Cincinnati Bell 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

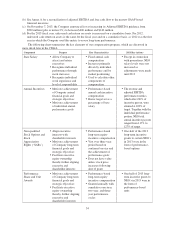

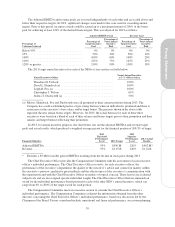

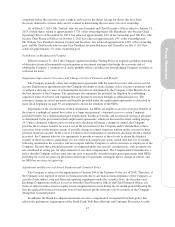

The Adjusted EBITDA and revenue goals are assessed independently of each other and are scaled above and

below their respective targets. In 2013, significant changes were made to the scale used for exceeding annual

targets. Prior to this period, incentive awards could be earned up to a maximum amount of 200% of the bonus

pool for achieving at least 120% of the desired financial goal. This was adjusted for 2013 as follows:

Percentage of

Criterion Achieved

Adjusted EBITDA Goal Revenue Goal

Percentage of

Target Incentive

Goal

Percentage of

Total Annual

Incentive

Paid

Percentage of

Target Incentive

Goal

Percentage of

Total Annual

Incentive

Paid

Below 95% ................................ 0% 0% 0% 0%

95% ...................................... 50% 30% 50% 10%

100% ..................................... 100% 60% 100% 20%

110% ..................................... 125% 75% 125% 25%

120% or greater ............................. 150% 90% 150% 30%

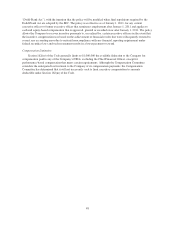

The 2013 target annual incentives for each of the NEOs at year-end are set forth below:

Named Executive Officer

Target Annual Incentive

as a % of Base Salary

Theodore H. Torbeck ...................................... 100%

David L. Heimbach (a) .................................... 100%

Leigh R. Fox (a) .......................................... 100%

Christopher J. Wilson ..................................... 65%

Joshua T. Duckworth (a) ................................... 50%

(a) Messrs. Heimbach, Fox and Duckworth were all promoted to their current positions during 2013. The

Company has a well-established practice of pro-rating bonuses when an individual is promoted and there is

an increase in the executive’s base salary and/or target bonus. The percents shown in the above table

represent the new annual bonus targets. However, for 2013, the actual bonuses for each of these three

executives were based on a blend of each of their salaries and bonus targets prior to their promotion and their

salaries and target bonuses following their promotion.

In 2013, for annual incentive purposes, the chart below sets out the adjusted EBITDA and revenue target

goals and actual results, which produced a weighted-average payout for the financial portion of 108.3% of target:

Financial Objective

2013

Threshold

Performance

Level 2013 Target

2013

Superior

Performance

Level

2013 Actual

Results

Adjusted EBITDA .................................. 95% $390M 120% $402 M*

Revenue .......................................... 95% $1.19 B 120% $1.24 B

* Excludes a $5.6M favorable gain in EBITDA resulting from the decline in stock price during 2013.

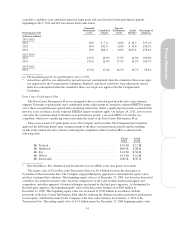

The Chief Executive Officer provides the Compensation Committee with his assessment of each executive

officer’s individual performance. The Chief Executive Officer reviews, for each executive officer, the

performance of the executive’s department, the quality of the executive’s advice and counsel on matters within

the executive’s purview, qualitative peer feedback and the effectiveness of the executive’s communication with

the organization and with the Chief Executive Officer on matters of topical concern. These factors are evaluated

subjectively and are not assigned specific individual weight. The Chief Executive Officer then recommends an

award for the individual performance-based portion for each of the other NEO’s annual incentive, which can

range from 0% to 200% of the target award for such portion.

The Compensation Committee meets in executive session to consider the Chief Executive Officer’s

individual performance. The Compensation Committee evaluates the information obtained from the other

directors concerning the Chief Executive Officer’s individual performance, based on a discussion led by the

Chairman of the Board. Factors considered include: operational and financial performance, succession planning,

39

Proxy Statement