Cincinnati Bell 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

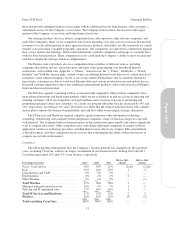

Form 10-K Part I Cincinnati Bell Inc.

Part I

Item 1. Business

Overview and Strategy

With headquarters in Cincinnati, Ohio, Cincinnati Bell Inc. and its consolidated subsidiaries (“Cincinnati

Bell”, “we”, “our”, “us” or the “Company”) is a full-service regional provider of entertainment, data and voice

communications services over wireline and wireless networks, a provider of managed and professional

information technology services, and a reseller of information technology (“IT”) and telephony equipment. In

addition, enterprise customers across the United States rely on Cincinnati Bell Technology Solutions Inc.

(“CBTS”), a wholly-owned subsidiary, for efficient, scalable communications systems and end-to-end IT

solutions.

Our goal is to transform Cincinnati Bell into a fiber-based entertainment, communications and IT solutions

company with growing revenue, growing profits and significant cash flows. During 2013, we invested

approximately $123 million in our strategic products, generating an 18% increase in our strategic revenues.

Revenue from these high demand products totaled $370.6 during the year and offset the declines from our legacy

products by 10%.

Wireline strategic revenue totaled $252.5 million, up 22% compared to the prior year, primarily due to

growth in our Fioptics suite of products, which provides entertainment, high-speed internet and voice services

using a combination of fiber to the home and fiber to the node technology. Fioptics revenue totaled $100.8

million, up 48% over the prior year, as we achieved record high net activations for both our entertainment and

high-speed internet products. Strategic revenue from business customers was also up 8% in 2013 due to increased

demand for metro-ethernet and Multi-Protocol Label Switching (“MPLS”) products. The growth and demand for

our strategic products continues to increasingly mitigate revenue declines from our legacy products. In total,

Wireline revenue was down less than 1% in 2013, and we believe our strategic investments will result in full year

2014 Wireline revenue growth.

Our IT Services and Hardware segment revenue totaled $344.1 million, up 9% year over year. Strategic

managed and professional services revenue totaled $118.1 million, up 8% due to increased demand for virtual

data center products and staff augmentation resources. Telecom and IT equipment sales were up 9% year over

year, and remain an important value added product to our existing customer base that requires very little capital.

The Wireless segment continues to be challenged by increased competitive pressures from national carriers.

During the year, our revenues declined by 17% due to continued subscriber losses. We plan to continue to

manage the business for cash flow and profitability as we consider strategic alternatives.

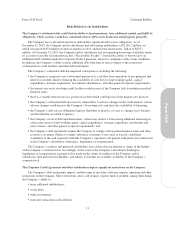

The Company was also able to take advantage of a favorable interest rate environment by amending its

Corporate Credit Agreement to include a $540 million Tranche B Term Loan facility (“Tranche B Term Loan”)

with a 4.0% interest rate at December 31, 2013. The proceeds from the facility were used to redeem all of the

Company’s $500 million 8 1/4% Senior Notes due 2017 (“8 1/4% Senior Notes”) on October 15, 2013 at a

redemption price of 104.125%. It is expected that these refinancing activities will save approximately $20

million of interest payments in 2014.

On January 24, 2013, we completed the initial public offering (“IPO”) of CyrusOne Inc. (“CyrusOne”), a

former subsidiary which owns and operates our former data center colocation business. CyrusOne, which

conducts its data center business through CyrusOne LP, an operating partnership, is a full service provider of data

center colocation services to enterprise customers through its facilities with fully redundant power and cooling

solutions that are currently located in the Midwest, Texas, Arizona, London and Singapore. Cincinnati Bell is the

majority owner of CyrusOne (NASDAQ: CONE), a real estate investment trust (“REIT”), effectively owning

approximately 69% of the economic interests of CyrusOne through the ownership of its common stock and

partnership units of CyrusOne LP. However, effective January 24, 2013, we no longer have control over

CyrusOne’s operations and no longer consolidate CyrusOne in our consolidated financial statements. Our

ownership in CyrusOne is now accounted for as an equity method investment.

3

Form 10-K