Cincinnati Bell 2013 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

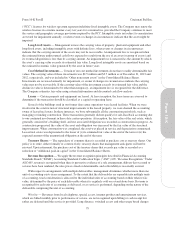

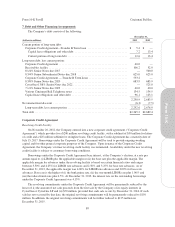

7. Debt and Other Financing Arrangements

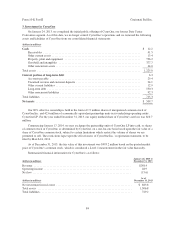

The Company’s debt consists of the following:

December 31,

(dollars in millions) 2013 2012

Current portion of long-term debt:

Corporate Credit Agreement—Tranche B Term Loan ............................ $ 5.4 $ —

Capital lease obligations and other debt ..................................... 7.2 13.4

Current portion of long-term debt .......................................... 12.6 13.4

Long-term debt, less current portion:

Corporate Credit Agreement ................................................ 40.0 —

Receivables facility ....................................................... 106.2 52.0

8 1/4% Senior Notes due 2017 .............................................. — 500.0

8 3/4% Senior Subordinated Notes due 2018 ................................... 625.0 625.0

Corporate Credit Agreement — Tranche B Term Loan ........................... 533.2 —

8 3/8% Senior Notes due 2020 .............................................. 683.9 683.9

CyrusOne 6 3/8% Senior Notes due 2022 ...................................... — 525.0

7 1/4% Senior Notes due 2023 .............................................. 40.0 40.0

Various Cincinnati Bell Telephone notes ...................................... 134.5 134.5

Capital lease obligations and other debt ....................................... 96.1 123.1

2,258.9 2,683.5

Net unamortized discount .................................................... (6.3) (7.5)

Long-term debt, less current portion .......................................... 2,252.6 2,676.0

Total debt ................................................................. $2,265.2 $2,689.4

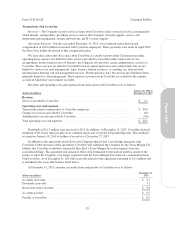

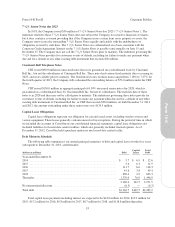

Corporate Credit Agreement

Revolving Credit Facility

On November 20, 2012, the Company entered into a new corporate credit agreement (“Corporate Credit

Agreement”) which provides for a $200 million revolving credit facility, with a sublimit of $30 million for letters

of credit and a $25 million sublimit for swingline loans. The Corporate Credit Agreement has a maturity date of

July 15, 2017. Borrowings under the Corporate Credit Agreement will be used to provide ongoing working

capital and for other general corporate purposes of the Company. Upon issuance of the Corporate Credit

Agreement, the Company’s former revolving credit facility was terminated. Availability under the new revolving

credit facility is subject to customary borrowing conditions.

Borrowings under the Corporate Credit Agreement bear interest, at the Company’s election, at a rate per

annum equal to (i) LIBOR plus the applicable margin or (ii) the base rate plus the applicable margin. The

applicable margin for advances under the revolving facility is based on certain financial ratios and ranges

between 3.50% and 4.25% for LIBOR rate advances and 2.50% and 3.25% for base rate advances. As of

December 31, 2013, the applicable margin was 4.00% for LIBOR rate advances and 3.00% for base rate

advances. Base rate is the higher of (i) the bank prime rate, (ii) the one-month LIBOR rate plus 1.00% and

(iii) the federal funds rate plus 0.5%. At December 31, 2013, the interest rate on the outstanding borrowings

under the Corporate Credit Agreement was 4.15%.

The revolving commitments under the Corporate Credit Agreement will be permanently reduced by the

lesser of (i) the amount of net cash proceeds from the first sale by the Company of its equity interests in

CyrusOne or CyrusOne LP and (ii) $50 million, provided that such sale occurs by December 31, 2014. If such

sale has not occurred by that date, the original revolving commitments will be permanently reduced to $150

million. In addition, the original revolving commitments will be further reduced to $125 million on

December 31, 2015.

89

Form 10-K