Comcast 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

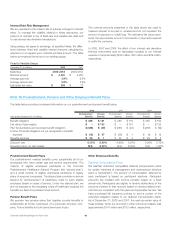

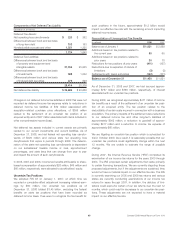

Interest Rate Risk Management

We are exposed to the market risk of adverse changes in interest

rates. To manage the volatility relating to these exposures, our

policy is to maintain a mix of fixed-rate and variable-rate debt and

to use interest rate derivative transactions.

Using swaps, we agree to exchange, at specified dates, the differ-

ence between fixed and variable interest amounts calculated by

reference to an agreed-upon notional principal amount. The table

below summarizes the terms of our existing swaps.

Fixed to Variable Swaps

December 31 (in millions) 2008 2007

Maturities 2009-2018 2008-2014

Notional amount $ 3,500 $ 3,200

Average pay rate 3.9% 6.8%

Average receive rate 5.8% 5.9%

Estimated fair value $ 309 $17

The notional amounts presented in the table above are used to

measure interest to be paid or received and do not represent the

amount of exposure to credit loss. The estimated fair value repre-

sents the approximate amount of proceeds or payments required

to settle the contracts.

In 2008, 2007 and 2006, the effect of our interest rate derivative

financial instruments was an (decrease) increase to our interest

expense of approximately $(34) million, $43 million and $39 million,

respectively.

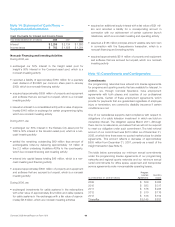

Note 10: Postretirement, Pension and Other Employee Benefit Plans

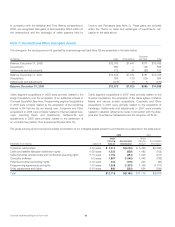

The table below provides condensed information on our postretirement and pension benefit plans.

2008 2007 2006

Year ended December 31 (in millions)

Postretirement

Benefits

Pension

Benefits

Postretirement

Benefits

Pension

Benefits

Postretirement

Benefits

Pension

Benefits

Benefit obligation $ 338 $ 181 $ 280 $ 179 $ 280 $ 184

Fair value of plan assets $ – $ 152 $ — $ 157 $ — $ 122

Plan funded status and recorded benefit obligation $ (338) $ (29) $ (280) $ (22) $ (280) $ (62)

Portion of benefit obligation not yet recognized in benefits

expense $ (18) $ 67 $ (39) $ 1 $ (4) $ 12

Benefits expense $36 $ 1 $34 $ 4 $29 $ 8

Discount rate 6.15% 6.00% 6.65% 6.25% 6.00% 5.75%

Expected return on plan assets N/A 8.00% N/A 8.00% N/A 7.00%

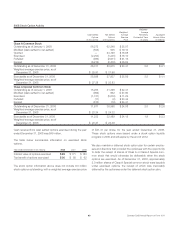

Postretirement Benefit Plans

Our postretirement medical benefits cover substantially all of our

employees who meet certain age and service requirements. The

majority of eligible employees participate in the Comcast

Postretirement Healthcare Stipend Program (the “stipend plan”),

and a small number of eligible employees participate in legacy

plans of acquired companies. The stipend plan provides an annual

stipend for reimbursement of healthcare costs to each eligible

employee based on years of service. Under the stipend plan, we

are not exposed to the increasing costs of healthcare because the

benefits are fixed at a predetermined amount.

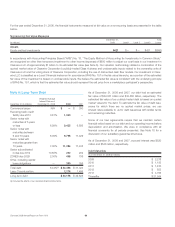

Pension Benefit Plans

We sponsor two pension plans that together provide benefits to

substantially all former employees of a previously acquired com-

pany. Future benefits for both plans have been frozen.

Other Employee Benefits

Deferred Compensation Plans

We maintain unfunded, nonqualified deferred compensation plans

for certain members of management and nonemployee directors

(each a “participant”). The amount of compensation deferred by

each participant is based on participant elections. Participant

accounts are credited with income primarily based on a fixed

annual rate. Participants are eligible to receive distributions of the

amounts credited to their account based on elected deferral peri-

ods that are consistent with the plans and applicable tax law. We

have purchased life insurance policies to fund a portion of the

unfunded obligation related to our deferred compensation plans.

As of December 31, 2008 and 2007, the cash surrender value of

these policies, which are recorded in other noncurrent assets, was

approximately $147 million and $112 million, respectively.

Comcast 2008 Annual Report on Form 10-K 60