instruments that are accounted for at fair value on a

recurring basis are presented in the table below.

Recurring Fair Value Measures

Fair value as of December 31, 2008

(in millions) Level 1 Level 2 Level 3 Total

Assets

Trading securities $932 $ — $— $ 932

Available-for-sale securities 73—10

Equity warrants —— 1 1

Cash surrender value of life insurance policies — 147 — 147

Interest rate exchange agreements — 291 — 291

$939 $ 441 $ 1 $1,381

Liabilities

Derivative component of indexed debt instruments $ — $ 23 $— $ 23

Derivative component of prepaid forward sale agreements — (466) — (466)

Interest rate exchange agreements — 1 — 1

$ — $(442) $— $ (442)

57 Comcast 2008 Annual Report on Form 10-K