Cincinnati Bell 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

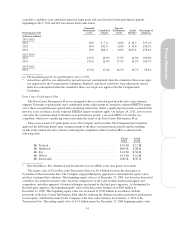

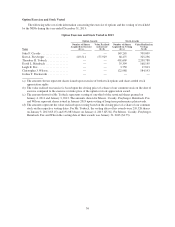

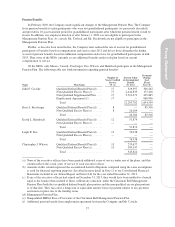

(d) Non-equity incentive plan compensation represents amounts earned for annual performance-based cash incentives, long-term

performance plan cash-settled awards and Data Center Performance Plan awards. The table below shows the amounts earned for each of

these awards:

Name Year

Annual

Performance-Based

Cash Incentive ($)

Long-Term

Cash-Settled

Performance Units

($) (1)

Data Center

Performance Plan

Cash Incentive

($)(2) Total ($)

John F. Cassidy .................... 2013 — 682,402 — 682,402

2012 1,354,722 1,522,478 — 2,877,200

2011 1,242,718 1,265,041 — 2,507,759

Kurt A. Freyberger ................. 2013 — — 1,593,534 1,593,534

2012 441,238 — — 441,238

2011 324,190 — — 324,190

Theodore H. Torbeck ............... 2013 949,950 — 2,231,840 3,181,790

2012 970,045 — — 970,045

2011 1,025,838 — — 1,025,838

David L. Heimbach ................. 2013 404,483 57,702 267,821 730,006

Leigh R. Fox ...................... 2013 306,623 36,064 714,189 1,056,876

Christopher J. Wilson ............... 2013 268,132 — 1,580,143 1,848,275

2012 284,111 — — 284,111

2011 301,223 — — 301,223

Joshua T. Duckworth ................ 2013 86,023 — 107,128 193,151

(1) The amounts shown above for long-term cash-settled performance units earned by Mr. Cassidy represent: (1) the amount earned in

2013 and paid in 2014 for the 2013 performance period related to cash-payment performance awards granted in January 2011 for

the 2011-2013 performance cycle (2) the amount earned in 2012 and paid in 2013 for the 2012 performance period related to cash-

payment performance awards granted in January 2010 for the 2010-2012 performance cycle and January 2011 for the 2011-2012

performance cycle, (3) the amount earned in 2011 and paid in 2012 for the 2011 performance period related to cash-payment

performance awards granted in January 2009 for the 2009-2011 performance cycle, January 2010 for the 2010-2011 performance

cycle, and January 2011 for the 2011 performance cycle. The amounts shown above for long-term cash-settled performance units

earned by Messrs. Fox and Heimbach represent: (1) the amount earned in 2013 and paid in 2014 for the 2013 performance period

related to cash-payment performance awards granted in January 2012 for the 2012-2013 performance cycle.

(2) The amounts shown above represent the amounts paid in 2013 for the long-term Data Center Performance Plan. Refer to pages 41-

42 for additional details on the plan.

(e) The amounts shown in this column for Messrs. Cassidy, Freyberger, Fox, Heimbach and Wilson represent the one-year increase in the

value of their qualified defined benefit plan and nonqualified excess plan for 2013, 2012 and 2011, respectively, projected forward to age

65 for each executive with interest credited at 3.5%, which is the rate a terminated participant would then be given (such interest rate was

increased to 4.0% effective as of March 1, 2012) and then discounted back to the respective year at the discount rate (4.2% for 2013,

3.3% for 2012 and 3.90% for 2011) required under ASC 960. The present value of the accrued pension benefits decreased in 2013

primarily due to an increase in the applicable discount rate and improved market performance of pension assets. The Company froze its

qualified pension plan for management employees in 2009; therefore, Mr. Torbeck and Mr. Duckworth are not entitled to any benefits

under this plan. None of the executives receive any preferential treatment or above-market interest under the Company’s retirement

plans.

(f) For each NEO except Mr. Freyberger, the amount represents the Company’s 401(k) match. Under the terms of the Cincinnati Bell Inc.

Retirement Savings Plan, the Company’s matching contribution is equal to 100% on the first 3% and 50% on the next 2% of

contributions made to the plan by the participant. Eligible compensation includes base wages plus any incentive paid to eligible

participants. The maximum company matching contribution is $10,000. For Mr. Freyberger, this amount represents the Company’s 401k

match and $930,000 due to him for a consulting agreement entered into upon his resignation, effective September 30, 2013.

(g) Mr. Cassidy retired from his position as President and Chief Executive Officer effective January 31, 2013 and assumed the role of Vice

Chairman of the Board. Mr. Cassidy retired from the Board effective December 31, 2013.

(h) Mr. Freyberger resigned as Chief Financial Officer on September 30, 2013.

(i) Mr. Torbeck was appointed Chief Executive Officer on January 31, 2013.

(j) Mr. Heimbach was appointed Chief Operating Officer on November 20, 2013.

(k) Mr. Fox was appointed Chief Financial Officer on October 1, 2013.

(l) Mr. Duckworth was appointed Vice President, Investor Relations and Controller on July 9, 2013.

51

Proxy Statement