Cincinnati Bell 2013 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

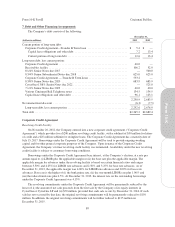

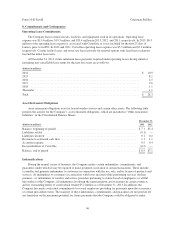

Borrowings and Commitment Fees, Corporate Credit Agreement

As of December 31, 2013, the Company had $40.0 million of outstanding borrowings under the Corporate

Credit Agreement, leaving $160.0 million available. There were no borrowings under the Corporate Credit

Agreement as of December 31, 2012.

The Company pays commitment fees for the unused amount of borrowings on the Corporate Credit

Agreement and letter of credit fees on outstanding letters of credit. The commitment fees are calculated based on

the total leverage ratio and range between 0.500% and 0.625% of the actual daily amount by which the aggregate

revolving commitments exceed the sum of outstanding revolving loans and letter of credit obligations. These fees

were $1.0 million in 2013, $1.6 million in 2012, and $2.3 million in 2011.

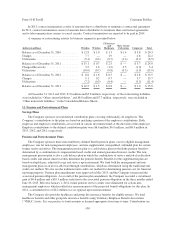

Accounts Receivable Securitization Facility

Cincinnati Bell Inc. and certain of its subsidiaries have an accounts receivable securitization facility

(“Receivables Facility”), which permits maximum borrowings of up to $120.0 million as of December 31, 2013.

On June 3, 2013, the Company executed an amendment of its Receivables Facility which, in addition to

modifying some of the defined terms and purchaser parties under the prior agreement, provided for an increase in

the maximum credit availability under the Receivables Facility from $105.0 million to $120.0 million and

extended the facility’s expiration through June 2016. CBT, CBET, Cincinnati Bell Wireless, LLC (“CBW”),

Cincinnati Bell Any Distance Inc. (“CBAD”), Cincinnati Bell Any Distance of Virginia LLC, CBTS, and eVolve

Business Solutions LLC (“eVolve”) all participate in this facility. The available borrowing capacity is calculated

monthly based on the quantity and quality of outstanding accounts receivable and thus may be lower than the

maximum borrowing limit. At December 31, 2013, the available borrowing capacity was $111.4 million. On

October 1, 2012, the Company and CBF amended the Receivables Facility to remove CyrusOne as an originator

and to remove the CyrusOne receivables from the financing provided under the Receivables Facility.

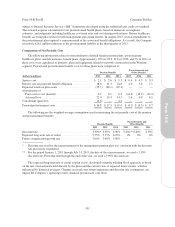

The transferors sell their respective trade receivables on a continuous basis to CBF, a wholly-owned limited

liability company. In turn, CBF grants, without recourse, a senior undivided interest in the pooled receivables to

various purchasers, including commercial paper conduits, in exchange for cash while maintaining a subordinated

undivided interest in the form of over-collateralization in the pooled receivables. The transferors have agreed to

continue servicing the receivables for CBF at market rates; accordingly, no servicing asset or liability has been

recorded. The Receivables Facility is subject to bank renewal every 364 days, and in any event expires in June

2016. In the event the Receivables Facility is not renewed, management believes it would be able to refinance

any outstanding borrowings under the Corporate Credit Agreement.

Although CBF is a wholly-owned consolidated subsidiary of the Company, CBF is legally separate from the

Company and each of the Company’s other subsidiaries. Upon and after the sale or contribution of the accounts

receivable to CBF, such accounts receivable are legally assets of CBF, and, as such, are not available to creditors

of other subsidiaries or the parent company.

For the purposes of consolidated financial reporting, the Receivables Facility is accounted for as a secured

financing. Because CBF has the ability to prepay the Receivables Facility at any time by making a cash payment

and effectively repurchasing the receivables transferred pursuant to the facility, the transfers do not qualify for

“sale” treatment on a consolidated basis under ASC 860, “Transfers and Servicing.”

Of the total borrowing capacity of $111.4 million at December 31, 2013, $106.2 million consisted of

outstanding borrowings and $5.2 million consisted of outstanding letters of credit. Interest on the Receivables

Facility is based on the LIBOR rate plus 0.5%. The average interest rate on the Receivables Facility was 0.7% in

2013. The Company pays letter of credit fees on the securitization facility and also pays commitment fees on the

total facility. These fees were $0.7 million in 2013, 2012 and 2011.

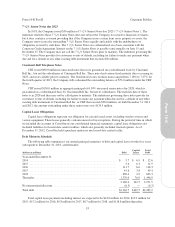

83/4% Senior Subordinated Notes due 2018

In March 2010, the Company issued $625 million of 8 3/4% Senior Subordinated Notes due 2018 (“8 3/4%

Senior Subordinated Notes”), which are fixed rate bonds to maturity.

91

Form 10-K