Comcast 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

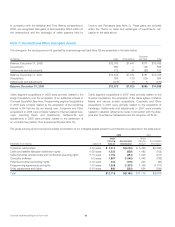

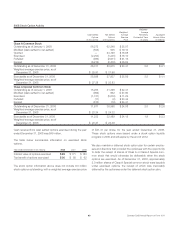

Note 6: Investments

The components of our investments are presented in the

table below.

December 31 (in millions) 2008 2007

Fair Value Method

Equity securities $ 940 $2,080

Debt securities 3621

943 2,701

Equity Method

Insight Midwest —1,877

SpectrumCo, LLC 1,354 1,352

Clearwire 421 —

Other 402 453

2,177 3,682

Cost Method

AirTouch 1,479 1,465

Other 243 213

1,722 1,678

Total investments 4,842 8,061

Less: Current investments 59 98

Noncurrent investments $4,783 $7,963

Fair Value Method

We hold equity investments in publicly traded companies that we

account for as AFS or trading securities. As of December 31,

2008, we held $932 million of fair value method equity securities

related to our obligations under prepaid forward contracts, which

mature between 2011 and 2015. At maturity of these prepaid

forward contracts, the counterparties are entitled to receive some

or all of the equity securities, or an equivalent amount of cash at

our option, based upon the market value of the equity securities at

that time.

The net unrealized gains on investments accounted for as AFS

securities as of December 31, 2008 and 2007 were $29 million

and $42 million, respectively. The amounts were reported primarily

as a component of accumulated other comprehensive income

(loss), net of related deferred income taxes of $10 million and $15

million in 2008 and 2007, respectively.

The cost, fair value, and unrealized gains and losses related to our

AFS securities are presented in the table below. The decreases in

2008 from 2007 are primarily due to the sale of debt securities.

Year ended December 31 (in millions) 2008 2007

Cost $60 $685

Unrealized gains 34 44

Unrealized losses (5) (2)

Fair value $89 $727

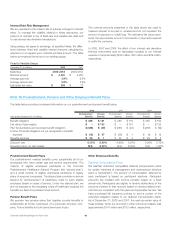

Proceeds from the sale of AFS securities in 2008, 2007 and 2006

were $638 million, $1.033 billion and $209 million, respectively.

Gross realized gains on these sales in 2008, 2007 and 2006 were

$1 million, $145 million and $59 million, respectively. Sales of AFS

securities for the year ended December 31, 2008 consisted

primarily of the sale of debt securities. Sales of AFS securities in

2007 and 2006 consisted primarily of sales of Time Warner Inc.

common stock.

Equity Method

Insight Midwest Partnership

We accounted for our interest in Insight Midwest as an equity

method investment until January 1, 2008, the date the Comcast

asset pool was distributed to us (see Note 5). As of December 31,

2007, our recorded investment in Insight exceeded our propor-

tionate interest in the book value of its net assets by $144 million.

The basis difference was attributed to indefinite-lived intangible

assets.

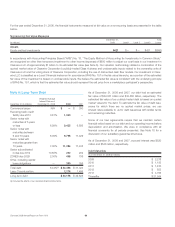

SpectrumCo, LLC

SpectrumCo, LLC (“SpectrumCo”), a consortium of investors

including us, Time Warner Cable, Bright House Networks and Cox

Communications (“Cox”), was the successful bidder for 137 wire-

less spectrum licenses for approximately $2.4 billion in the Federal

Communications Commission’s advanced wireless spectrum auc-

tion that concluded in September 2006. Our portion of the total

cost to purchase the licenses was approximately $1.3 billion. In

October 2008, SpectrumCo and its members entered into an

agreement under which Cox would withdraw as a member of

SpectrumCo and have its interest in SpectrumCo redeemed in

accordance with its pre-existing exit rights. Under the agreement,

Cox was entitled to receive from SpectrumCo at the closing

approximately $70 million and certain spectrum licenses covering

areas in or near Cox’s service area. The agreement required the

$70 million to be funded by contributions to SpectrumCo from the

remaining members. This transaction closed in January 2009 and

we contributed $45 million to SpectrumCo to satisfy our funding

obligations under the agreement. Based on SpectrumCo’s cur-

rently planned activities, we have determined that it is not a VIE.

We have and continue to account for this joint venture as an equity

method investment based on its governance structure, notwith-

standing our majority interest.

Clearwire

In November 2008, Sprint Nextel (“Sprint”) and the legal prede-

cessor of Clearwire Corporation (“old Clearwire”) closed on a

series of transactions (collectively the “Clearwire transaction”) with

an investor group made up of us, Intel, Google, Time Warner

Cable and Bright House Networks. As a result of the Clearwire

transaction, Sprint and old Clearwire combined their next-

generation wireless broadband businesses and formed a new

independent holding company, Clearwire Corporation, and its

operating subsidiary, Clearwire Communications LLC (“Clearwire

Comcast 2008 Annual Report on Form 10-K 54