Comcast 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

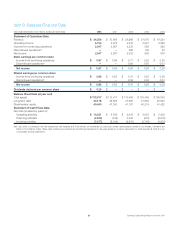

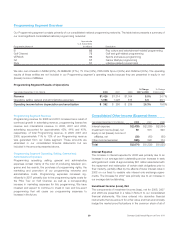

Operating Activities

Components of Net Cash Provided by Operating Activities

Year ended December 31 (in millions) 2008 2007 2006

Operating income $ 6,732 $ 5,578 $ 4,619

Depreciation and amortization 6,400 6,208 4,823

Operating income before

depreciation and

amortization 13,132 11,786 9,442

Operating income before

depreciation and

amortization from

discontinued operations —— 264

Noncash share-based

compensation and

contribution expense 258 223 223

Changes in operating assets

and liabilities (251) (200) (280)

Cash basis operating

income 13,139 11,809 9,649

Payments of interest (2,256) (2,134) (1,880)

Payments of income taxes (762) (1,638) (1,284)

Proceeds from interest,

dividends and other

nonoperating items 125 185 233

Payments related to settlement

of litigation of an acquired

company —— (67)

Excess tax benefit under SFAS

No. 123R presented in

financing activities (15) (33) (33)

Net cash provided by

operating activities $10,231 $ 8,189 $ 6,618

The increases in interest payments in 2008 and 2007 were primar-

ily due to an increase in our average debt outstanding.

The decrease in tax payments in 2008 was primarily due to the

Economic Stimulus Act of 2008, which resulted in a reduction in

our tax payments of approximately $600 million. The increase in

tax payments in 2007 was primarily due to the effects of increases

in income, sales of investments, and the settlement of federal and

state tax audits of $376 million.

Financing Activities

Net cash provided by (used in) financing activities consists primar-

ily of our proceeds from borrowings offset by our debt

repayments, our repurchases of our Class A and Class A Special

common stock and dividend payments. Proceeds from borrow-

ings fluctuate from year to year based on the amounts paid to fund

acquisitions and debt repayments. We have made, and may from

time to time in the future make, optional repayments on our debt

obligations, which may include repurchases of our outstanding

public notes and debentures, depending on various factors, such

as market conditions. In 2008, we made $307 million of optional

public bond repurchases. See Note 9 to our consolidated financial

statements for further discussion of our financing activities, includ-

ing details of our debt repayments and borrowings.

Available Borrowings Under Credit Facilities

We traditionally maintain significant availability under our lines of

credit and our commercial paper program to meet our short-term

liquidity requirements. In January 2008, we entered into an

amended and restated revolving bank credit facility that may be

used for general corporate purposes. This amendment increased

the size of the credit facility from $5.0 billion to $7.0 billion and

extended the maturity of the loan commitment from October 2010

to January 2013. Under our credit facility, other lenders are not

obligated to fund a defaulting lender’s commitment, although

another lender could agree to fund the defaulting lender’s

commitment. However, non-defaulting lenders are not able to use

a default by another bank to avoid their own commitments. In

December 2008, we terminated a $200 million commitment to our

credit facility by Lehman Brothers Bank, FSB (“Lehman”) as a

result of Lehman’s default under a borrowing request. At a dis-

counted value, we repaid Lehman’s portion of our outstanding

credit facility, along with accrued interest and fees. Subsequent to

this termination, the size of our credit facility is $6.8 billion. As of

December 31, 2008, amounts available under all of our credit

facilities totaled approximately $5.5 billion.

Debt Covenants

We and our cable subsidiaries that have provided guarantees are

subject to the covenants and restrictions set forth in the indentures

governing our public debt securities and in the credit agreements

governing our bank credit facilities (see Note 18 to our con-

solidated financial statements). We and the guarantors are in

compliance with the covenants, and we believe that neither the

covenants nor the restrictions in our indentures or loan documents

will limit our ability to operate our business or raise additional capi-

tal. Our credit facilities’ covenants are tested on an ongoing basis.

The only financial covenant in our $6.8 billion revolving credit

31 Comcast 2008 Annual Report on Form 10-K