Cincinnati Bell 2013 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

71/4% Senior Notes due 2023

In 1993, the Company issued $50 million of 7 1/4% Senior Notes due 2023 (“7 1/4% Senior Notes”). The

indenture related to these 7 1/4% Senior Notes does not subject the Company to restrictive financial covenants,

but it does contain a covenant providing that if the Company incurs certain liens on its property or assets, the

Company must secure the outstanding 7 1/4% Senior Notes equally and ratably with the indebtedness or

obligations secured by such liens. The 7 1/4% Senior Notes are collateralized on a basis consistent with the

Corporate Credit Agreement. Interest on the 7 1/4% Senior Notes is payable semi-annually on June 15 and

December 15. The Company may not call the 7 1/4% Senior Notes prior to maturity. The indenture governing the

71/4% Senior Notes provides for customary events of default, including for failure to make any payment when

due and for a default of any other existing debt instrument that exceeds $20 million.

Cincinnati Bell Telephone Notes

CBT issued $80.0 million in unsecured notes that were guaranteed on a subordinated basis by Cincinnati

Bell Inc., but not the subsidiaries of Cincinnati Bell Inc. These notes had various final maturity dates occurring in

2023, and were callable prior to maturity. The fixed interest rates on these notes ranged from 7.18% to 7.27%. In

the fourth quarter of 2012, the Company fully redeemed the outstanding balance of $73.0 million under the CBT

Notes.

CBT issued $150.0 million in aggregate principal of 6.30% unsecured senior notes due 2028, which is

guaranteed on a subordinated basis by Cincinnati Bell Inc. but not its subsidiaries. The maturity date of these

notes is in 2028 and they may not be called prior to maturity. The indentures governing these notes provide for

customary events of default, including for failure to make any payment when due and for a default of any other

existing debt instrument of Cincinnati Bell Inc. or CBT that exceeds $20.0 million. At both December 31, 2013

and 2012, the amount outstanding under these senior notes was $134.5 million.

Capital Lease Obligations

Capital lease obligations represent our obligation for certain leased assets, including wireless towers and

various equipment. These leases generally contain renewal or buyout options. During the period of time in which

we included the accounts of CyrusOne in our consolidated financial statements, capital lease obligations also

included liabilities for leased data center facilities, which also generally included renewal options. As of

December 31, 2012, CyrusOne held a purchase option on one leased data center facility.

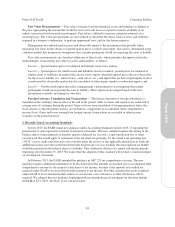

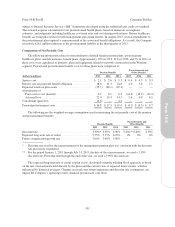

Debt Maturity Schedule

The following table summarizes our annual principal maturities of debt and capital leases for the five years

subsequent to December 31, 2013, and thereafter:

Capital Total

(dollars in millions) Debt Leases Debt

Year ended December 31,

2014 ............................................................. $ 5.7 $ 6.9 $ 12.6

2015 ............................................................. 5.6 6.3 11.9

2016 ............................................................. 111.7 6.6 118.3

2017 ............................................................. 45.6 3.8 49.4

2018 ............................................................. 630.4 2.9 633.3

Thereafter ......................................................... 1,370.0 76.0 1,446.0

2,169.0 102.5 2,271.5

Net unamortized discount ............................................. (6.3) — (6.3)

Total debt ......................................................... $2,162.7 $102.5 $2,265.2

Total capital lease payments including interest are expected to be $14.0 million for 2014, $12.9 million for

2015, $13.2 million for 2016, $9.8 million for 2017, $8.7 million for 2018, and $116.8 million thereafter.

93

Form 10-K