Cincinnati Bell 2013 Annual Report Download - page 270

Download and view the complete annual report

Please find page 270 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Form 10-K/A Part IV Cincinnati Bell Inc.

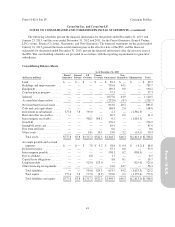

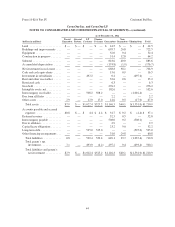

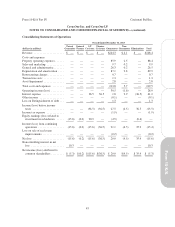

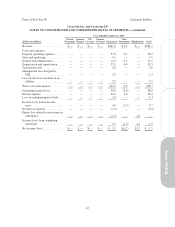

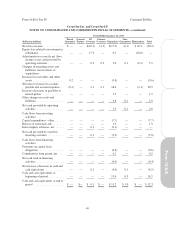

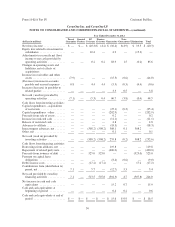

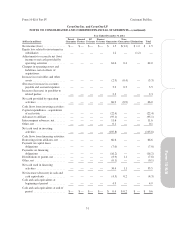

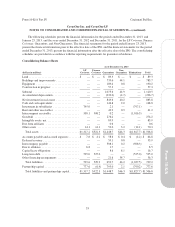

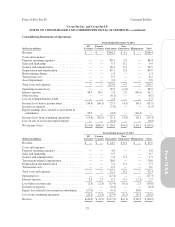

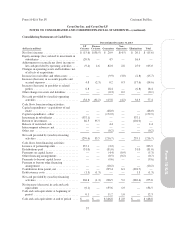

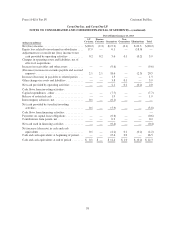

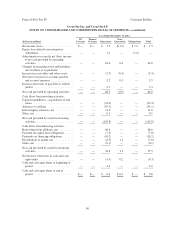

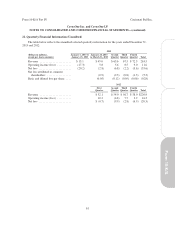

CyrusOne Inc. and CyrusOne LP

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(continued)

CyrusOne LP

CyrusOne LP and CyrusOne Finance Corp., as “LP Co-issuer” and “Finance Co-issuer,” respectively

(together, the “Issuers”), had $525 million aggregate principal amount of Senior Notes outstanding at

December 31, 2013 and 2012. The Senior Notes are fully and unconditionally and jointly and severally

guaranteed on a senior basis by CyrusOne Inc. (“Parent Guarantor”), CyrusOne GP (“General Partner”), and

CyrusOne LP’s 100% owned subsidiaries, CyrusOne LLC, CyrusOne TRS Inc. and CyrusOne Foreign Holdings

LLC (such subsidiaries, together the “Guarantors”). None of the subsidiaries organized outside of the United

States (collectively, the “Non-Guarantors”) guarantee the Senior Notes. Subject to the provisions of the indenture

governing the Senior Notes, in certain circumstances, a Guarantor may be released from its guarantee obligation,

including:

•upon the sale or other disposition (including by way of consolidation or merger) of such Guarantor or of

all of the capital stock of such Guarantor such that such Guarantor is no longer a restricted subsidiary

under the indenture,

•upon the sale or disposition of all or substantially all of the assets of the Guarantor,

•upon the LP Co-issuer designating such Guarantor as an unrestricted subsidiary under the terms of the

indenture,

•if such Guarantor is no longer a guarantor or other obligor of any other indebtedness of the LP Co-issuer

or the Parent Guarantor, and

•upon the defeasance or discharge of the Senior Notes in accordance with the terms of the indenture.

The following provides information regarding the entity structure of each guarantor of the Senior Notes:

CyrusOne Inc. — CyrusOne Inc. was formed on July 31, 2012. As of January 23, 2013, CyrusOne Inc. was

a 100% owned subsidiary of CBI. Effective January 24, 2013, CyrusOne Inc. completed its IPO of common

stock for net proceeds of $337.1 million, and together with the General Partner, purchased a 33.9% ownership

interest in CyrusOne LP. CyrusOne Inc. also represents a guarantor or Parent Guarantor. In addition, CyrusOne

Inc. became a separate registrant with the SEC upon completion of its IPO.

CyrusOne GP — CyrusOne GP was formed on July 31, 2012, and was a 100% owned subsidiary of

CyrusOne Inc. as of January 23, 2013. Effective upon completion of CyrusOne Inc.’s IPO, this entity became the

general partner and 1% owner of CyrusOne LP and has no other assets or operations. Prior to the IPO, this entity

did not incur any obligations or record any transactions.

Issuers — The Issuers include CyrusOne LP and CyrusOne Finance Corp. CyrusOne Finance Corp., a 100%

owned subsidiary of CyrusOne LP, was formed for the sole purpose of acting as co-issuer of the Senior Notes

and has no other assets or operations. CyrusOne LP, in addition to being the co-issuer of the Senior Notes, is also

the 100% owner, either directly or indirectly, of the Guarantors and Non-Guarantors.

Guarantors — The guarantors include CyrusOne LLC, CyrusOne TRS Inc., and CyrusOne Foreign Holdings

LLC. CyrusOne LLC accounts for all of the domestic operations of CyrusOne LP, including the businesses that

composed the Predecessor operations. CyrusOne LLC, together with CyrusOne Foreign Holdings LLC, directly

or indirectly owns 100% of the Non-Guarantors. As of December 31, 2013, CyrusOne TRS Inc. had not incurred

any obligations or recorded any material transactions for the period ended December 31, 2013 and January 23,

2013.

As of December 31, 2013, the Non-Guarantors consist of 100% owned subsidiaries, which conduct

operations in the United Kingdom and Singapore.

52