Cincinnati Bell 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 10-K Part II Cincinnati Bell Inc.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Annual Report on Form 10-K and the documents incorporated by reference herein contain forward-

looking statements regarding future events and results that are subject to the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are

statements that could be deemed forward-looking statements. See “Private Securities Litigation Reform Act of

1995 Safe Harbor Cautionary Statement,” for further information on forward-looking statements.

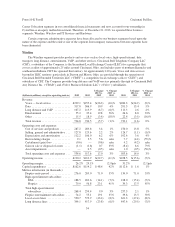

Executive Summary

Segment results described in the Executive Summary and Consolidated Results of Operations section are net

of intercompany eliminations.

For the year ended December 31, 2013, the Company was a full-service regional provider of entertainment,

data and voice communications services over wireline and wireless networks, a provider of managed and

professional information technology services, and a reseller of information technology (“IT”) and telephony

equipment. In addition, enterprise customers across the United States rely on CBTS, a wholly-owned subsidiary,

for efficient, scalable communications systems and end-to-end IT solutions.

On January 24, 2013, we completed the IPO of CyrusOne, which owns and operates our former data center

colocation business. CyrusOne conducts its data center business through CyrusOne LP, an operating partnership.

Although we effectively own approximately 69% of the economic interests of CyrusOne through our ownership

of its common stock and partnership units of CyrusOne LP, we no longer control its operations. Effective

January 24, 2013, we no longer consolidate the accounts of CyrusOne in our consolidated financial statements,

but account for our ownership in CyrusOne as an equity method investment. Due to the change in presentation of

CyrusOne, our results of operations and cash flows for the year ended December 31, 2013 are not comparable to

prior periods.

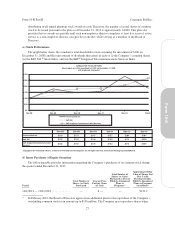

On a consolidated basis, revenue for the year totaled $1,256.9 million. Excluding the results of our former

data center segment, revenue for 2013 totaled $1,241.7 million, down 1% from the prior year. Revenue from our

strategic products totaled $358.6 million in 2013, up 17% compared to 2012, and continues to increasingly

mitigate the revenue declines from our legacy Wireline products and the loss of revenue from a declining

postpaid Wireless subscriber base.

Operating income in 2013 was $163.8 million, down from $270.1 million in the prior year due in part to the

deconsolidation of CyrusOne, which accounted for $27.2 million of the decrease. Operating income was also

negatively impacted by continued loss of postpaid Wireless subscribers and higher margin access lines, in

addition to the $42.6 million of transaction-related compensation paid as a result of the successful IPO of

CyrusOne.

During the third quarter of 2013, the Company amended and restated its Corporate Credit Agreement,

originally dated as of November 20, 2012, to include a $540 million Tranche B Term Loan that matures on

September 10, 2020. Net proceeds of $529.8 million were used to redeem all of the Company’s $500 million 8

1/4% Senior Notes due 2017 on October 15, 2013 at a redemption price of 104.125%.

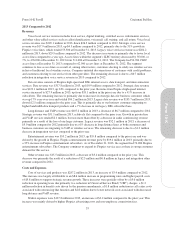

Consolidated Results of Operations

2013 Compared to 2012

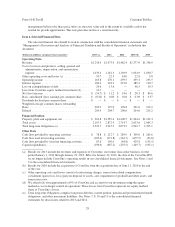

Service revenue was $1,039.3 million in 2013, a decrease of $233.5 million compared to 2012, primarily

due to the deconsolidation of CyrusOne, which accounted for $199.7 million of the decline. Wireless service

revenue was down $39.6 million from the prior year as a result of continued postpaid subscriber losses. Wireline

service revenue declined by only $2.7 million compared to 2012 as the growth in our strategic products continues

to increasingly mitigate the loss from access line, long-distance and DSL subscriber declines. IT Services and

Hardware service revenue was up $8.5 million from a year ago due to strong demand from enterprise customers

for managed and professional services.

29

Form 10-K