Cincinnati Bell 2013 Annual Report Download - page 128

Download and view the complete annual report

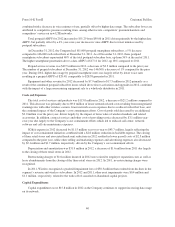

Please find page 128 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management believes that cash on hand, operating cash flows, its Corporate Credit Agreement and its

Receivables Facility, and the expectation that the Company will continue to have access to capital markets to

refinance debt and other obligations as they mature and come due, should allow the Company to meet its cash

requirements for the foreseeable future.

Cash Flows

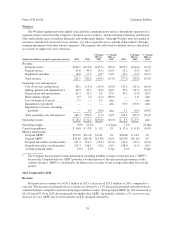

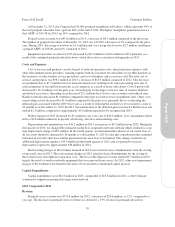

Cash flows from operating activities

Cash provided by operating activities during 2013 was $78.8 million, a decrease of $133.9 million

compared to 2012. This decrease was largely driven by the deconsolidation of CyrusOne in January of 2013, the

$42.6 million payment of transaction related compensation, $16.0 million of higher pension and postretirement

payments and increased working capital usage.

Cash provided by operating activities during 2012 was $212.7 million, a decrease of $77.2 million

compared to $289.9 million generated during 2011. This decrease was largely driven by unfavorable changes in

operating assets and liabilities, combined with $6.6 million of higher pension and postretirement payments and

$6.1 million of additional interest payments.

Cash flows from investing activities

Cash flows used in investing activities were $185.4 million in 2013 compared to $371.8 million in 2012 and

$244.7 million in 2011. Capital expenditures were $196.9 million for 2013, which was $170.3 million lower than

2012 due primarily to the deconsolidation of CyrusOne, offset by increased investment in our strategic fiber

products. Capital expenditures were $111.7 million higher for 2012 versus 2011 as a result of the continued

expansion of our former data center operations and our Fioptics network. As a result of the IPO of CyrusOne, we

received dividends of $21.3 million from CyrusOne in 2013. In 2012, we deposited $11.1 million of cash into an

escrow account and released $4.9 million from this account to fund construction of a data center.

Proceeds from the sale of assets were $2.0 million and $1.6 million in 2013 and 2012, respectively,

primarily from the sale of copper cable. In 2011, the sale of substantially all of the home security monitoring

business assets provided cash of $11.5 million.

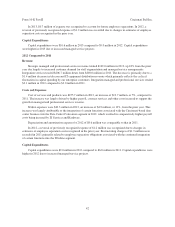

Cash flows from financing activities

Cash flows provided by financing activities were $87.6 million in 2013. The Company received $529.8

million in net proceeds from the Tranche B Term Loan on September 10, 2013. In 2013, the Company also had

net borrowings of $54.2 million under its Receivables Facility and $40 million on its Corporate Credit

Agreement facility. We also received cash proceeds of $7.1 million from the exercise of stock options and

warrants. Proceeds of the Tranche B Term Loan were used to redeem all of the Company’s $500 million 8 1/4%

Senior Notes on October 15, 2013. In 2013, cash was used to pay $10.4 million of preferred stock dividends.

Cash flows provided by financing activities were $109.0 million in 2012. During 2012, CyrusOne LP and

CyrusOne Finance Corp. issued $525 million of 6 3/8% Senior Notes due 2022 and used $480 million of the $511

million net proceeds to repay intercompany payables. The Company repaid $442.4 million of debt during the

year, largely with the net proceeds received from CyrusOne, including the redemption of the $247.5 million of

7% Senior Notes due 2015, $91.1 million of 8 3/8% Senior Notes due 2020, purchased pursuant to a tender offer

completed in the fourth quarter of 2012, and $73.0 million of various series of CBT Notes due 2023. The

Company also used the net proceeds received from CyrusOne to pay the redemption premiums, debt issuance and

other costs associated with this series of transactions and to repay the outstanding borrowings on our prior credit

facility of $40 million. In 2012, the Company also borrowed $52.0 million under its Receivables Facility and

received cash proceeds of $12.1 million from the exercise of stock options and warrants. In 2012, cash was used

to pay $10.4 million of preferred stock dividends and to fund $5.7 million of costs associated with the CyrusOne

IPO.

48

Form 10-K Part II Cincinnati Bell Inc.