Cincinnati Bell 2013 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

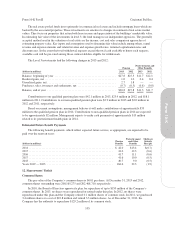

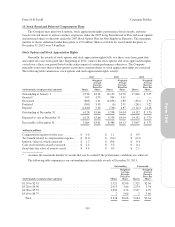

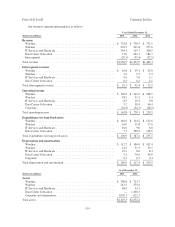

15. Business Segment Information

As of December 31, 2012, and for the period January 1, 2013 through January 23, 2013, we operated four

business segments: Wireline, Wireless, IT Services and Hardware, and Data Center Colocation. Effective

January 24, 2013, the date of the CyrusOne IPO, we no longer include CyrusOne, our former Data Center

Colocation segment, in our consolidated financial statements and now account for our ownership in CyrusOne as

an equity method investment. Therefore, at December 31, 2013, we operated three business segments: Wireline,

Wireless and IT Services and Hardware. For further details of the CyrusOne IPO, see Note 1 and Note 3 of Notes

to consolidated financial statements.

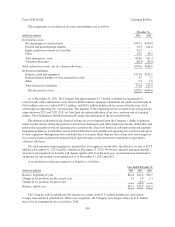

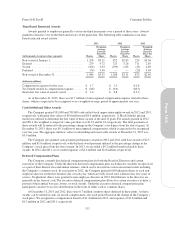

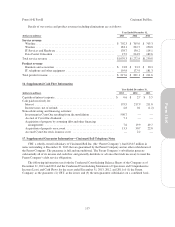

The Wireline segment provides products and services such as local voice, high-speed internet, data

transport, long distance, entertainment, voice over internet protocol (VoIP), and other services. Voice local

service revenue includes local service, digital trunking, switched access, information services, and other value-

added services such as caller identification, voicemail, call waiting, and call return. Data services include

Fioptics high-speed internet and DSL internet access primarily for residential consumers. Data services also

provide data transport for businesses, including local area network services, dedicated network access, metro-

ethernet and Dense Wavelength Division Multiplexing (“DWDM”), which principally are used to transport large

amounts of data over private networks. Long distance and VoIP services include long distance voice, audio

conferencing, VoIP and other broadband services including private line and multi-protocol label switching, a

technology that enables a business customer to privately interconnect voice and data services at its locations.

Entertainment services are comprised of television media through our Fioptics product suite. Other services

primarily include inside wire installation for business enterprises and rental revenue. These services are primarily

provided to customers in southwestern Ohio, northern Kentucky, and southeastern Indiana.

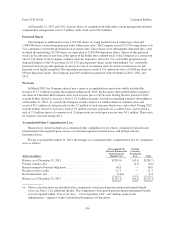

Wireline recognized restructuring charges of $9.1 million, $3.5 million, and $7.7 million in 2013, 2012 and

2011, respectively, for costs associated with employee separation, lease abandonments and contract termination

costs. A curtailment gain of $0.6 million was recognized during the second quarter of 2013 due to the

remeasurement of the Company’s projected benefit obligation following an amendment to the management

pension plan that eliminated all future pension service credits as of July 1, 2013. During 2011, a curtailment loss

of $4.2 million was recognized from the reduction of future pension benefits for certain bargained employees.

Gains on the sale assets were $1.1 million, $1.8 million, and $8.4 million, in 2013, 2012 and 2011, respectively.

The gains in 2013 and 2012 were primarily from the sale of copper cabling that was no longer in use. In 2011,

the Company sold substantially all of the assets associated with its home security monitoring business. There

were no asset impairments in 2013. Asset impairments of $0.5 million in 2012 relate primarily to the write-off of

an out-of-territory fiber network. The impairment losses in 2011 of $1.0 million were related to abandoned

leasehold improvements on vacated office space and the write-down to fair value of certain assets that were held

for sale.

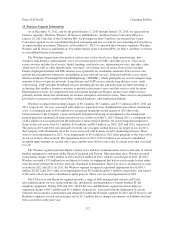

The Wireless segment provides digital wireless voice and data communications services and sales of related

handset equipment to customers in the Greater Cincinnati and Dayton, Ohio operating areas. Wireless incurred

restructuring charges of $0.2 million in 2013 and $1.6 million in 2012, with no such charges in 2011. In 2013,

Wireless recorded a $3.5 million loss on disposal of assets for equipment that had no resale market or has either

been disconnected from the wireless network, abandoned or demolished. There was no loss on disposal of assets

recorded in 2012 and 2011. In 2011, the Wireless segment recognized a goodwill impairment loss of $50.3

million. In 2012 and 2011, other asset impairments were $0.4 million and $1.1 million, respectively, and related

to the write-off of canceled or abandoned capital projects. There were no such impairments in 2013.

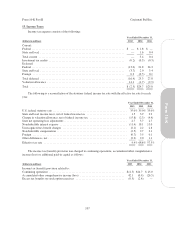

The IT Services and Hardware segment provides a range of fully managed and outsourced IT and

telecommunications services along with the sale, installation, and maintenance of major branded IT and

telephony equipment. During 2013 and 2011, the IT Services and Hardware segment incurred employee

separation charges of $0.7 million and $1.9 million, respectively, associated with the elimination of certain

functions due to product consolidation and integration within the Wireline segment. In 2012, the IT Services and

Hardware segment reversed restructuring costs of $1.2 million due to changes in estimates of liabilities that had

been accrued for in the prior year.

112

Form 10-K Part II Cincinnati Bell Inc.