Cincinnati Bell 2013 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Amendment for Tranche B Term Loan Facility

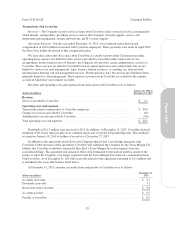

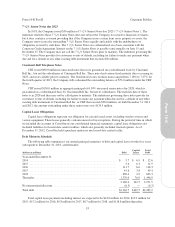

On September 10, 2013, the Company amended and restated its Corporate Credit Agreement, originally

dated as of November 20, 2012, to include a $540 million Tranche B Term Loan facility (“Tranche B Term

Loan”) that matures on September 10, 2020.

The Company received $529.8 million in net proceeds from the Tranche B Term Loan, after deducting the

original issue discount, fees and expenses. These proceeds were used to redeem all of the Company’s $500

million 8 1/4% Senior Notes due 2017 (“8 1/4% Senior Notes”) on October 15, 2013 at a redemption price of

104.125%, including payment of accrued interest thereon totaling $20.6 million.

The Tranche B Term Loan was issued with 0.75% of original issue discount and requires quarterly principal

payments of 0.25% of the original principal amount. Loans under the Tranche B Term Loan bear interest, at the

Company’s election, at a rate per annum equal to (i) LIBOR (subject to a 1.00% floor) plus 3.00% or (ii) the base

rate plus 2.00%. Base rate is the greatest of (a) the bank prime rate, (b) the one-month LIBOR rate plus 1.00%

and (c) the federal funds rate plus 0.5%. At December 31, 2013, the interest rate on the outstanding Tranche B

Term Loan was 4.00%.

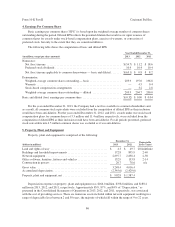

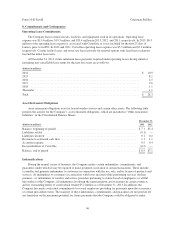

In accordance with the terms of the amended Corporate Credit Agreement, the Company’s ability to make

restricted payments, which include share repurchases and common stock dividends, is limited to a total of $15

million, with certain permitted exceptions, given that its Consolidated Total Leverage Ratio, as defined by the

Corporate Credit Agreement, exceeds 3.50 to 1.00 as of December 31, 2013. The Company may make restricted

payments of $45 million annually when the Consolidated Total Leverage Ratio is less than or equal to 3.50 to

1.00. There are no dollar limits on restricted payments when the Consolidated Total Leverage Ratio is less than

or equal to 3.00 to 1.00. These restricted payment limitations do not impact the Company’s ability to make

regularly scheduled dividend payments on its 6 3/4% Cumulative Convertible Preferred Stock. Furthermore, the

Company may make restricted payments in the form of share repurchases or dividends up to 15% of CyrusOne

sale proceeds, subject to a $35 million annual cap with carryovers.

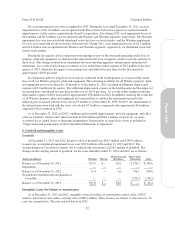

The Corporate Credit Agreement was also modified to provide that the Tranche B Term Loan participates in

mandatory prepayments, subject to the terms and conditions (including with respect to payment priority) set forth

in the restated Corporate Credit Agreement. In addition, the Corporate Credit Agreement was modified to

provide that 85%, rather than 100%, of proceeds from monetizing any portion of our CyrusOne common stock

partnership units, are applied to mandatory prepayments under the restated Corporate Credit Agreement, subject

to the terms and conditions set forth therein. Other revisions were also effected pursuant to the amended

agreement, including with respect to financial covenant compliance levels.

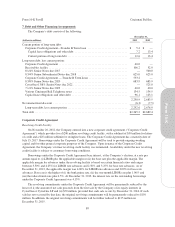

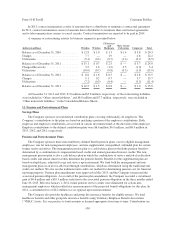

Guarantors and Security Interests, Corporate Credit Agreement (Including Tranche B Term Loan)

All existing and future subsidiaries of the Company (other than Cincinnati Bell Telephone Company LLC,

Cincinnati Bell Funding LLC (and any other similar special purpose receivables financing subsidiary), Cincinnati

Bell Shared Services LLC, Cincinnati Bell Extended Territories LLC, CBMSM Inc. and its direct and indirect

subsidiaries, and the Company’s joint ventures, subsidiaries prohibited by applicable law from becoming

guarantors and foreign subsidiaries) are required to guarantee borrowings under the Corporate Credit Agreement.

Debt outstanding under the Corporate Credit Agreement is secured by perfected first priority pledges of and

security interests in (i) substantially all of the equity interests of the Company’s U.S. subsidiaries (other than

subsidiaries of non-guarantors of the Corporate Credit Agreement) and 66% of the equity interests in the first-tier

foreign subsidiaries held by the Company and the guarantors under the Corporate Credit Agreement, (ii) certain

personal property and intellectual property of the Company and its subsidiaries (other than that of non-guarantors

of the Corporate Credit Agreement and certain other excluded property) and (iii) the Company’s equity interests

in CyrusOne and CyrusOne LP, both of which, together with their respective subsidiaries, are treated as non-

subsidiaries of the Company and are not guarantors for purposes of the Corporate Credit Agreement.

90

Form 10-K Part II Cincinnati Bell Inc.