Comcast 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 3: Recent Accounting Pronouncements

SFAS No. 141R

In November 2007, the FASB issued SFAS No. 141R, which con-

tinues to require that all business combinations be accounted for

by applying the acquisition method. Under the acquisition method,

the acquirer recognizes and measures the identifiable assets

acquired, the liabilities assumed, and any contingent consideration

and contractual contingencies, as a whole, at their fair value as of

the acquisition date. Under SFAS No. 141R, all transaction costs

are expensed as incurred. SFAS No. 141R rescinds EITF 93-7.

Under EITF 93-7, the effect of any subsequent adjustments to

uncertain tax positions was generally applied to goodwill, except

for post-acquisition interest on uncertain tax positions, which was

recognized as an adjustment to income tax expense. Under SFAS

No. 141R, all subsequent adjustments to income tax liabilities and

related interest that would have impacted goodwill are recognized

within income tax expense. The guidance in SFAS No. 141R will

be applied prospectively to any business combination for which

the acquisition date is on or after January 1, 2009.

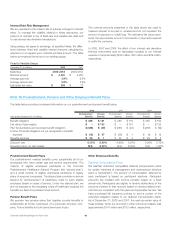

SFAS No. 157

In September 2006, the FASB issued SFAS No. 157, “Fair Value

Measurements,” (“SFAS No. 157”). SFAS No. 157 defines fair

value, establishes a framework for measuring fair value and

expands disclosure about fair value measurements. SFAS No. 157

is effective for financial assets and financial liabilities in fiscal years

beginning after November 15, 2007 and for nonfinancial assets

and nonfinancial liabilities in fiscal years beginning after March 15,

2008. Effective January 1, 2008, we adopted the provisions of

SFAS No. 157 that relate to our financial assets and financial

liabilities. We are evaluating the impact of the provisions of SFAS

No. 157 that relate to our nonfinancial assets and nonfinancial

liabilities, which are effective for us as of January 1, 2009, and

currently do not expect the adoption to have a material impact on

our consolidated financial statements. See Note 8 for further

details regarding the adoption of this standard.

SFAS No. 159

In February 2007, the FASB issued SFAS No. 159, which provides

the option to report certain financial assets and financial liabilities at

fair value, with the intent to mitigate the volatility in financial report-

ing that can occur when related assets and liabilities are each

recorded on a different basis. SFAS No. 159 amends FASB

Statement No. 95, “Statement of Cash Flows,” (“SFAS No. 95”)

and FASB Statement No. 115, “Accounting for Certain Invest-

ments in Debt and Equity Securities,” (“SFAS No. 115”). SFAS

No. 159 specifies that cash flows from trading securities, including

securities for which an entity has elected the fair value option,

should be classified in the statement of cash flows based on the

nature of and purpose for which the securities were acquired.

Before this amendment, SFAS No. 95 and SFAS No. 115 speci-

fied that cash flows from trading securities must be classified as

cash flows from operating activities. Effective January 1, 2008, we

adopted SFAS No. 159. We have not elected the fair value option

for any financial assets or financial liabilities. Upon adoption, we

reclassified $603 million of proceeds from the sale of trading secu-

rities within our statement of cash flows for the year ended

December 31, 2007 from an operating activity to an investing

activity. The adoption of SFAS No. 159 had no effect on our

statement of cash flows for the year ended December 31, 2006.

SFAS No. 160

In November 2007, the FASB issued SFAS No. 160, “Accounting

and Reporting of Noncontrolling Interest,” (“SFAS No. 160”). SFAS

No. 160 requires that a noncontrolling interest (previously referred

to as a minority interest) be separately reported in the equity sec-

tion of the consolidated entity’s balance sheet. SFAS No. 160 also

established accounting and reporting standards for (i) ownership

interests in subsidiaries held by parties other than the parent,

(ii) the amount of consolidated net income attributable to the

parent and to the noncontrolling interest, (iii) changes in a parent’s

ownership interest and (iv) the valuation of retained noncontrolling

equity investments when a subsidiary is deconsolidated. SFAS

No. 160 is effective for us beginning January 1, 2009, at which

time our financial statements will reflect the new presentation for

noncontrolling interests.

EITF Issue No. 06-10

In March 2007, the EITF reached a consensus on EITF Issue

No. 06-10, “Accounting for Deferred Compensation and

Postretirement Benefit Aspects of Collateral Assignment Split-

Dollar Life Insurance Arrangements,” (“EITF 06-10”). EITF 06-10

provides that an employer should recognize a liability for the post-

retirement benefit related to collateral assignment split-dollar life

insurance arrangements. We adopted EITF 06-10 on January 1,

2008, at which time we adjusted beginning retained earnings and

recorded a liability of $132 million. See Note 10 for further details

regarding the adoption of this standard.

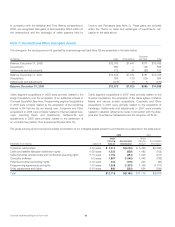

Note 4: Earnings Per Share

Basic earnings per common share (“Basic EPS”) is computed by

dividing net income from continuing operations by the weighted-

average number of common shares outstanding during the period.

Our potentially dilutive securities include potential common shares

related to our stock options and restricted share units (“RSUs”).

Diluted earnings per common share (“Diluted EPS”) considers the

impact of potentially dilutive securities using the treasury stock

method except in periods in which there is a loss because the

inclusion of the potential common shares would have an anti-

dilutive effect. Diluted EPS excludes the impact of potential

common shares related to our stock options in periods in which

the option exercise price is greater than the average market price

of our Class A common stock or our Class A Special common

stock, as applicable (see Note 12).

Comcast 2008 Annual Report on Form 10-K 50