Comcast 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Adelphia and Time Warner transactions added cable systems

in 16 states (California, Colorado, Connecticut, Florida, Georgia,

Louisiana, Maryland, Massachusetts, Minnesota, Mississippi,

Oregon, Pennsylvania, Tennessee, Vermont, Virginia and West

Virginia).

The cable systems we transferred to TWC included our previously

owned cable systems located in Los Angeles, Cleveland and Dal-

las (the “Comcast exchange systems”). The operating results of

the Comcast exchange systems are reported as discontinued

operations and are presented in accordance with SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-Lived Assets,”

(“SFAS No. 144”) (see “Discontinued Operations” below).

Purchase Price Allocation

The results of operations for the cable systems acquired in the

Adelphia and Time Warner transactions have been included in our

consolidated financial statements since July 31, 2006 (the acquis-

ition date). The weighted-average amortization period of the

franchise-related customer relationship intangible assets acquired

was 7 years. As a result of the redemption of our investment in

TWC and the exchange of certain cable systems in 2006, we

reversed deferred tax liabilities of approximately $760 million,

which were primarily related to the excess of tax basis of the

assets acquired over the tax basis of the assets exchanged, and

reduced the amount of goodwill and other noncurrent assets that

would have otherwise been recorded in the acquisition. Sub-

stantially all of the goodwill recorded is expected to be amortizable

for tax purposes.

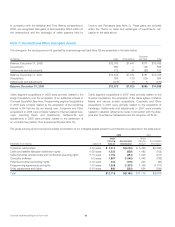

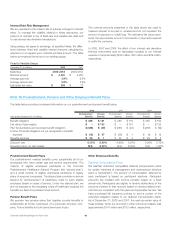

The table below presents the purchase price allocation to assets

acquired and liabilities assumed as a result of the Adelphia and

Time Warner transactions.

(in millions)

Property and equipment $ 2,640

Franchise-related customer relationships 1,627

Cable franchise rights 6,730

Goodwill 420

Other assets 111

Total liabilities (351)

Net assets acquired $11,177

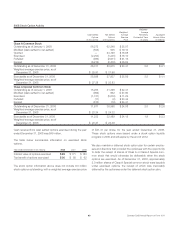

Discontinued Operations

As discussed above, the operating results of the Comcast

exchange systems transferred to TWC are reported as dis-

continued operations and are presented in accordance with SFAS

No. 144. The table below presents the operating results of the

Comcast exchange systems through the closing date of the

exchanges (July 31, 2006):

Year ended December 31, 2006 (in millions)

Revenue $734

Income before income taxes $121

Income tax expense $ (18)

Net income $103

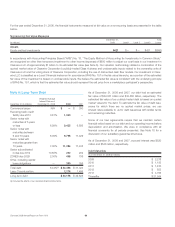

Other 2006 Acquisitions

E! Entertainment Television

In November 2006, we acquired the 39.5% of E! Entertainment

Television, which operates the E! and Style programming net-

works, that we did not already own for approximately $1.2 billion.

We have historically consolidated the results of operations of E!

Entertainment Television. We allocated the purchase price to

property and equipment, intangibles, and goodwill.

Susquehanna

In April 2006, we acquired the cable systems of Susquehanna

Cable Co. and its subsidiaries (“Susquehanna”) for a total pur-

chase price of approximately $775 million. These cable systems

are located primarily in Pennsylvania, New York, Maine and Mis-

sissippi. Before the acquisition, we held an approximate 30%

equity ownership interest in Susquehanna that we accounted for

as an equity method investment. On May 1, 2006, Susquehanna

Cable Co. redeemed the approximate 70% equity ownership

interest in Susquehanna held by Susquehanna Media Co., which

resulted in Susquehanna becoming 100% owned by us. The

results of operations of these cable systems have been included in

our consolidated financial statements since the acquisition date

and are reported in our Cable segment. We allocated the pur-

chase price to property and equipment, franchise-related

customer relationship intangibles, cable franchise rights, and

goodwill. The acquisition of these cable systems was not material

to our consolidated financial statements for the year ended

December 31, 2006.

53 Comcast 2008 Annual Report on Form 10-K