Comcast 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

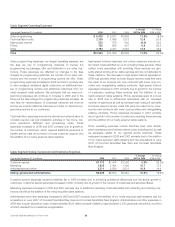

indicated that the estimated fair value of our cable franchise rights

exceeded the carrying value (“headroom”) for each of our units of

accounts by a significant amount (see table below). Given the sig-

nificant headroom that existed on July 1, 2008, we do not believe

the current economic environment, regulatory changes, or the

decline in our market capitalization since our July 1 testing, repre-

sent events or changes in circumstances that are indicative of an

impairment of value at December 31, 2008. The table below illus-

trates the impairment related to our various cable divisions that

would have occurred had the hypothetical reductions in fair value

existed at the time of our last annual impairment testing.

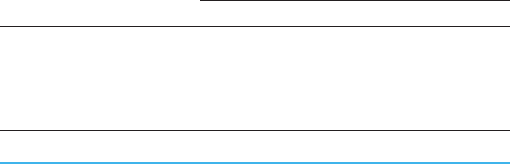

Percent Hypothetical Reduction in Fair Value

and Related Impairment

(in millions) 10% 15% 20% 25%

Eastern Division $ — $ (55) $ (999) $ (1,942)

NorthCentral Division — — — —

Southern Division — — — —

Western Division — — — —

$ — $ (55) $ (999) $ (1,942)

Income Taxes

Our provision for income taxes is based on our current period

income, changes in deferred income tax assets and liabilities,

income tax rates, changes in estimates of our uncertain tax posi-

tions, and tax planning opportunities available in the jurisdictions in

which we operate. We prepare and file tax returns based on our

interpretation of tax laws and regulations, and we record estimates

based on these judgments and interpretations.

On January 1, 2007, we adopted Financial Accounting Standards

Board (“FASB”) Interpretation (“FIN”) No. 48, “Accounting for

Uncertainty in Income Taxes – an Interpretation of FASB State-

ment No. 109,” (“FIN 48”). We evaluate our tax positions using the

recognition threshold and the measurement attribute in accord-

ance with this interpretation. From time to time, we engage in

transactions in which the tax consequences may be subject to

uncertainty. Examples of these transactions include business

acquisitions and disposals, including consideration paid or

received in connection with these transactions, and certain financ-

ing transactions. Significant judgment is required in assessing and

estimating the tax consequences of these transactions. We

determine whether it is more likely than not that a tax position will

be sustained on examination, including the resolution of any

related appeals or litigation processes, based on the technical

merits of the position. In evaluating whether a tax position has met

the more-likely-than-not recognition threshold, we presume that

the position will be examined by theappropriatetaxingauthority

that has full knowledge of all relevant information. A tax position

that meets the more-likely-than-not recognition threshold is meas-

ured to determine the amount of benefit to be recognized in the

financial statements. The tax position is measured at the largest

amount of benefit that has a greater than 50% likelihood of being

realized when the position is ultimately resolved.

We adjust our estimates periodically because of ongoing examina-

tions by and settlements with the various taxing authorities, as well

as changes in tax laws, regulations and precedent. The effects on

our financial statements of income tax uncertainties that arise in

connection with business combinations and those associated with

entities acquired in business combinations are discussed in Note 2

to our consolidated financial statements. We believe that adequate

accruals have been made for income taxes. When uncertain tax

positions are ultimately resolved, either individually or in the

aggregate, differences between our estimated amounts and the

actual amounts are not expected to have a material adverse effect

on our consolidated financial position but could possibly be

material to our consolidated results of operations or cash flow for

any one period.

35 Comcast 2008 Annual Report on Form 10-K