Comcast 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

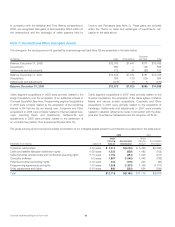

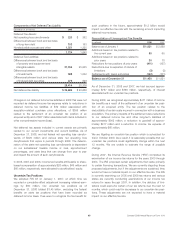

Debt Issuances and Borrowings

Year ended December 31, 2008 (in millions)

Revolving bank credit facility due 2013 $ 1,510

5.70% notes due 2018 1,000

6.40% notes due 2038 1,000

Other, net 25

Total $ 3,535

We used the net proceeds of these issuances and borrowings for

the repayment of certain debt obligations, the repurchase of our

common stock, the purchase of investments, working capital and

general corporate purposes.

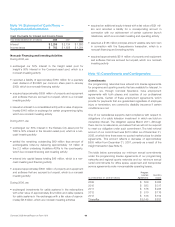

Debt Redemptions and Repayments

Year ended December 31, 2008 (in millions)

Commercial paper $ 300

Revolving bank credit facility due 2013 505

6.2% notes due 2008 800

7.625% notes due 2008 350

9.0% notes due 2008 300

ZONES due 2029 264

Other, net 91

Total $ 2,610

Debt Instruments

Commercial Paper Program

Our commercial paper program provides a lower cost borrowing

source of liquidity to fund our short-term working capital require-

ments. The program allows for a maximum of $2.25 billion of

commercial paper to be issued at any one time. Our revolving

bank credit facility supports this program. Amounts outstanding

under the program are classified as long term in our consolidated

balance sheet because we have both the ability and the intent to

refinance these obligations, if necessary, on a long-term basis

using funds available through our revolving bank credit facility.

Revolving Bank Credit Facility

In January 2008, we entered into an amended and restated revolv-

ing bank credit facility that may be used for general corporate

purposes. This amendment increased the size of our existing

revolving bank credit facility from $5.0 billion to $7.0 billion and

extended the maturity of the loan commitment from October 2010

to January 2013. The base rate, chosen at our option, is either the

London Interbank Offered Rate (“LIBOR”) or the greater of the

prime rate or the Federal Funds rate plus 0.5%. The borrowing

margin is based on our senior unsecured debt ratings. As of

December 31, 2008, the interest rate for borrowings under the

credit facility was LIBOR plus 0.35%. In December 2008, we

terminated a $200 million commitment to our credit facility by

Lehman Brothers Bank, FSB (“Lehman”) as a result of Lehman’s

default under a borrowing request. At a discounted value, we

repaid Lehman’s portion of our outstanding credit facility, along

with accrued interest and fees. Subsequent to this termination, the

size of the credit facility is $6.8 billion.

Lines and Letters of Credit

As of December 31, 2008, we and certain of our subsidiaries had

unused lines of credit totaling $5.501 billion under various credit

facilities and unused irrevocable standby letters of credit totaling

$337 million to cover potential fundings under various agreements.

ZONES

At maturity, holders of our 2.0% Exchangeable Subordinated

Debentures due 2029 (the “ZONES”) are entitled to receive in cash

an amount equal to the higher of the principal amount of the out-

standing ZONES of $1.060 billion or the market value of

approximately 14.1 million shares of Sprint Nextel common stock

and approximately 0.7 million shares of Embarq common stock.

Before maturity, each of the ZONES is exchangeable at the hold-

er’s option for an amount of cash equal to 95% of the aggregate

market value of one share of Sprint Nextel common stock and

0.05 shares of Embarq common stock.

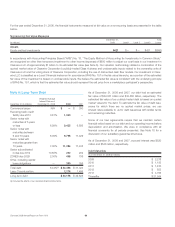

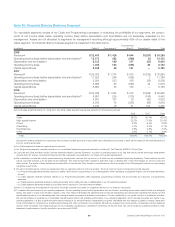

We separate the accounting for the ZONES into derivative and

debt components. The following table presents the change in the

carrying value of the debt component and the change in the fair

valueofthederivativecomponent(seeNote6).

(in millions)

Debt

Component

Derivative

Component Total

Balance as of January 1,

2008 $ 625 $ 81 $ 706

Change in debt component

to interest expense 24 — 24

Change in derivative

component to investment

income (loss), net — (58) (58)

Repurchases and retirements (264) — (264)

Balance as of December 31,

2008 $ 385 $ 23 $ 408

59 Comcast 2008 Annual Report on Form 10-K